-

Customers' needs and expectations changed drastically in 2020, overturning conventional thinking about their experience in the process. How can we strike the right balance between embracing digital channels and recognizing the value of human touch?

October 15 -

The North Carolina company had promised regulators not to close large numbers of branches until December. Meanwhile, vendor contracts, leases and other hurdles have made it hard to accelerate efforts to offset a sudden decline in revenue.

October 15 -

Drive-thru is almost synonymous with fast food, but for some quick-serve chains — like Subway — a past emphasis on in-store dining meant a much sharper pivot when the coronavirus pandemic struck.

October 15 -

Defaults have been milder than expected thanks to government relief and stricter underwriting. But with the crisis dragging on and policymakers unable to agree on a stimulus plan, loans to highly indebted companies remain at risk.

October 15 -

The Minnesota-based institution is allowing children of some employees to attend school virtually in their branches in order to make it easier for parents to work during the pandemic.

October 15 -

Four of the nation's largest banks updated their progress in recent days on return-to-office plans. The takeaway: Most workers won't be back anytime soon.

October 14 -

Regulators in the spring temporarily eased a key benchmark of balance-sheet strength to allow institutions to help customers navigate the pandemic, but Federal Reserve Vice Chairman Randal Quarles said it would be “premature” right now to suspend it for good.

October 14 -

Executives are urging Congress and the White House to prioritize another round of help for businesses amid concerns that the continuing restrictions on reopening could lead to more loan defaults.

October 13 -

The San Francisco bank reported record loan originations thanks to explosive growth in single-family home loans, and profits beat analysts' expectations.

October 13 -

The banking giant may be sitting pretty with plenty of money reserved for bad loans — or it could have to set aside billions more in coming quarters. It hinges on an ongoing U.S. recovery and the passage of a new stimulus package.

October 13 -

A survey sent to workers in New York, New Jersey and Connecticut last month found that most wanted to start by returning to the office just a few days a week.

October 13 -

The findings of a recent TD Bank survey suggest that targeting millennials for new credit cards will require surgical risk-management as the economy lurches toward an uneven recovery.

October 13 -

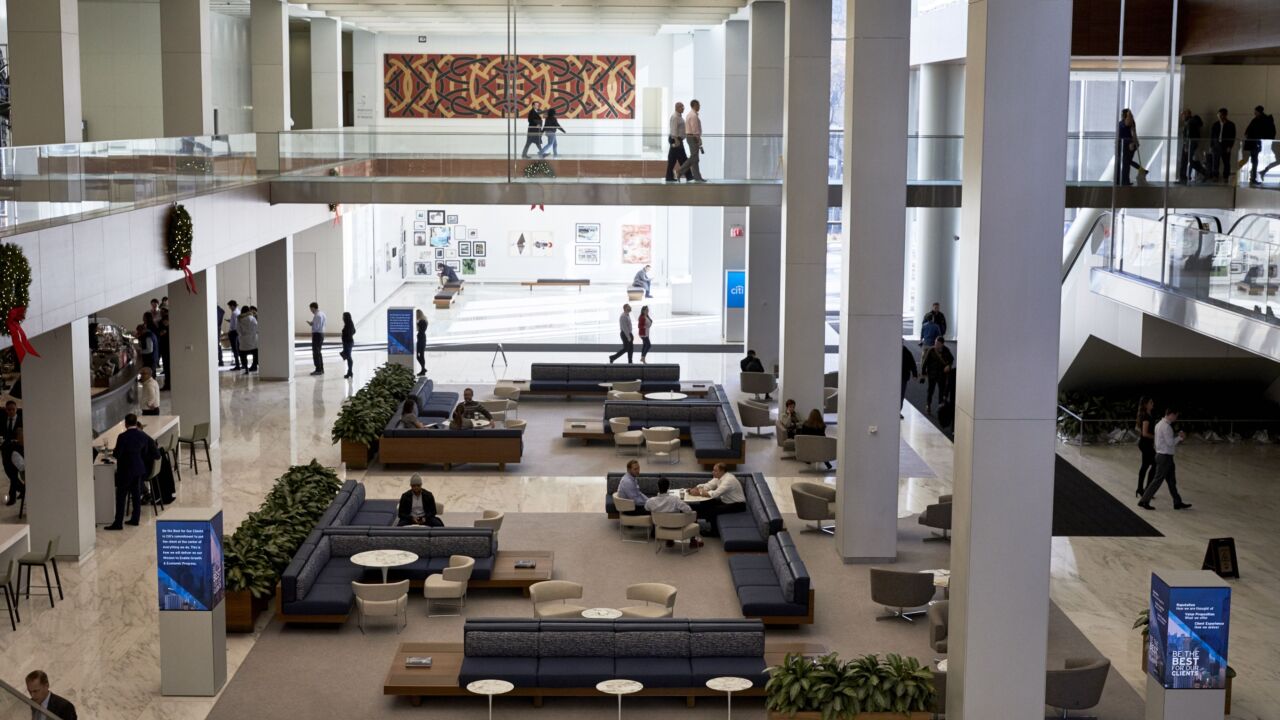

Citigroup posted its biggest quarterly profit of the pandemic after reaping another windfall from trading bonds and expressing newfound confidence in the resilience of its loan book.

October 13 -

Cash, Treasurys and other securities effectively guaranteed by the federal government now make up more than 35% of the combined balance sheets of the 25 biggest U.S. banks, according to data compiled by the Fed. That’s the biggest share in records dating to 1985.

October 9 -

The JPMorgan Chase CEO, among the biggest Wall Street proponents of returning workers to the office, doesn’t see life returning to some form of normal until mid-2021 at the earliest.

October 9 -

Lenders welcomed the move as a helpful first step but are still urging policymakers to develop a broader, simpler process for expediting the approvals of loans extended to troubled small businesses under the Paycheck Protection Program.

October 9 -

What Jason Gardner, founder and CEO of Marqeta, has learned leading a 450-person fintech from home.

October 8 -

Federal Reserve Bank of Boston President Eric Rosengren said the long period of low interest rates before the coronavirus pandemic is contributing to the depth of the current recession.

October 8 -

The pandemic has caused a massive shift in corporate expenses, turning the company dime upside down as plane tickets give way to home office equipment. It’s a complication for those who track, approve and pay for these expenses, requiring a new approach in the back office.

October 8 -

U.S. consumer borrowing unexpectedly fell in August as credit card balances declined for a sixth consecutive month with the coronavirus pandemic continuing to limit some purchases amid elevated unemployment.

October 7