-

Consumers are increasingly looking to consolidate debt, while loans for more luxury expenditures, such as vacations, are a thing of the past.

April 13 -

Banks, which previously shunned unsecured small-dollar lending, are now embracing the product because of the outbreak. It's just a matter of whether the shift is permanent.

April 13 -

In blue states in particular, governors and attorneys general are taking up the mantle of consumer protection during the coronavirus emergency, effectively adding another layer of regulation to the patchwork of state and federal oversight.

April 12 -

After opening-day fiasco, SBA upgrades lender portal with Amazon assist; West Virginia’s First State Bank closed by regulators; BofA offers emergency loans to borrowers first, freezing out depositors; and more from this week’s most-read stories.

April 10 -

Closed showrooms, temporary bans on repossessions and a sudden spike in unemployment have dimmed the prospects of a sector that has boomed since the last recession.

April 8 -

Credit unions in the Great Lakes State saw widespread membership growth in 2019 but it was the third consecutive year in which the pace of growth slowed.

April 6 -

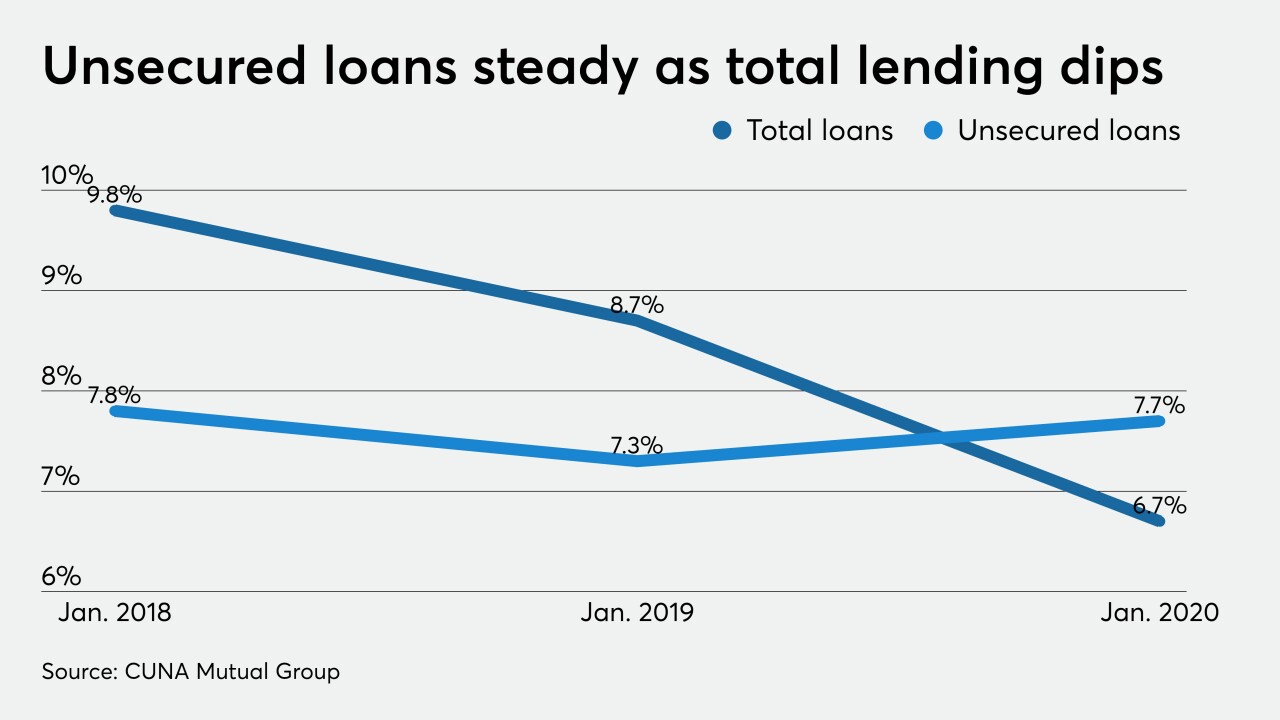

Car loans make up about a third of credit unions' total lending portfolio, and any drop in that sector could resonate across the entire industry.

April 6 -

Cobalt Credit Union is currently a state-chartered institution but is looking to once again become a federal one because of Iowa state taxes.

April 3 -

The $5.9 billion-asset Liberty Bank in Middletown had set aside $5 million to make small-dollar loans to customers affected by the coronavirus pandemic.

April 3 -

The CEO says he is getting stronger and working remotely; if the lockdown lasts several months, the GSEs may need a bailout, FHFA head Mark Calabria says.

April 3