-

Federal relief efforts have minimized loan losses so far, but risks remain in credit card, auto and business lending. Many borrowers will need another lifeline to stay afloat until the economy rebounds, CEO Jamie Dimon says.

January 15 -

In these uncertain times, strengthening relationships with clients is the one thing front-line bankers can control.

January 15

-

A slower-than-expected rollout of the COVID-19 vaccines and the threat of social unrest after the Jan. 6 riot at the U.S. Capitol could threaten the recovery, according to an American Bankers Association panel.

January 14 -

Most consumers expect to be offered a variety of digital payment options in stores in a post-COVID-19 world, and small and midsize business believe that change will be permanent, a Visa study finds.

January 14 -

U.S. economic activity increased modestly at the end of 2020 while hiring slowed amid resurgent infections and new restrictions, even as vaccinations got underway, the Federal Reserve said.

January 13 -

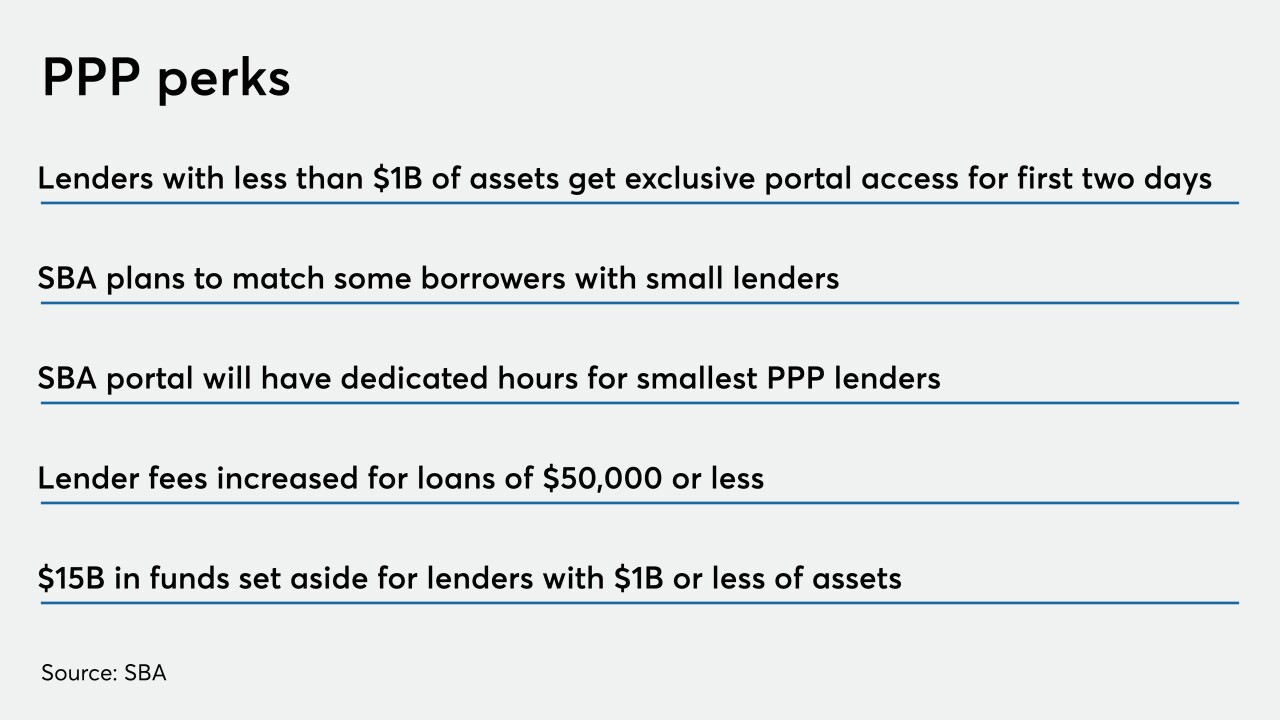

The Small Business Administration will allow lenders with less than $1 billion of assets to process applications in two days. The portal will open to all lenders on Tuesday.

January 13 -

In the pandemic age, banks are getting creative in a bid to keep affluent customers.

January 13 -

Commercial real estate portfolios have held up better than expected during the pandemic. But rising delinquencies and fears of a delayed economic recovery are renewing questions about credit quality.

January 12 -

Sen. Sherrod Brown, D-Ohio, said elevating affordable housing issues, examining the financial system through a climate and racial justice "lens" and holding banks accountable for their impact on consumers will be among his priorities.

January 12 -

Synchrony wasn’t unscathed by the pandemic — consumer spending slowed during the first half of the year — but its mix of private-label and cobranded cards for everyday items suffered far less than other issuers' cards that emphasized luxury and travel.

January 12 -

Several community banks said they didn't have enough time to review the Paycheck Protection Program's application forms, forcing them to sit out Monday's reopening. The SBA is not saying when more lenders will be allowed to access its portal.

January 12 -

The original coronavirus stimulus program in 2020 stumbled out of the gate, delaying payments for months and exposing America's lack of universal access to the financial system. With round two, it's the digital rails that are sputtering early on.

January 12 -

Flush with excess capital, Bank of Montreal, TD Bank and others say they might be in the market to do a cross-border deal.

January 11 -

Bankers have several unanswered questions about the Paycheck Protection Program before it reopens to select lenders on Monday. Among them: When will forms be available, and which portal will the Small Business Administration use?

January 8 -

The Treasury Department and IRS are sending out approximately 8 million Visa prepaid cards to deliver a second round of Economic Impact Payments (EIPs) to consumers.

January 8 -

The COVID-19 pandemic of 2020 saw some businesses become big winners — such as Zoom, Home Depot and payments companies like PayPal — while other businesses suffered heavily, most notably the travel and hospitality industries. Credit card issuers also suffered, as demand lagged heavily for new cards and their overall spending dropped considerably during the year.

January 8 -

There's a way to manage the tricky balance between rapid digitization and the people who still need or prefer cash, and for Ram Chary it can be found in a casino.

January 8 -

The Federal Reserve has returned about $42 billion to the U.S. Treasury, and will soon transfer another $20 billion in excess funds connected to emergency lending facilities that stopped offering new loans last month, it said Thursday.

January 7 -

Bank of America's chief operations and technology officer says even digital experts benefit from in-person collaboration. She wants her 95,000-person staff to return once it's safe.

January 7 -

Community banks will have access to allocated funds and at least two days of exclusive portal access when the Small Business Administration relaunches the Paycheck Protection Program.

January 7