-

CUNA Mutual Group found that loan balances increased by 6.6% for the year ending in the second quarter.

September 20 -

Readers react to plans by Democratic presidential candidates to reform college tuition, credit unions buying more banks, whether the next president could fire the CFPB head and more.

September 19 -

A first-in-the-nation bill that drew unanimous support from the state Senate failed to get over the finish line this year. What happened?

September 19 -

Board Member Todd Harper was the lone dissenting vote on the rule, saying it was a "bridge too far." Lawmakers and consumer groups have also spoken out against it.

September 19 -

With 20- and 30-somethings just beginning to build financial wealth, banks must orient their business to meet the needs of these consumers.

September 19 Financial Health Network

Financial Health Network -

Linda Lacewell, New York’s superintendent of financial services, said the CFPB's debt collection proposal does not go far enough to protect consumers.

September 18 -

Nitin Mhatre of Webster Financial explains why the Consumer Bankers Association — whose members want a bigger piece of the student lending market — backs legislation that would make the federal government tell borrowers how much they will ultimately owe, as private lenders are already required to do.

September 18 -

Senate Democrats are warning the Consumer Financial Protection Bureau to be careful as it considers changes to its mortgage underwriting rules.

September 17 -

A proposal to define wages-on-demand would protect consumers and serve as an example for others.

September 17 University of Houston Law Center

University of Houston Law Center -

Mission Lane, which was spun off from LendUp in December, said Monday that Shane Holdaway took the helm in August after roughly a year serving as CEO of Barclays' U.S. consumer bank. The upstart lender also announced that it has raised $200 million in equity funding.

September 16 -

Congress is in session, but actions at NCUA, FASB and more will dominate the upcoming week in Washington for credit unions.

September 16 -

The vote Friday was a victory for consumer advocacy groups that have been pushing for years to rein in lenders that charge triple-digit rates.

September 13 -

The CEOs of Sallie Mae and Discover Financial Services were largely dismissive this week of the threat posed by the two Democratic presidential candidates, though their optimism seemed to be rooted in an assumption that the more sweeping proposals will never become law.

September 12 -

Credit unions have traditionally struggled to access analytics due to limited resources but that is now beginning to change thanks to recent advances.

September 12Experian -

A proposal to define wages-on-demand would protect consumers and serve as an example for others.

September 12 University of Houston Law Center

University of Houston Law Center -

At the median, credit unions saw growth slacken in several key areas during the year ending at June 30.

September 12 -

In an interview with Credit Union Journal, Todd Harper, NCUA board member, said the regulator was working to avert similar problems in the future.

September 11 -

The chairman of the National Credit Union Administration gave CU Journal more details on the agency’s forthcoming rule providing guidance for credit unions purchasing banks.

September 10 -

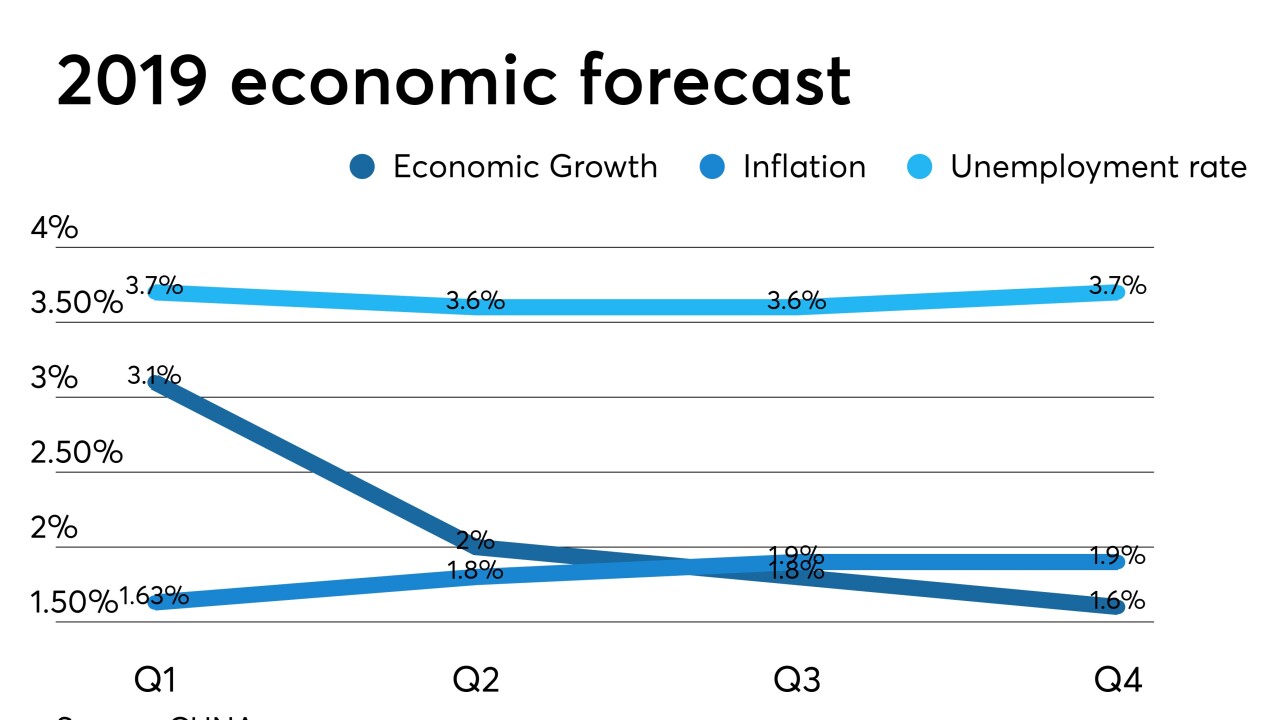

Some industry economists say this yield curve inversion is not as reliable an indicator as it has been for past recessions, but credit unions should still start preparing for an eventual economic downturn.

September 10 -

When the former vice president and Massachusetts senator appear together in Houston, they could present two contrasting visions of financial policy within the presidential field.

September 9