Credit cards

Credit cards

-

JPMorgan Chase and Wells Fargo detailed aggressive marketing plans, defended their credit judgments and downplayed the threat of a retailer revolt over high fees on rewards cards.

November 6 -

Synthetic fraud brings the pain from many angles — a fluid mix of fake credentials and phony accounts that can overwhelm traditional identity theft tools.

November 5 -

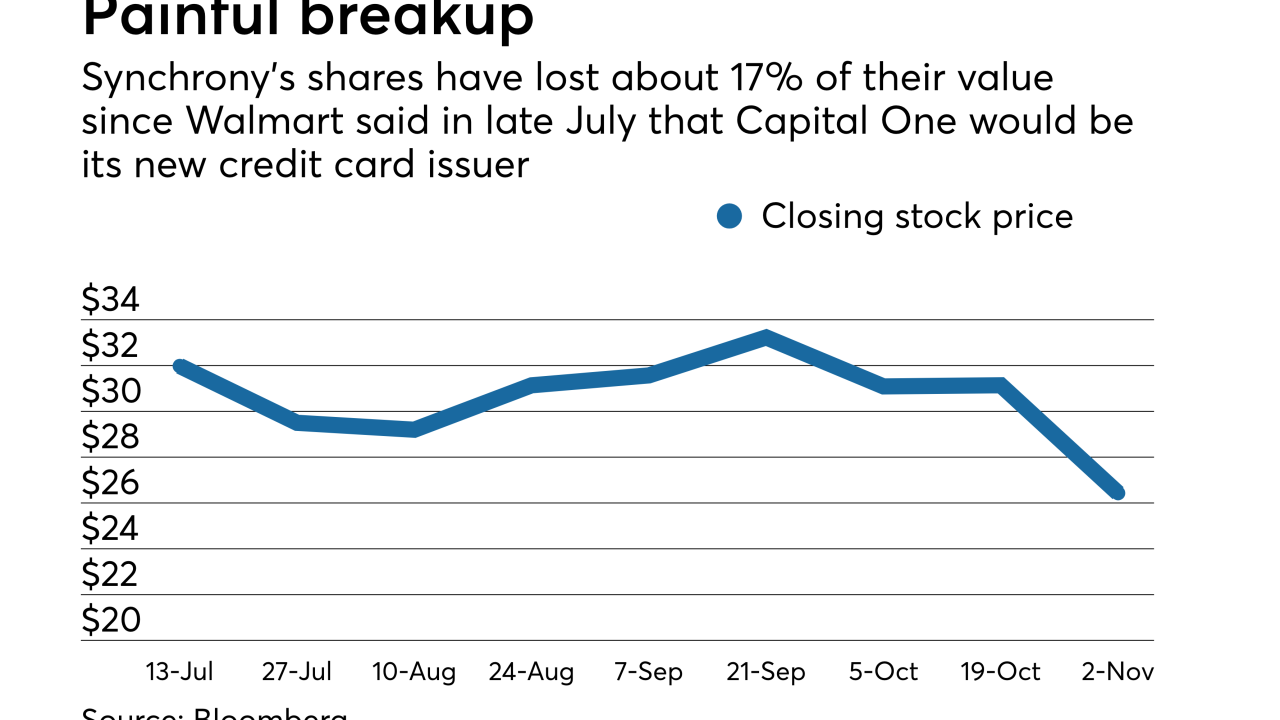

After the retail giant filed an $800 million lawsuit against its former credit card partner, shares in Synchrony plunged. Now analysts fear its relationship with Sam’s Club may be in jeopardy.

November 2 -

The suit is tied to Walmart's decision to shift its credit card business to Capital One.

November 2 -

Margaret Keane discussed Synchrony's investments in technology, including how the card issuer plans to use customer data to help retailers create targeted ads, during an appearance Tuesday in New York,

October 30 -

Mastercard and Visa’s single online payment experience, which has angered some merchants and could shake up the e-commerce market from PayPal to Amazon, is progressing toward a 2019 launch.

October 30 -

Despite improvements in the proportion of consumers without a bank account, there is still work to do to bring more Americans into the banking system, argues FDIC Chairman Jelena McWilliams.

October 29 -

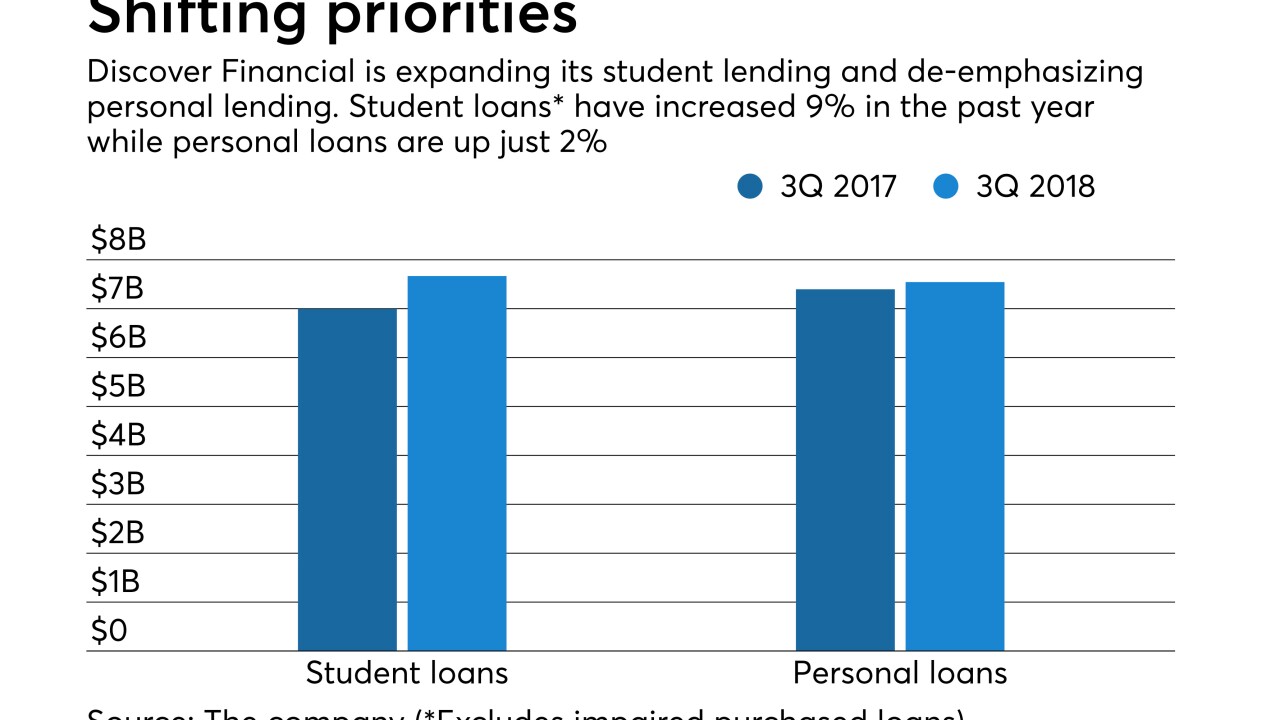

Personal loans are "tricky to underwrite" because consumer credit scores are high at the time of origination and then drift downward, says Roger Hochschild, who recently took over as the head of Discover Financial Services.

October 26 -

Executives offer support to lift investment bankers’ morale; retailer’s move from Synchrony Financial could force card issuers to make concessions.

October 25 -

The card brand company spent less on client incentives than analysts expected during its fiscal fourth quarter, showing the world’s largest payment network is resisting pressure to ramp up efforts to get banks and retailers to route more spending its way.

October 24