-

The bureau issued an interpretive rule clarifying that consumers under certain conditions can modify or waive waiting periods required by the Truth in Lending Act and Real Estate Settlement Procedures Act.

April 29 -

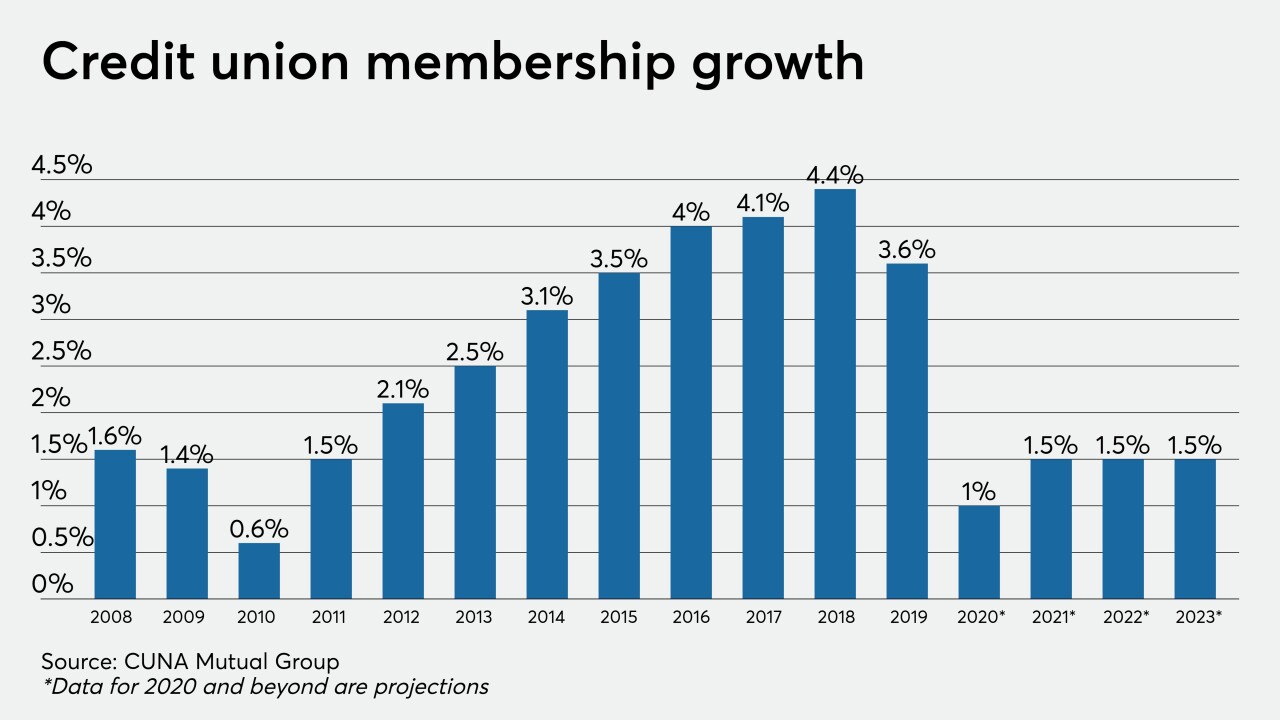

The company’s latest Credit Union Trends Report predicts that membership and lending will stall as job losses rise and consumer demand for loans dries up.

April 29 -

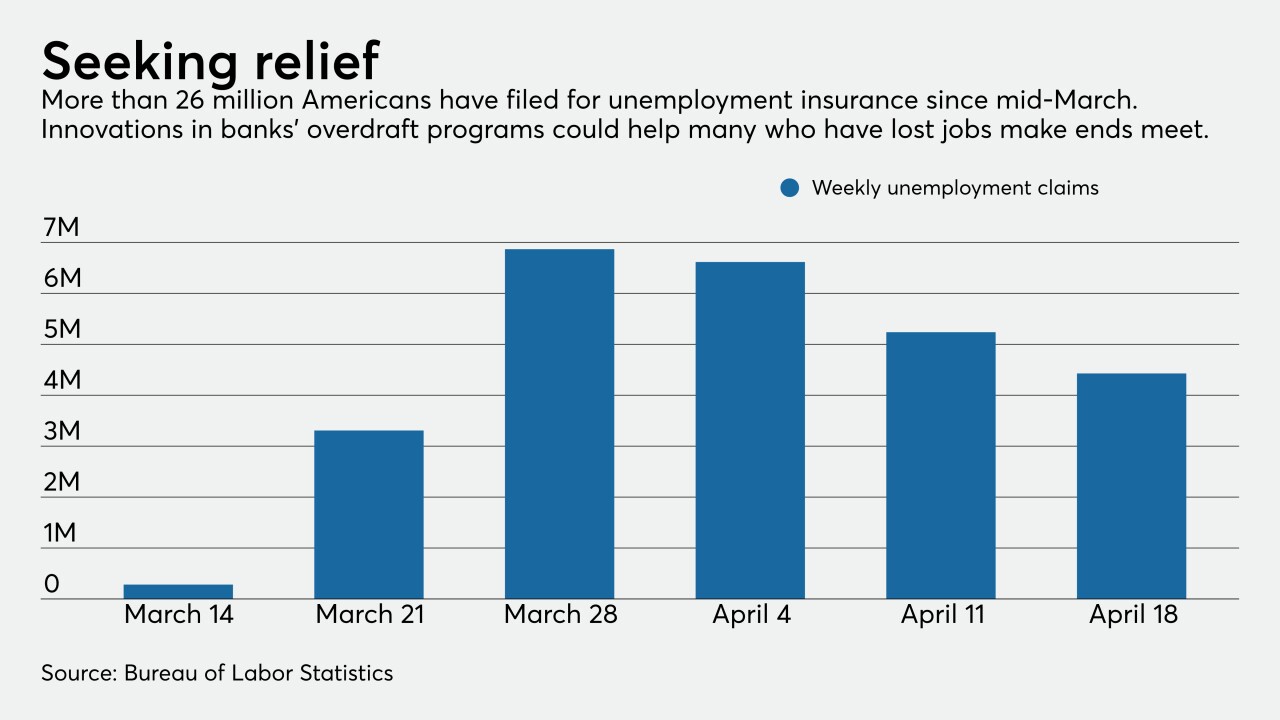

Some bankers, economists, policy experts and even Mark Cuban say that creative uses of overdraft programs could be lifelines for consumers and businesses whose finances have been upended by the coronavirus crisis.

April 28 -

Just over 40% of respondents with private student loans said they had worked with their lenders to come up with a plan for reduced payments.

April 28 -

The two lenders are being more aggressive than other European banks in putting a price on the economic devastation caused by the coronavirus outbreak.

April 28 -

More details have emerged about the damage the coronavirus pandemic is inflicting on the hospitality industry. One servicer alone has received 2,000 workout requests in the past month.

April 24 -

The company reported a loss of $1.3 billion in the first quarter after setting aside more than $5.4 billion for potential loan losses.

April 24 -

Discover and Sallie Mae are the latest to report a surge in forbearance requests as households struggle with job loss and other hardships resulting from the coronavirus pandemic.

April 23 -

Discover is the latest card lender to say it's reining in credit lines as the coronavirus pandemic leaves millions of Americans jobless and struggling to keep up on loans.

April 23 -

More than a dozen firms have struck agreements with nine states to provide forbearance to customers struggling to make payments in the midst of the coronavirus pandemic.

April 22 -

The online lender, reeling from the economic fallout of the coronavirus pandemic, also said it is cutting senior executives' salaries by 25%.

April 21 -

In a rare show of unity, banking industry and consumer advocacy groups told congressional leaders that it is not too late to ensure individuals can access all of their coronavirus relief funds promised by the government.

April 21 -

The lender behind the credit cards for Gap, J.C. Penney and other retailers took a large provision for loan losses and abandoned full-year earnings guidance as the nationwide shutdowns tied to the coronavirus pandemic have led to a sharp decline in spending on its cards.

April 21 -

Credit Acceptance Corp., the lender to car buyers with subprime credit scores, warned it's seeing a sharp drop-off in payments as people shift their financial priorities to get through the coronavirus pandemic.

April 21 -

After more than tripling its loan-loss provision, the $182 billion-asset company became the first large U.S. bank to report a quarterly loss as a result of the coronavirus pandemic.

April 20 -

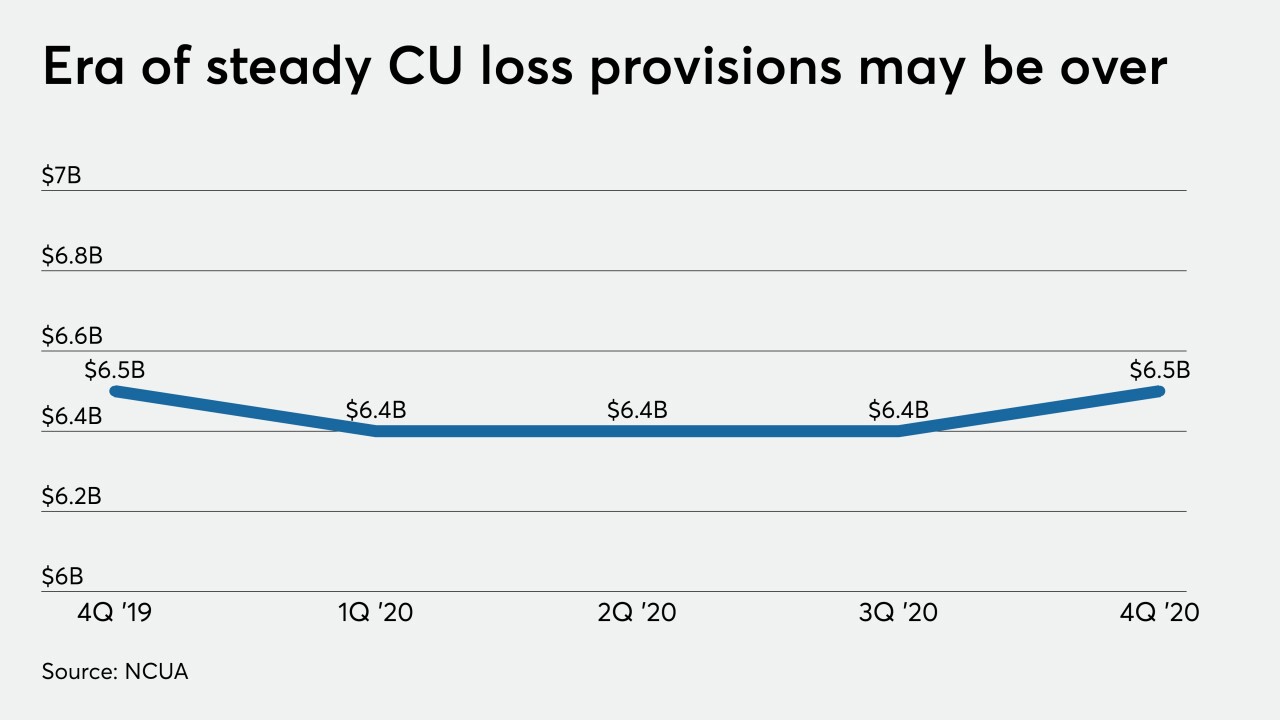

Smaller institutions should prepare themselves for some of what the competition has experienced, including increased provisions for losses and declining net interest margins.

April 20 -

The agency is still moving forward on key regulations dealing with payday lending and mortgage underwriting despite new demands posed by the crisis.

April 15 -

The two large banks are holding off for a month on collecting on negative balances to ensure that customers receive the full amount of government payments deposited into their accounts.

April 15 -

Net income fell 46% in the first quarter as the company added nearly $5 billion to its loss reserves in anticipation of a wave of loan defaults.

April 15 -

With the coronavirus pandemic bringing economic activity to a virtual standstill, BofA, like Wells Fargo and JPMorgan Chase, is shoring up its reserves to brace for a likely recession.

April 15