-

Sherrod Brown, the top Democrat on the Senate Banking Committee, explains why consumer protection is so important as the coronavirus pandemic ravages the economy.

April 13 -

PayPal, Intuit QuickBooks Capital and Square Capital have been named direct lenders in the Paycheck Protection Program, and more await the go-ahead. They could be crucial to reaching the smallest firms trying to survive the economic toll of the coronavirus pandemic.

April 13 -

The Consumer Financial Protection Bureau wants to make it easier for those who lack bank accounts to receive pandemic relief payments authorized by Congress.

April 13 -

At issue is whether the U.S. should step in now to save nonbank mortgage servicers to head off damage to the housing market.

April 13 -

Just days after the Fed lifted Wells Fargo's asset cap so it could make more Paycheck Protection Program loans, it warned customers its queue is long and they may want to go elsewhere before program funds are exhausted.

April 13 -

Consumers are increasingly looking to consolidate debt, while loans for more luxury expenditures, such as vacations, are a thing of the past.

April 13 -

Tenants have threatened to suspend payments during the pandemic to pressure officials into providing rental assistance, but the effects on multifamily loans would compound concerns about servicers' liquidity and, ultimately, lenders' performance.

April 13 -

Reluctant to cancel what have become pipelines for developing talent, banks are delaying start dates or moving programs entirely online.

April 13 -

Suneera Madhani, CEO of the digital acquirer Fattmerchant, tells PaymentsSource how the coronavirus pandemic has affected how her employees go to market with new payments technology — and how making the shift to digital helps both the acquirer and its clients.

April 13 -

The National Credit Union Administration this week will consider an interim final rule regarding its Central Liquidity Facility and changes to real estate appraisal requirements.

April 13 -

There is no doubt that many restaurants and merchants are struggling right now. But it makes no sense to hurt consumers and financial institutions by expanding failed policies like the Durbin Amendment, argues Jeff Tassey, chairman of the board for the Electronic Payments Coalition.

April 13 Electronic Payments Coalition

Electronic Payments Coalition -

The agency's top supervisory official said the Comprehensive Capital Analysis and Review will proceed on schedule, and signaled that the Fed will look at how institutions are responding to fallout from the coronavirus.

April 13 -

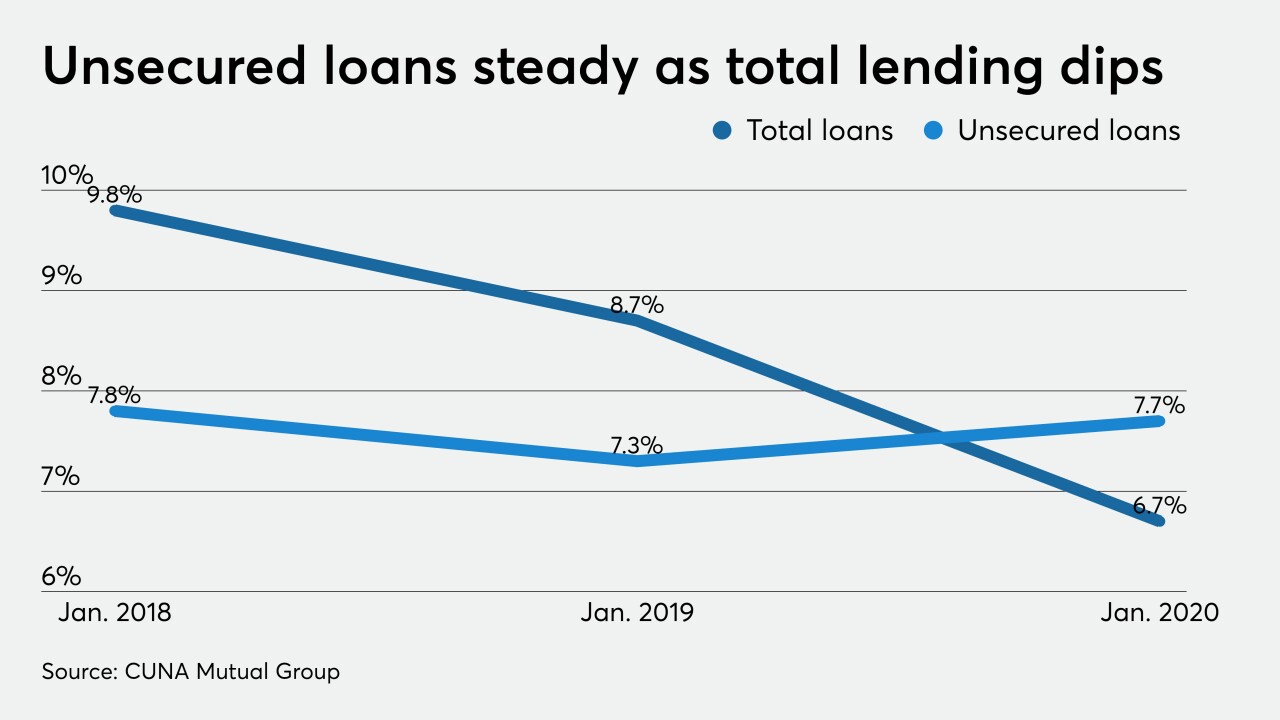

Banks, which previously shunned unsecured small-dollar lending, are now embracing the product because of the outbreak. It's just a matter of whether the shift is permanent.

April 13 -

The $2 trillion coronavirus rescue package and other government moves are designed to provide a lifeline for small businesses, but they also create complications as businesses must quickly accumulate payment records and other information to apply for the loans.

April 13 -

In blue states in particular, governors and attorneys general are taking up the mantle of consumer protection during the coronavirus emergency, effectively adding another layer of regulation to the patchwork of state and federal oversight.

April 12 -

Ginnie Mae will begin taking requests for assistance from issuers who, having exhausted all other options, are having trouble advancing borrowers' principal-and-interest payments to investors amid the pandemic.

April 11 -

After opening-day fiasco, SBA upgrades lender portal with Amazon assist; West Virginia’s First State Bank closed by regulators; BofA offers emergency loans to borrowers first, freezing out depositors; and more from this week’s most-read stories.

April 10 -

Bank of America, which came under fire for prioritizing applications from existing small-business customers, asked a federal judge in Baltimore to reject a request in a lawsuit to temporarily bar it from employing the practice.

April 10 -

Bankers say they’re still trying to figure out if the Fed’s complex loan-buying vehicles will help them cater to the needs of midsize commercial customers hammered by the economic shock from the coronavirus outbreak.

April 9 -

The week-old Paycheck Protection Program will be opened up to sole proprietors and independent contractors on Friday.

April 9