-

Patricia Wesenberg spent more than two decades at the Wisconsin-based institution. She retired in October to deal with health issues.

February 17 -

Sundie Seefried, one of the credit union industry's foremost experts on cannabis banking, will transition to a new role this summer, leading a new venture serving the legal marijuana space.

February 16 -

A planned combination with Premier Federal Credit Union in Greensboro, N.C., will expand the Charlotte-based credit union's reach in the Tar Heel State.

February 16 -

Noninterest income from Paycheck Protection loans and mortgage refinancings isn't enough to make up for shortfalls elsewhere, and growth prospects are hard to identify.

February 16 -

A deal to merge with First General Credit Union in Norton Shores, Mich., will extend the Detroit-area institution's reach across the state.

February 12 -

A plan to make expansion easier for credit unions is getting pushback not just from bankers, but also from the regulator's current chairman and a former board member.

February 12 -

The Jackson, Miss.-based credit union is part of an alliance that also includes the megabank, seven cities and nine historically Black colleges and universities, and aims to provide investments of up to $130 million to help stabilize businesses and communities hit hard by the pandemic.

February 10 -

The Philadelphia-based institution will host free coronavirus screenings for the public this month as part of a partnership with the Greater Bustleton Civic League.

February 10 -

The combined institution will hold assets of more than $335 million and serve over 20,000 members across eight counties in Oregon.

February 9 -

Richard Daugherty stepped down after more than three decades at the Maryland-based institution, including overseeing four mergers and asset growth of nearly 500%.

February 9 -

Tom Rachael, who has led the Muncy, Pa.-based institution since 2003, will be succeeded by Scott Naughton, who is new to credit unions but has extensive experience in the financial services sector.

February 9 -

Home loans accounted for the bulk of the industry’s lending gains in 2020, but inventory shortages in some markets and an uneven economic recovery may dim prospects this year.

February 9 -

A recently approved TIP charter, the latest in a series of growth initiatives over the last five years, will allow the Tampa-based credit union to serve anyone working in the medical field statewide.

February 8 -

When its proposed sale to Suncoast Credit Union fell through, Apollo Bank decided to step up commercial lending and revamp its digital offerings in anticipation of an economic rebound in South Florida.

February 8 -

The North Carolina-based credit union, which purchased the vacant bank branch last summer, serves some members across the state line but has not had a brick-and-mortar presence there until now.

February 5 -

The North Carolina-based credit union is one of a handful in the industry to prioritize diversity, equity and inclusion at the management level.

February 5 -

The onset of COVID-19 forced the industry’s largest trade group to put its Open Your Eyes campaign on hold, but nearly a full year later it’s still struggling for industry buy-in.

February 5 -

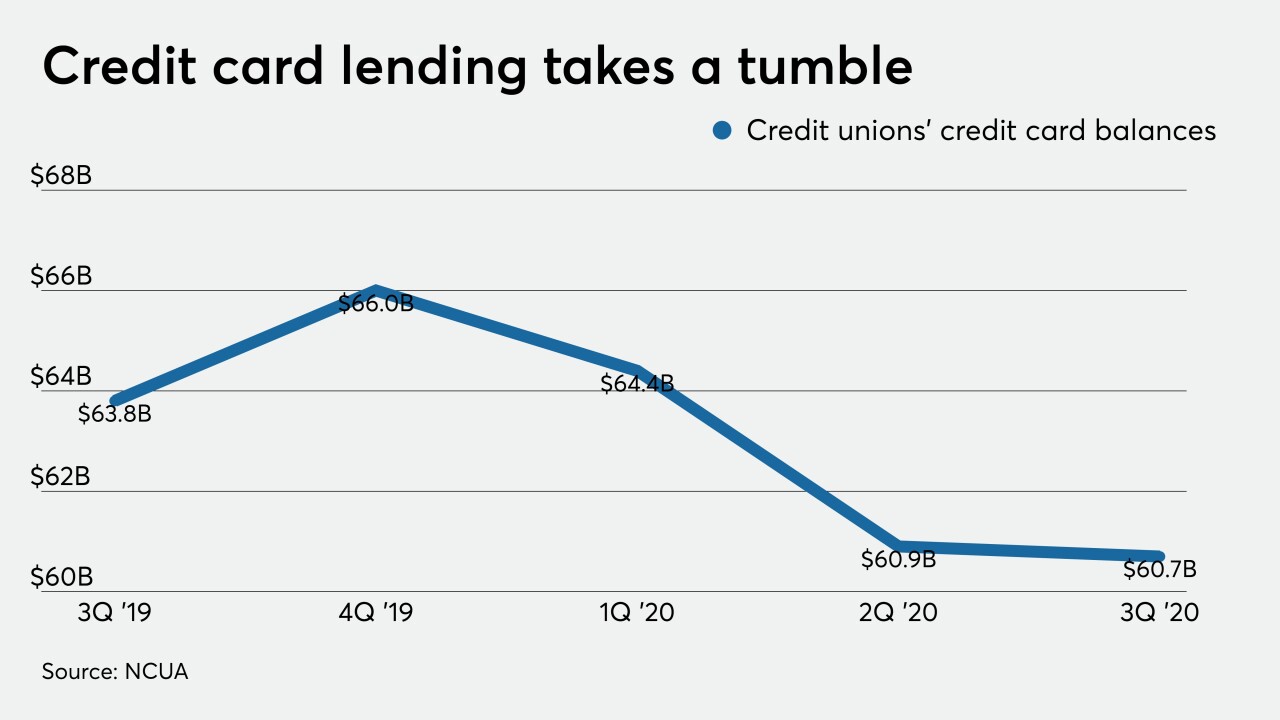

Credit unions are hoping for a return to normal credit card spending patterns sometime during the second half, but the pandemic has created a domino effect of complicating factors.

February 4 -

The decision comes after a decade in which several U.S.-based institutions elected to drop the words "credit union" from their branding.

February 3 -

The bank trade group called for lawmakers to revoke the industry’s tax exemption and suggested that credit union acquisitions of banks create a “brain drain” of local lending expertise that could slow any economic recovery.

February 3