-

The credit union said the conversion is part of its "members first" approach.

May 4 -

All six institutions have assets of $1 billion or more.

April 27 -

All six credit unions will utilize Fiserv’s DNA core platform, extending contracts with the technology provider that go on for more than 20 years.

April 19 -

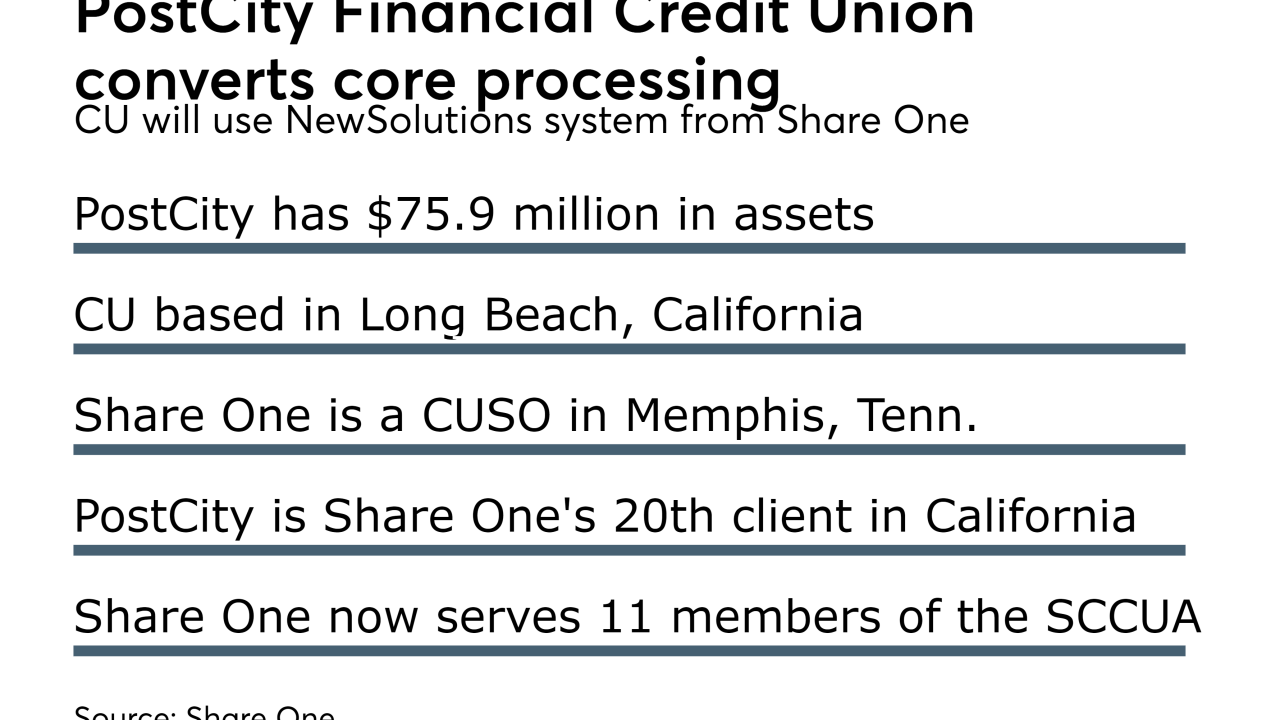

Credit union will switch May 1, becoming the 20th Share One client in California.

April 18 -

In our recent Community Bank Tech Projects series, we looked at the way a handful of banks chose to invest their precious resources over the last year. Here is a roundup of those projects.

March 31 -

Bank3 started as a $12 million-asset institution with a single branch, no online banking and a core system that was obsolete. Now it's much more.

March 24 -

With a hand from Geezeo, Jack Henry is rolling out a product that will guide consumers in managing their finances and is said to give banks better insights.

March 14 -

Banks that are customers of one or both vendors may look to leverage the situation to get better terms for certain products. But would small clients get enough attention from the global player the merger would create?

March 13 -

The private-equity firm Vista Equity Partners will acquire D+H in a deal valued at $3.57 billion.

March 13 -

A core processing startup gets $16 million and a U.K. challenger bank raises $27.6 million.

February 23 -

OpenFin, a devotee of open source software, has raised $15 million in Series B funding to fuel staff expansion, business development and new products.

February 16 -

The Massachusetts-based CU liked COCC’s cooperative business model.

January 27 -

Chatbots, virtual assistants and the like may mean fewer direct interactions between banks and consumers, fintech leaders say. But branches will become self-service destinations.

January 9 -

The bank's new CEO, Onur Genc, fresh from Turkey, will have to find a way to leverage the considerable tech and innovation investments the bank has made and strengthen the brand's U.S. presence.

January 3 -

So much of the blockchain hype has dwelt on the efficiency it could bring to the financial system, but finding ways it could make money would excite more bankers about the nascent technology.

December 30 -

As some banks warm up to the idea of open banking, several tech vendors are vying to be the intermediaries that connect them to the fintech ecosystem.

December 28 -

The core-tech vendor Fiserv has agreed to buy Online Banking Solutions in Atlanta.

December 12 -

A flood of fintech companies are promising to create a better experience for mortgage borrowers, forcing lenders to contemplate buying a vendor's software, building applications in-house or even outright acquiring a company with digital expertise.

December 9 -

SAN FRANCISCO Want to improve the customer experience? Start by making the employees' tools better.

December 8 -

Community banks are increasingly looking to fintech firms as a way to offer customers the tech they want in order to be competitive.

December 7