-

The growth in remittance providers' digital customer sign-ups accelerated as the U.S. went into a nationwide lockdown in the middle of March, and has continued through the summer despite store reopenings that could pull customers back to their old habits of paying in person.

July 17 -

The coronavirus relief law allows forbearance plans for up to a year on federally backed mortgages, but House Democrats say homeowners have had difficulty getting relief.

July 16 -

Bank of America was the latest large bank to report a second-quarter drop in the key earnings metric after a March surge in credit line utilizations gave way to rapid payoffs in May and June.

July 16 -

The North Carolina regional created by the merger of BB&T and SunTrust is saving money by shedding office space and reworking vendor contracts, but it was forced to put its systems integration on hold for up to a year to prioritize tech upgrades tied to the pandemic.

July 16 -

Fraudsters hit U.S. banks and merchants hardest with bogus credit card applications in April, while most consumers were in full pandemic lockdown, according to new data from Socure.

July 16 -

The coronavirus pandemic has exposed weaknesses even at well-established fintechs. They could become more resilient by partnering with traditional financial institutions.

July 16 CCG Catalyst

CCG Catalyst -

Mass transit usage cratered during the coronavirus pandemic, but there’s signs of recovery based on how people are paying for their fares.

July 16 -

Second-quarter earnings fell by more than 50% from the same period last year after the company allocated $5.1 billion for potential loan losses.

July 16 -

With the COVID-19 health pandemic wreaking havoc on jobs, investments, consumer debt and lending, secured credit cards can address a vital need for people who may not have considered the product in the past.

July 16 -

While the use of behavioral biometrics such as keystroke patterns has become commonplace for web-based security, this has less applicability to mobile commerce given the different form factor and interface of a smartphone, says Incognia's André Ferraz.

July 16 Incognia

Incognia -

The credit union regulator revised its summary of what examiners will focus on to reflect legal and regulatory changes that have taken place since the COVID-19 outbreak began.

July 15 -

The Pittsburgh bank says fewer borrowers are asking for help and that many borrowers who received assistance are making payments again. But with the coronavirus pandemic still raging in much of the country, CEO William Demchak and other bankers are tempering their optimism.

July 15 -

The Minneapolis company said 75% transactions have been handled online since the pandemic hit.

July 15 -

EMVCo has developed guidelines that allow the travel industry to provide more data to issuers authorizing ticketing transactions as a way to reduce fraud in air travel, hotel and car rental purchases.

July 15 -

Businesses affected by the pandemic are accepting online and touchless in-person payments from consumers with the help of technologies developed originally for B2B invoicing and payments.

July 15 -

Some criticized the Fed’s decision to temporarily lift capital restrictions for megabanks, but the move will help ease the crisis.

July 15 Financial Services Forum

Financial Services Forum -

Video banking can be safe and effective but members and staff need to be reminded of common-sense precautions to guard against cybercriminals.

July 15 University Credit Union

University Credit Union -

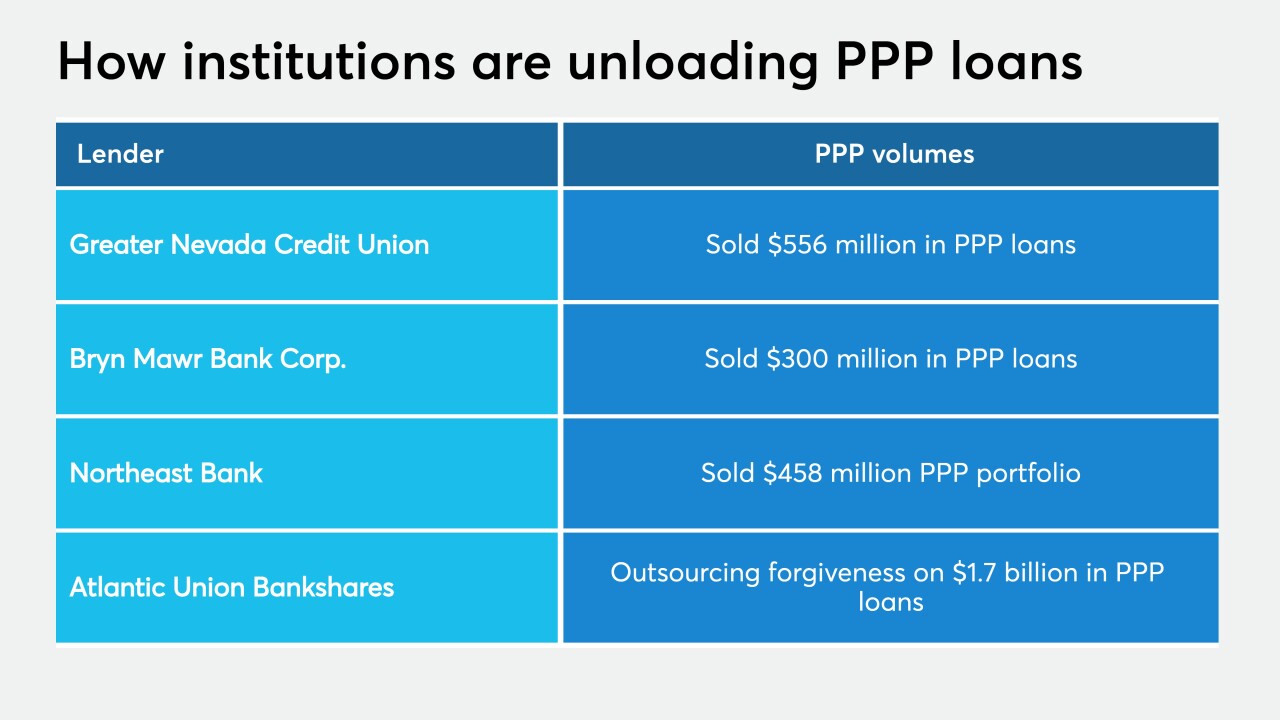

A growing number of lenders are unloading loans made through the Paycheck Protection Program.

July 15 -

The energy sector, retail and hospitality are among the industries that are faring poorly during the pandemic. The bank expects loan losses to remain elevated well into 2021.

July 14 -

Net charge-offs fell at Citigroup and Wells Fargo, thanks to forbearance and federal stimulus. Leaders of those banks are warning that delinquencies could rise once the benefits of those programs wear off.

July 14

![“Many don't see [normalization] coming until we feel like there's an antivirus vaccine that's available for the mass population," says Citigroup CEO Michael Corbat. "So the economy ... will continue to be hit.”](https://arizent.brightspotcdn.com/dims4/default/5bd101e/2147483647/strip/true/crop/750x422+0+11/resize/1280x720!/quality/90/?url=https%3A%2F%2Fsource-media-brightspot.s3.us-east-1.amazonaws.com%2Fd1%2F9d%2Fbf18d6814feeaf046e79f1b7236d%2Fmichael-corbat.jpg)