-

Mortgage lenders have imposed steep pricing adjustments for cash-out refinancing as more borrowers seek forbearance.

May 4 -

Lenders implemented stricter underwriting across all loan types in the first quarter as the pandemic upended the economy, the Federal Reserve said in its survey of loan officers.

May 4 -

The Fed has tweaked its Main Street Lending Program to stir more enthusiasm, including the creation of a third financing option for larger companies. Will it make a difference?

May 4 -

Visa’s the first card company to push back the October deadline for U.S. gas station EMV compliance, but that’s just one of a mounting set of challenges petroleum merchants are facing because of the coronavirus.

May 4 -

Industry groups have called for a variety of measures to help CUs weather the pandemic’s economic fallout, including more money for funds that aid community development financial institutions.

May 4 -

The path away from cash and plastic was well underway before the pandemic, and will deeping during the crisis and beyond, says Paysafe's Daniel Kornitzer.

May 4 Paysafe

Paysafe -

Credit unions moved quickly to reduce branch access as the coronavirus crisis worsened. The harder decision will be when and how to begin lifting those restrictions.

May 4 -

The shortage of personal protective equipment (PPE) for medical workers is one of the most troublesome elements of the coronavirus outbreak, though prior work to declutter cross-border supply chain payments provides some hope.

May 4 -

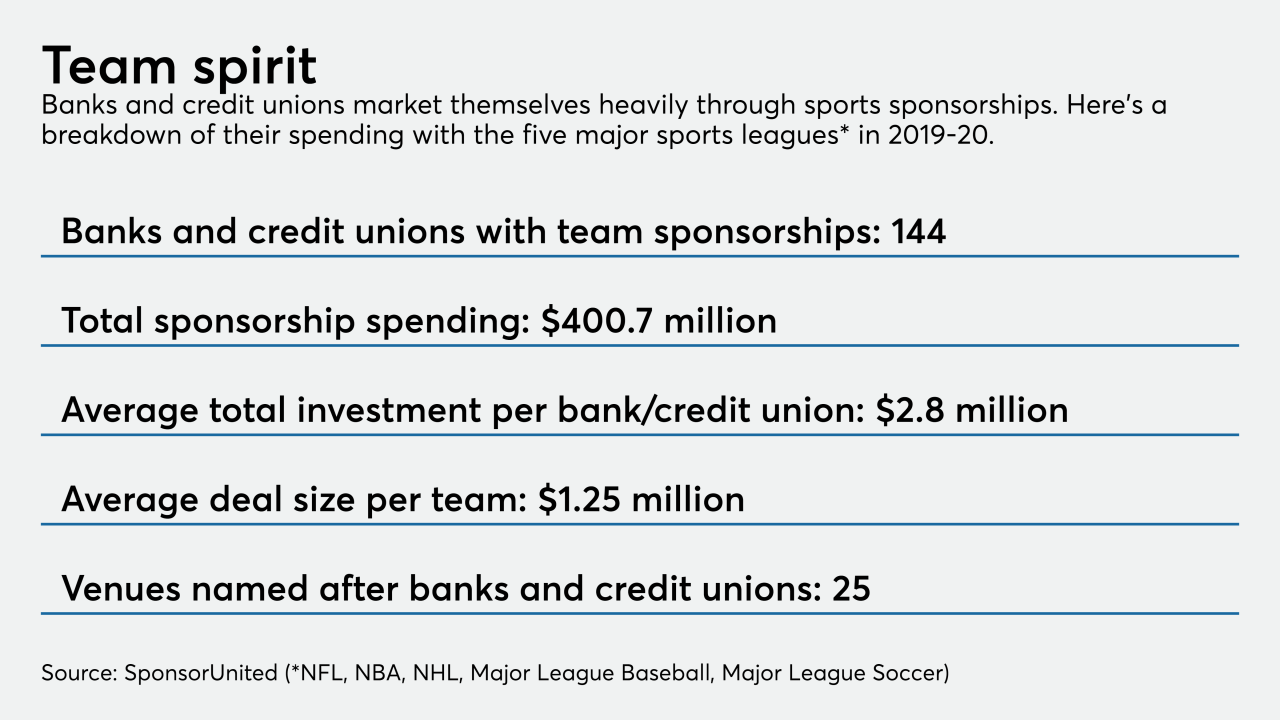

Many banks are slashing their spending. Others are changing their messaging strategies. And those banks that partner with pro sports teams are stuck in limbo, since it remains unclear when games will resume.

May 3 -

Small businesses that received loans from the Paycheck Protection Program pandemic still don’t know how much they may have to repay after the government missed a deadline to give specific guidance.

May 3 -

The deal was expected to close this summer, but First BanCorp said a regulatory review is hitting snags.

May 1 -

Locally sourced campaigns are providing more capital as traditional loans fall short of covering operating expenses.

May 1 -

Credit inquiries for auto lending, revolving credit cards and mortgages fell sharply in March as unemployment surged, according to a Consumer Financial Protection Bureau report.

May 1 -

Federal regulators are now conducting nearly all supervision off-site as a result of the pandemic. The temporary measures are stoking a debate about whether they should be permanent.

May 1 -

These tech-obsessed consumers still crave human interaction. Banks' challenge: Designing products and services that meet their needs.

May 1 -

The Home Loan bank will make zero-interest loans, match charitable donations that members make to nonprofits and small businesses, and provide additional funding for economic development grants.

May 1 -

There is a need and opportunity here to rebuild the aging, legacy infrastructure in payments, at the IRS, and within the banking system. It is not a technology problem. It is an opportunity, says payments consultant Collin Canright.

May 1 Canright Communications

Canright Communications -

Regulators need to revamp their proposal to overhaul the Community Reinvestment Act now that the coronavirus outbreak has created unforeseen financial needs.

May 1 Buckley LLP

Buckley LLP -

American Express Co., long synonymous with premium travel rewards, will now offer a meditation app and credits for streaming services as the coronavirus pandemic forces its customers to stay home.

May 1 -

The short-term coronavirus response revealed most merchants will need a more robust option for digital payments — and that’s prompting fresh investment in what was expected to be a slow period.

May 1