-

Federal Reserve Bank of Boston President Eric Rosengren said he expects companies to begin receiving money through the central bank's long-awaited Main Street Lending Program within two weeks.

May 24 -

The new legislation directs the Treasury Department to protect electronic payments that Americans receive through the pandemic rescue package.

May 24 -

The new Paycheck Protection Program rules, which created a review process and timeline for paying lenders, did not extend the time borrowers have to comply or increase how much money can be spent nonpayroll expenses.

May 24 -

The pandemic has already shown the importance of a robust tech platform for credit unions and that's only going to increase as things return to normal.

May 22 Oak Tree Business Systems, Inc.

Oak Tree Business Systems, Inc. -

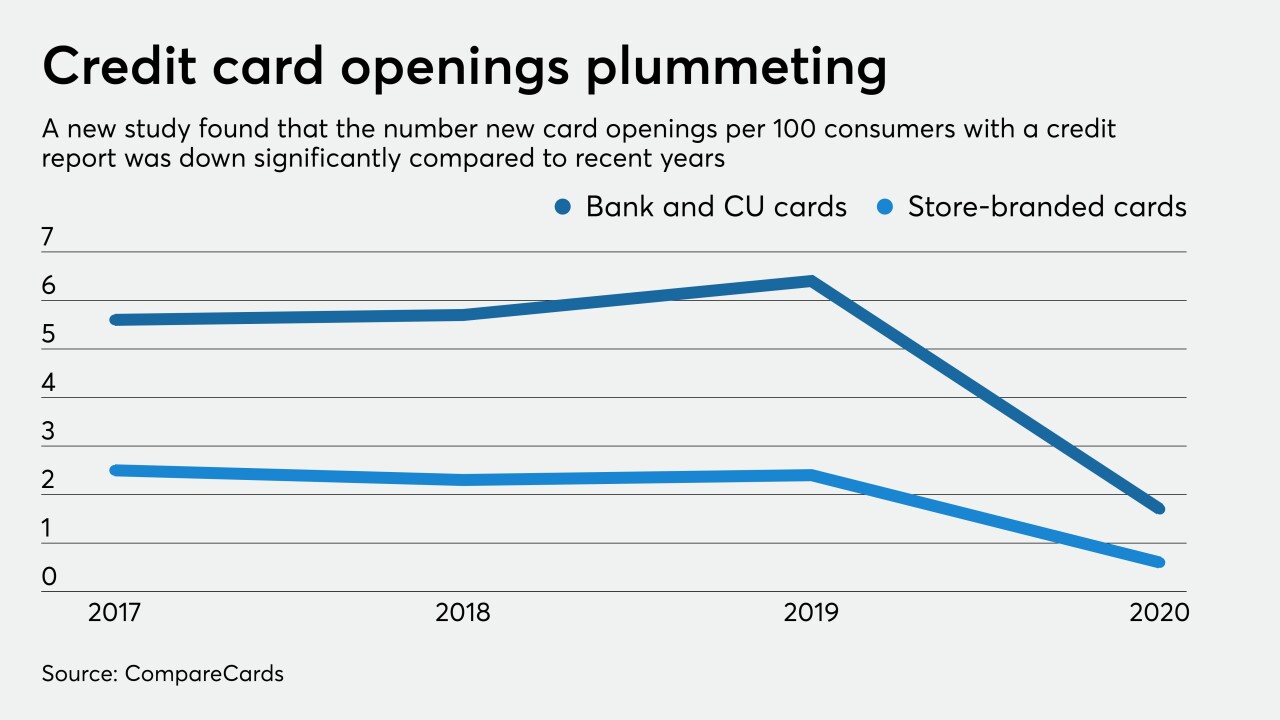

The drop is likely from both a decline in consumer demand and lenders becoming more cautious, according to CompareCards.

May 22 -

The SBA and Treasury Department release more guidance on PPP loan forgiveness; Santander Consumer reaches $550M settlement with state AGs; how Wells Fargo's tech chief is managing coronavirus response; and more from this week's most-read stories.

May 22 -

The Financial Conduct Authority is pushing for a review of fintechs that provide payment technology, out of concern that the coronavirus may be harming their financial performance.

May 22 -

The coronavirus pandemic is driving a rapid increase in NatWest’s U.K. small-business merchant acquiring unit, with many being first-time card acceptors.

May 22 -

Checkout-free stores would seem to be the perfect fit for germaphobic shoppers during the coronavirus pandemic, but until now the model has been mostly experimental.

May 22 -

Some lenders are issuing debt and preferred stock to provide an extra buffer for credit losses. Others are preparing for growth opportunities.

May 22 -

Companies that received funding from the Paycheck Protection Program in early April can start to submit forgiveness applications at the end of May.

May 22 -

If the agency hadn’t revised the 1977 law now, nothing would be done for communities in need that are struggling even more in the coronavirus pandemic, writes Faith Bautista, CEO of the National Diversity Coalition.

May 22National Diversity Coalition -

The HEROES Act aims to clarify whether economic stimulus checks from the government can be used for debt collection, but it's unclear if that language will survive the legislative process.

May 22 -

Fraudsters are licking their chops at the prospect of businesses and financial services extending remote working because of the coronavirus pandemic.

May 22 -

If Democrats retake both the White House and Senate in the 2020 election, analysts see threats to the industry from the appointment of new regulators and possible reversal of Trump-era deregulation. But legislation imposing new rules on financial institutions would face long odds.

May 21 -

A Democratic measure to freeze foreclosures and auto repossessions through the coronavirus crisis while expanding eligibility for loan forbearance is getting strong pushback from banks and credit unions, which complain it would constrain credit.

May 21 -

The panel shot down a proposed interim final rule regarding time limits for overdrafts, the first time in recent memory that an issue before the board did not have the votes to pass.

May 21 -

Customers normally receive debit and credit cards inside a branch. Now banks are shifting the process to their drive-throughs and finding alternative ways for cardholders to key in their PINs.

May 21 -

The company, the product of a big merger shortly before the outbreak, had to build portals on the fly, help many customers shift to mobile and accomplish in days tasks that once took months, its digital chief says.

May 21 -

Artificial intelligence and machine learning are some examples of technology available now to help combat money launderers profiting from the pandemic.

May 21 Consilient

Consilient