-

Consumers are increasingly looking to consolidate debt, while loans for more luxury expenditures, such as vacations, are a thing of the past.

April 13 -

Banks, which previously shunned unsecured small-dollar lending, are now embracing the product because of the outbreak. It's just a matter of whether the shift is permanent.

April 13 -

In blue states in particular, governors and attorneys general are taking up the mantle of consumer protection during the coronavirus emergency, effectively adding another layer of regulation to the patchwork of state and federal oversight.

April 12 -

After opening-day fiasco, SBA upgrades lender portal with Amazon assist; West Virginia’s First State Bank closed by regulators; BofA offers emergency loans to borrowers first, freezing out depositors; and more from this week’s most-read stories.

April 10 -

Closed showrooms, temporary bans on repossessions and a sudden spike in unemployment have dimmed the prospects of a sector that has boomed since the last recession.

April 8 -

Credit unions in the Great Lakes State saw widespread membership growth in 2019 but it was the third consecutive year in which the pace of growth slowed.

April 6 -

Car loans make up about a third of credit unions' total lending portfolio, and any drop in that sector could resonate across the entire industry.

April 6 -

Cobalt Credit Union is currently a state-chartered institution but is looking to once again become a federal one because of Iowa state taxes.

April 3 -

The $5.9 billion-asset Liberty Bank in Middletown had set aside $5 million to make small-dollar loans to customers affected by the coronavirus pandemic.

April 3 -

The CEO says he is getting stronger and working remotely; if the lockdown lasts several months, the GSEs may need a bailout, FHFA head Mark Calabria says.

April 3 -

If Capitol Hill plans another round of stimulus, Democrats could have more leverage to demand steps such as suspending overdraft fees – a measure which could have a big impact on credit union revenue.

April 2 -

If Capitol Hill plans another round of stimulus, Democrats could have more leverage to demand steps such as suspending overdraft fees or placing a temporary cap on consumer lending rates.

April 1 -

Last month's enforcement actions included the former CEO of Western Heritage Federal Credit Union in Alliance, Neb.

April 1 -

Federal Housing Finance Agency Director Mark Calabria said a virus-induced financial crisis might give rise to more delinquencies and foreclosures than the 2007 subprime mortgage meltdown.

April 1 -

The agency has relaxed some reporting requirements and joined other regulators in encouraging banks to help borrowers, but pressure is building on the bureau to do more to aid consumers suffering financial hardship.

March 30 -

CEO Brian Moynihan also said in an interview that the bank is helping clients affected by the coronavirus pandemic through increased commercial lending to companies and expanded forbearance for Main Street customers.

March 27 -

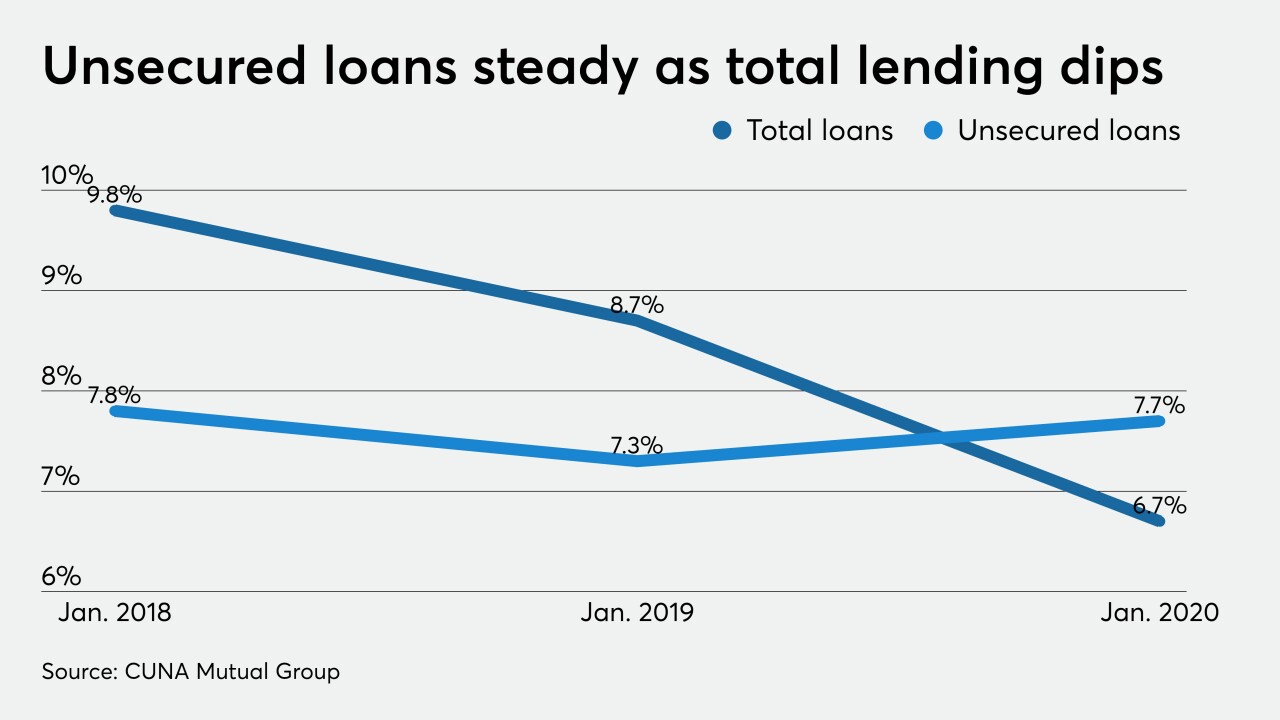

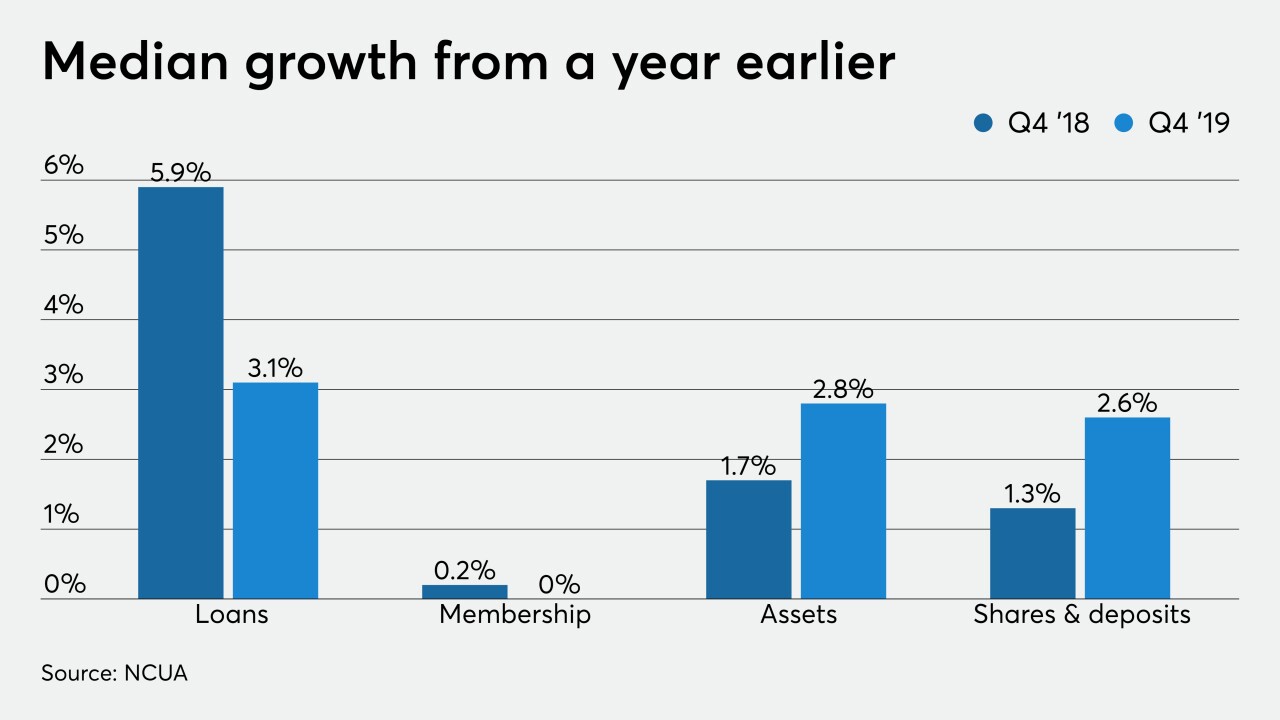

While loans continued to increase, growth was slower than one year previously and membership was flat.

March 25 -

The Federal Reserve committed Monday to conducting more asset purchases of Treasury securities and mortgage-backed securities and announced $300 billion in new financing for credit facilities.

March 23 -

The Federal Reserve committed Monday to conducting more asset purchases of Treasury securities and mortgage-backed securities and announced $300 billion in new financing for credit facilities.

March 23 -

With the government’s backing and thanks to the unprecedented capital levels they built up since the 2008 financial crisis, banks could provide relief in a way that they never have before.

March 22 American Banker

American Banker