-

Even as banks have built up their defenses, fraudsters continue to find new ways to try steal consumers’ identities to open accounts, take out loans or intercept payments.

May 8 -

Among the findings, credit unions may not be doing enough to protect against malware, which involved in nearly 40 percent of hacking incidents, as well as Trojan botnets and denial of service attacks.

May 8 -

The hackers gained entry to affected systems through a client-access portal and the company’s internal monitoring systems detected the intrusion.

May 4 -

Banks, technology developers and payment companies are all experimenting with new ways to identify consumers by their unique physical traits, with the ultimate goal of improving security while also streamlining customer onboarding and authentication.

May 4 -

A new strain of malware that targets cryptocurrency users — but not users of mainstream payment options like bank accounts — highlights how much the cybercrime game is changing behind the scenes.

May 4 -

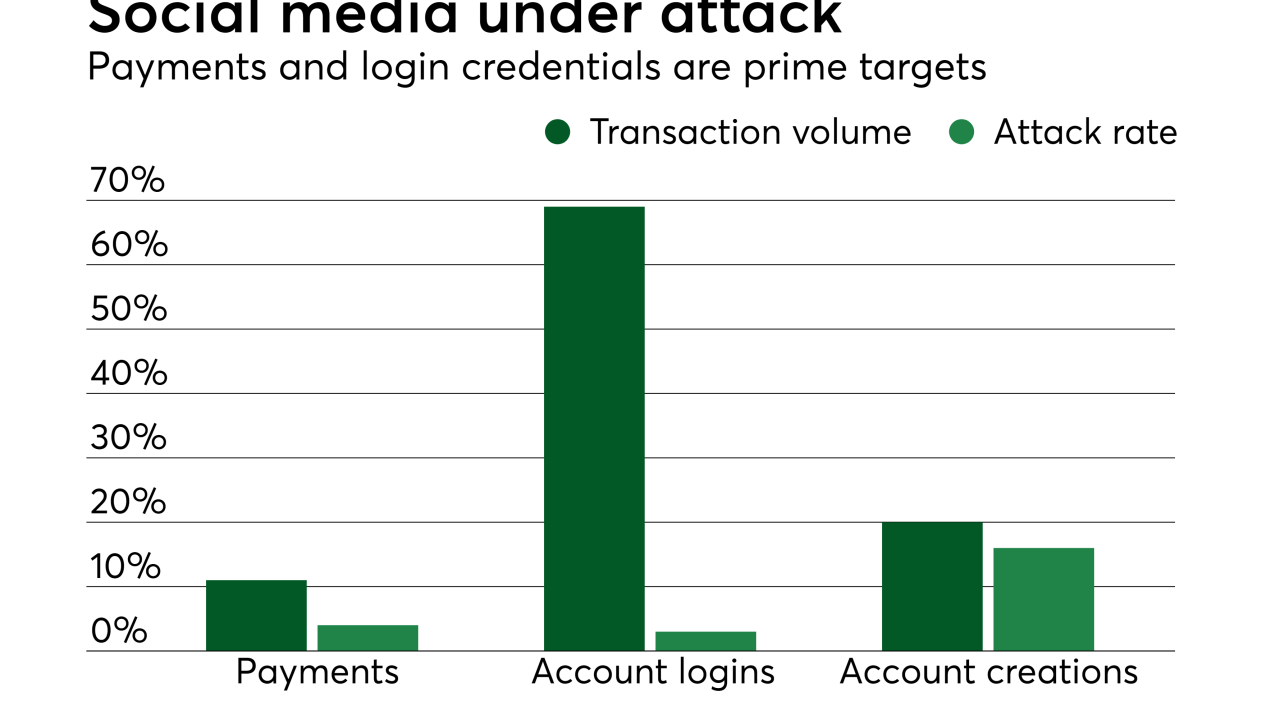

Data breaches have become routine, but the public reaction to these events is changing. Consumers are increasingly wary of sharing their information — just ask Mark Zuckerberg — and this trend raises the stakes for all financial institutions and merchants.

May 3 -

The provision would make it harder for criminals who use real Social Security numbers to create fake personas and then apply for credit.

May 3 -

The spread of breached identity information has resulted in an outbreak of new account creation fraud with a new ground zero for the crimes pointing right at Latin America.

May 3 -

The provision would make it harder for criminals who use real Social Security numbers to create fake personas and then apply for credit.

May 2 -

Agencies are examining regulating cybercurrencies not named bitcoin; is Paul Achleitner to blame for the German bank’s problems?

May 1