-

Whatever the reason that Plaid, a prominent data aggregator, can no longer access data from Capital One, the situation demonstrates how fragile fintechs are when they lose banking access.

July 5 BankThink

BankThink -

Hotels have elaborate systems to capture lodging fees and other purchases charged to rooms, but when customers book special events such as weddings or conferences, payment security can be more of a problem.

July 3 -

Nonlisted encryption solutions are designed for easier deployment, but often lack many of the key attributes of PCI-listed point-to-point encryption products, writes Ruston Miles, founder and chief strategy officer of Bluefin.

July 3 Bluefin

Bluefin -

Turnover of chief risk officers is on the rise as CEOs look to add executives whose experience goes far beyond assessing credit risk. Sometimes they are promoting from within, but often they are poaching talent from rival banks.

July 2 -

A new standard would make financial apps work together the way iPhone apps do. Twelve large banks, including JPMorgan Chase, Morgan Stanley and RBC, are already using it.

July 2 -

As Nvoicepay expands, the payment automation company is keeping an eye on how it may fall under European data rules that have a knack for requiring compliance even from companies that should be exempt.

July 2 -

Phone-based customer service opens opportunity for voice phishing, or "vishing," and other types of attacks linked to card not present transactions, according to Rafael Lourenco, an executive vice president at ClearSale.

July 2 ClearSale

ClearSale -

The Illinois commercial bank gained a new role when it realized it shared the same digital transformation challenges as its customers.

June 29 -

Whatever the reason that Plaid, a prominent data aggregator, can no longer access data from Capital One, the situation demonstrates how fragile fintechs are when they lose banking access.

June 29 BankThink

BankThink -

The measure, which has been compared to the EU’s new consumer privacy rules, grants Californians new rights over how companies collect and use their personal data.

June 29 -

Disruptive upstarts. Glitches galore. Open banking adoption. Financial institutions are being challenged on multiple fronts — here’s a look at how they’re coping.

June 28 -

Eight states want the credit bureau to show what it’s doing to improve data security; Goldman, Morgan Stanley and Wells Fargo will be the focus of this set.

June 28 -

In the past few years of fighting against cyberattacks, security teams have developed "kill chain" models that document what steps the bad guys take to infiltrate a network and how to thwart them. The problem is, a significant number of data breaches occur from insider threats, which these models often overlook.

June 28 -

Under a consent order with Texas and seven other states, the Atlanta-based credit reporting firm agreed to shore up its information security efforts, but it will not have to pay any financial penalties.

June 27 -

Ticket sales company Ticketmaster has warned customers in the U.K. that malicious code running on its website could have led to personal data and payment details being stolen. This kind of breach through third-party JavaScript code is quite common and may go undetected for months.

June 27 -

Capital One Financial Corp. is limiting how account data flows to outside apps for managing finances, prompting a backlash from the bank’s customers who say they have been locked out of their own information.

June 27 -

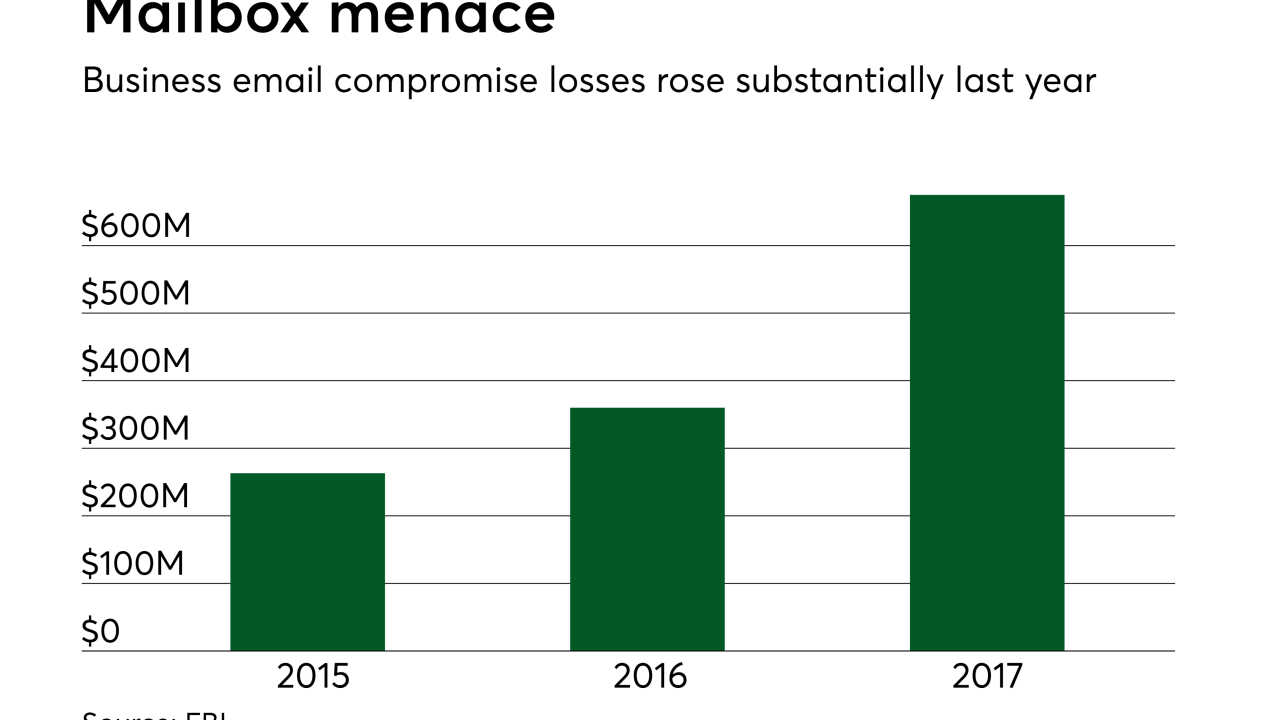

Payments fraud from business email compromise, or BEC, occurs when scammers use phishing tricks and email to fool businesses into making fraudulent payments to perceived suppliers. Experts suggest newer factors are accelerating the trend.

June 27 -

HSBC is the first bank in the U.S. to deploy SoftBank's lifelike Pepper robot in a branch to help customers learn about bill pay, remote check capture and even ask the weather — but in Pepper's current iteration, it won't take deposits or payments.

June 26 -

Credit unions know they need big data, but many aren't sure what to do with it.

June 26 -

A ballot initiative that taps into the public's anger about online data abuses has qualified for the November ballot. But lawmakers are considering whether to head off the statewide vote by passing a measure that may be more amenable to the financial industry.

June 26