-

A nationwide branch network remains a calling card for the entire industry, while also exemplifying the movement's cooperative spirit.

September 24 CO-OP Financial Services

CO-OP Financial Services -

With staff scattered between working at home and in the office, management at many institutions has taken steps to revamp intranets and launch employee-only Facebook groups to keep their workforce connected.

September 23 -

Credit unions need to improve their processes to ensure the problems that have arisen with credit reporting during the coronavirus don't happen again.

September 22 LendEDU

LendEDU -

The credit union turned to a new engagement strategy for employees after the pandemic forced most of the organization to transition to working from home.

September 22 -

The pandemic has forced the institutions on this year's Best Credit Unions to Work For list to be more flexible with their policies for how and when employees take time off.

September 21 -

The coronavirus has created unprecedented challenges for employers but these credit unions rose to the occasion.

September 20 -

A collaboration between the two industries to help voters cast absentee ballots has been approved to continue through the general election.

September 18 -

More than 160 institutions will use the money to help members weather the coronavirus by offering new products and providing help with loan payments.

September 16 -

New analysis from CO-OP Financial Services showed credit union members veering closer to traditional card usage, but the lack of additional pandemic relief could hamper interchange growth this fall.

September 16 -

The Credit Union Cherry Blossom Run, the industry's biggest annual philanthropic event, saw a nearly 10% increase in giving this year despite being canceled.

September 15 -

It's unlikely that lawmakers will pass new coronavirus-related legislation before Congress leaves for its October recess.

September 14 -

Over the last six months, the movement has shown it is ready to step up during challenging times, including doubling down on service and rolling out new digital products.

September 14 National Association of Federally-Insured Credit Unions

National Association of Federally-Insured Credit Unions -

For all the damage from the pandemic and economic downturn, this crisis has not impacted liquidity. Lawmakers would be foolish to permanently alter the Central Liquidity Facility.

September 11

-

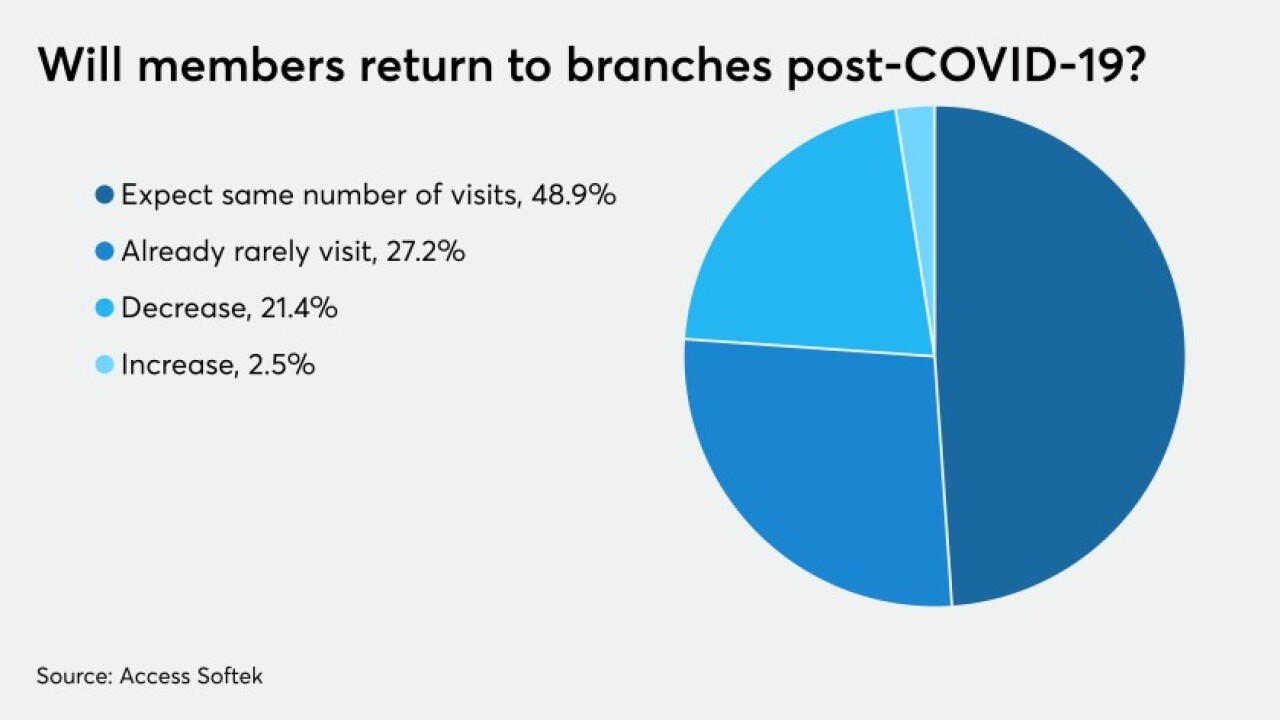

Members are completing more of their banking online than ever before, forcing many institutions to rethink their strategies for physical locations.

September 11 -

A new program will provide tuition-free schooling opportunities for those who stayed on the job during the state's lockdown earlier this year.

September 10 -

Thanks to a donation from the Credit Union Federation of Korea, the global trade group is working with international partners to distribute personal protective equipment to institutions in need.

September 8 -

A new jobs report was better than expected, but recent NCUA data on credit union performance for the first half of 2020 shows how hard the industry has been hit by COVID-19.

September 8 -

A new report from the National Credit Union Administration shows how hard the industry was hit during the second quarter as businesses closed and consumer spending dropped.

September 8 -

The move is part of the effort by lenders and other companies to promote racial equity and be more sensitive to the stresses on front-line employees. It also coincides with rising concerns about the postal system’s ability to handle the rush of absentee ballots.

September 2 -

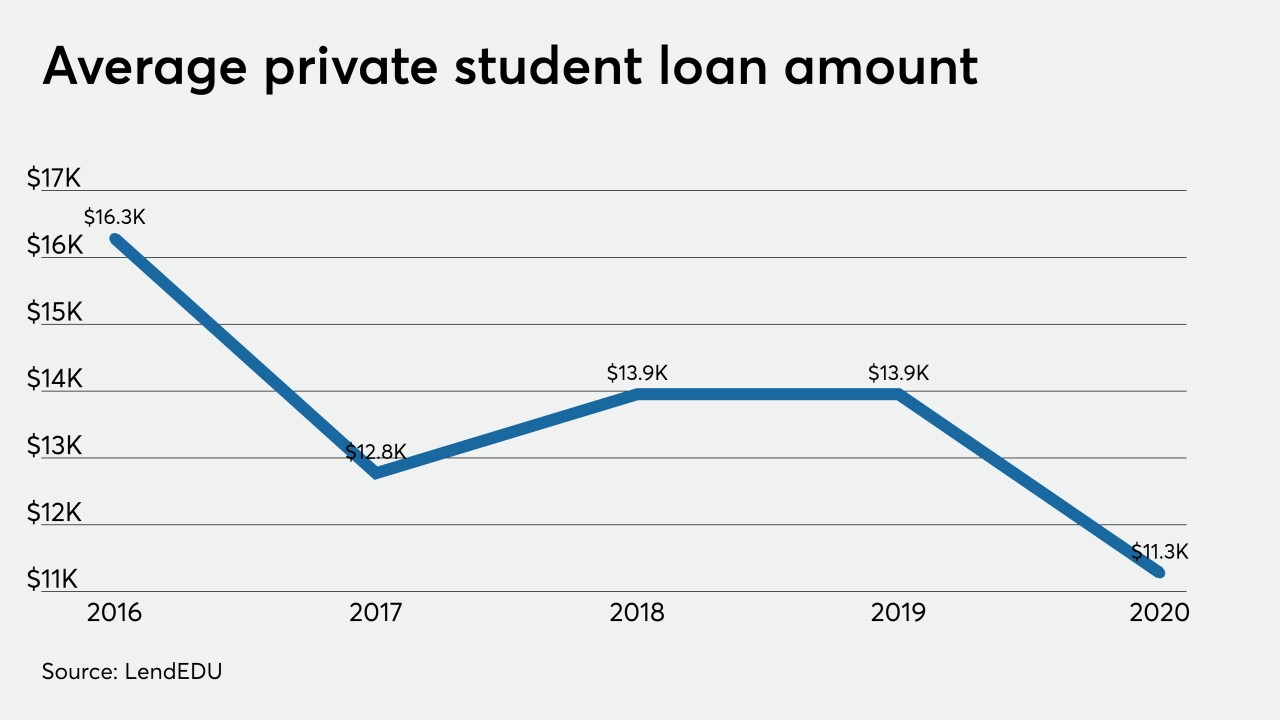

Lenders are struggling to deploy deposits into interest-earning assets, and changes to post-secondary education may further limit these options.

September 1