-

As universities move classes online, there are signs enrollment could be down in the coming academic year. That could have a major impact on credit unions’ private student loan portfolios.

April 15 -

Its prediction that business conditions will remain weak this year — and into next year — stands in stark contrast to forecasts from political leaders that the economy will rebound quickly from the coronavirus pandemic.

April 14 -

The San Francisco bank said the amount of loans that could go into forbearance so far represents a small percentage of its total portfolio.

April 14 -

Though hopeful for a second-half bounceback in the economy, JPMorgan Chase is prepared for 20% unemployment, lackluster GDP and losses in its loan portfolio that could reach tens of billions of dollars.

April 14 -

Republicans balked at measures like an overdraft fee ban and interest rate cap in the recent stimulus bill, but Sen. Sherrod Brown, D-Ohio, isn’t done trying to add such proposals to future relief packages.

April 14 -

The results preview a tough first year for new CEO Charlie Scharf as the coronavirus pandemic brings the U.S. economy to a standstill.

April 14 -

The nation's largest bank set aside nearly $8.3 billion for bad loans, more than double what some analysts had expected.

April 14 -

By helping borrowers now, banks hope customers can quickly catch up on payments once the coronavirus pandemic ends. If they can’t, interest income will remain low and charge-offs could pile up if the crisis drags on.

April 13 -

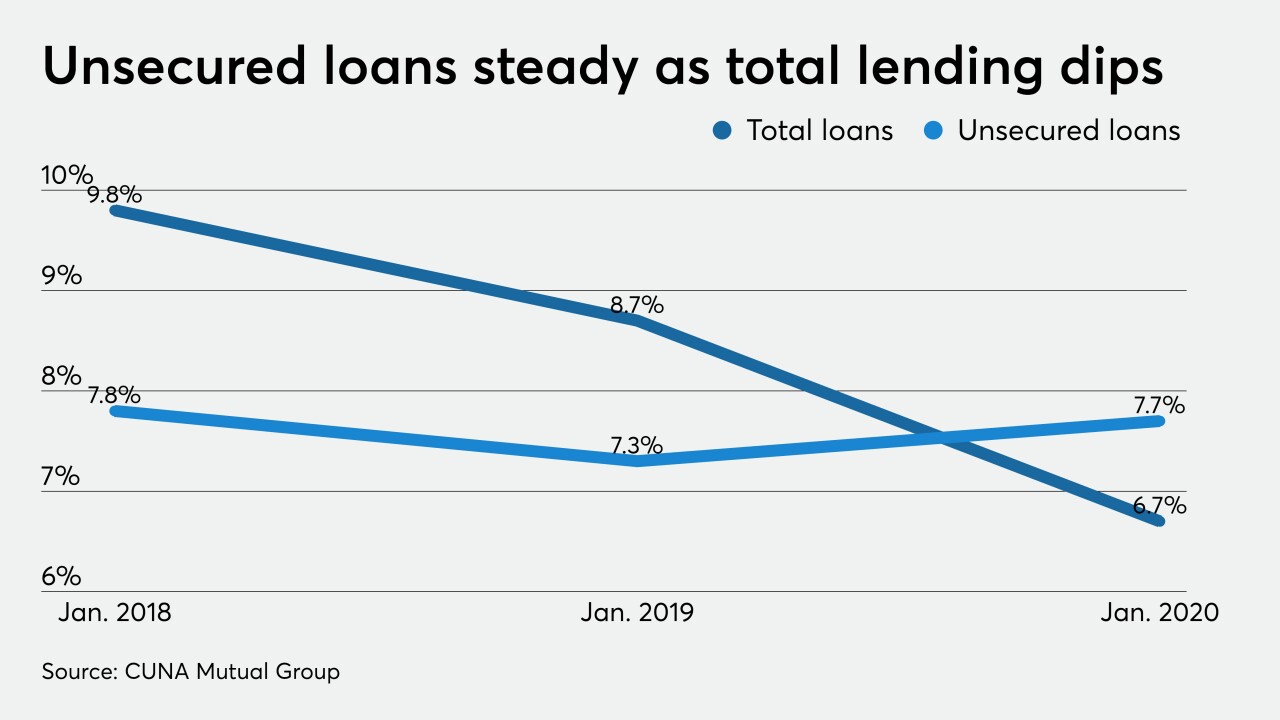

Consumers are increasingly looking to consolidate debt, while loans for more luxury expenditures, such as vacations, are a thing of the past.

April 13 -

Banks, which previously shunned unsecured small-dollar lending, are now embracing the product because of the outbreak. It's just a matter of whether the shift is permanent.

April 13 -

In blue states in particular, governors and attorneys general are taking up the mantle of consumer protection during the coronavirus emergency, effectively adding another layer of regulation to the patchwork of state and federal oversight.

April 12 -

After opening-day fiasco, SBA upgrades lender portal with Amazon assist; West Virginia’s First State Bank closed by regulators; BofA offers emergency loans to borrowers first, freezing out depositors; and more from this week’s most-read stories.

April 10 -

Closed showrooms, temporary bans on repossessions and a sudden spike in unemployment have dimmed the prospects of a sector that has boomed since the last recession.

April 8 -

Credit unions in the Great Lakes State saw widespread membership growth in 2019 but it was the third consecutive year in which the pace of growth slowed.

April 6 -

Car loans make up about a third of credit unions' total lending portfolio, and any drop in that sector could resonate across the entire industry.

April 6 -

Cobalt Credit Union is currently a state-chartered institution but is looking to once again become a federal one because of Iowa state taxes.

April 3 -

The $5.9 billion-asset Liberty Bank in Middletown had set aside $5 million to make small-dollar loans to customers affected by the coronavirus pandemic.

April 3 -

The CEO says he is getting stronger and working remotely; if the lockdown lasts several months, the GSEs may need a bailout, FHFA head Mark Calabria says.

April 3 -

If Capitol Hill plans another round of stimulus, Democrats could have more leverage to demand steps such as suspending overdraft fees – a measure which could have a big impact on credit union revenue.

April 2 -

If Capitol Hill plans another round of stimulus, Democrats could have more leverage to demand steps such as suspending overdraft fees or placing a temporary cap on consumer lending rates.

April 1