-

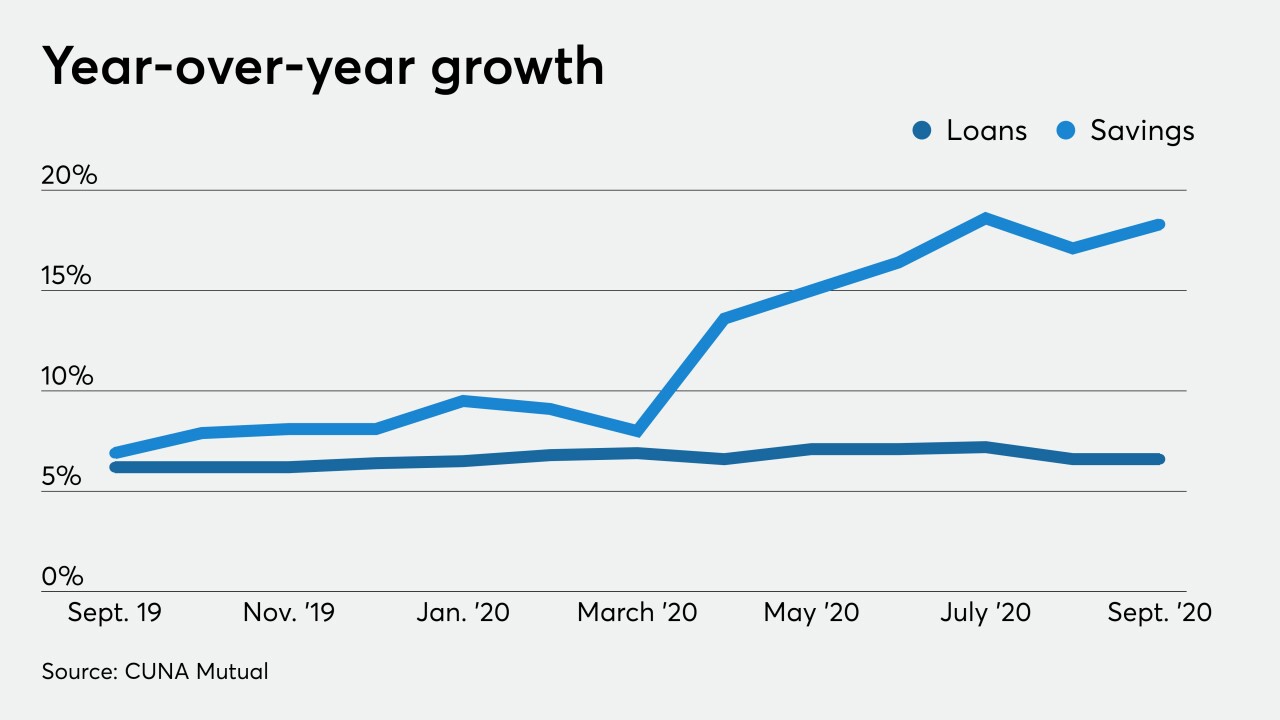

Comerica, Citizens Financial and other companies are buying up securities, paying off high-cost borrowing and trying to develop specialty lending niches. But loan growth remains weak, and the likelihood of extreme volatility in deposits makes it hard to plan ahead.

January 29 -

Deposits are soaring while loan demand lags and mortgage-backed securities offer weak returns. So the Alabama company has parked loads of cash at the Fed in hopes the economy will pick up steam before profit margins suffer.

January 22 -

From dealing with a flood of deposits to working with examiners virtually, credit unions were forced to quickly adapt to a new normal after the pandemic hit. Here's a look at some of the biggest changes and challenges they faced.

December 31 -

The revamp of the brokered deposits framework offers relief to banks and their partners that saw the prior rule as outdated. Meanwhile, new standards for industrial loan company parents aim to clarify the bank chartering process for fintechs and other nontraditional firms.

December 15 -

On Sep. 30, 2020. Dollars in thousands.

December 14 -

The agency's principals are scheduled to meet Dec. 15 to vote on a new definition for brokered deposits and on regulatory standards for industrial bank parents.

December 11 -

Credit quality has remained strong at credit unions, but there are hints that some of them — especially the smallest ones — could report lackluster earnings well into next year, according to the National Credit Union Administration's latest intel on industrywide finances.

December 8 -

The Massachusetts company, which had a big second-quarter loss after writing down the goodwill tied to past acquisitions, will sell eight branches to Investors Bancorp and shutter 16.

December 2 -

Current economic conditions are greatly tied to controlling the spread of the coronavirus. To survive this volatile situation, financial institutions must be resilient.

November 24 Bonneville Power Administration

Bonneville Power Administration -

Year to date Jun. 30, 2020. Dollars in thousands.

November 23 -

The company's latest report predicted there could be sustained economic pressures well into next year tied to rising coronavirus cases.

November 20 -

Technology imperatives, weak loan demand and the need for increased efficiency could put pressure on dozens of regional banks to join forces with rivals.

November 17 -

The forthcoming measure could override staff opinions that helped certain deposit-gathering companies partner with banks.

November 13 -

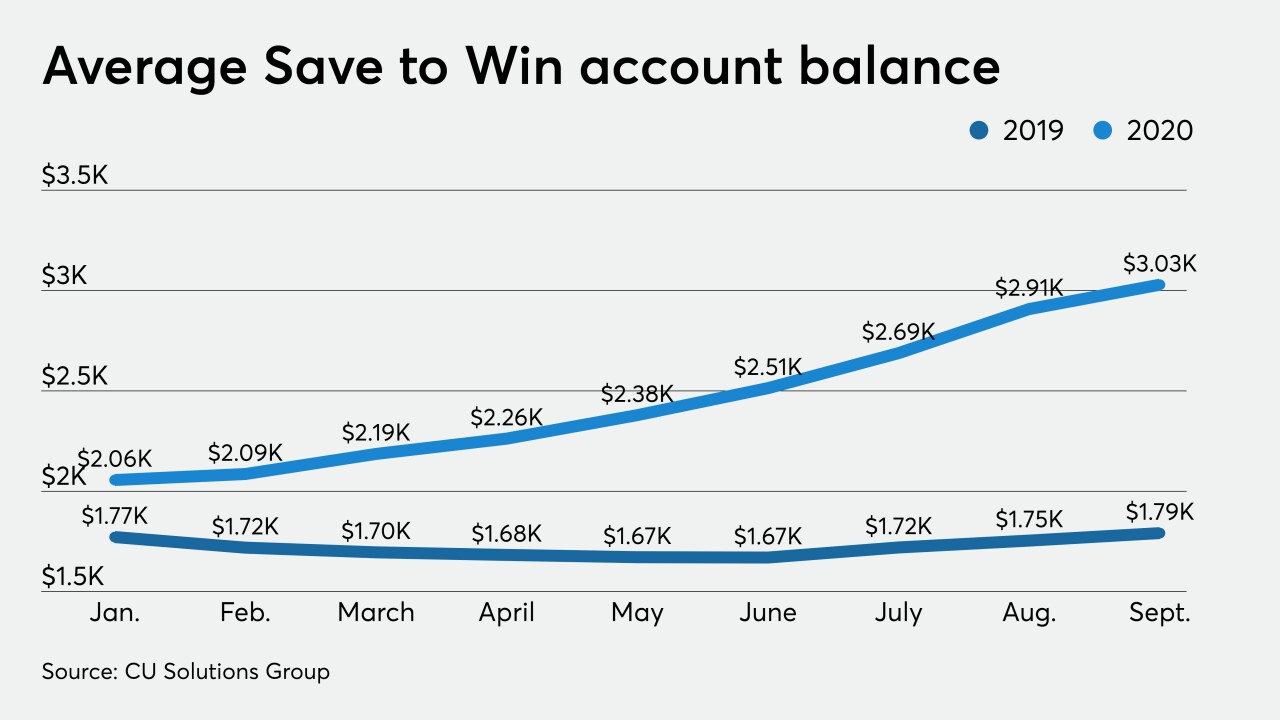

Many credit unions offer these accounts to help members improve their financial behaviors, but some in the industry are wondering how long the surge could last.

November 10 -

On Jun. 30, 2020. Dollars in thousands.

November 2 -

The company is best known for its reciprocal deposit program, but it’s finding new ways to serve banks without competing for their customers.

October 29 -

First City Bank of Florida had suffered “longstanding capital and asset quality issues” that were unrelated to the pandemic, the FDIC said.

October 16 -

The family-owned bank from the South and the New York commercial lender each would fill a clear need for the other. First Citizens would gain business lending expertise and an online deposit-gathering platform, and CIT would get the cheap deposits it coveted.

October 16 -

Cash, Treasurys and other securities effectively guaranteed by the federal government now make up more than 35% of the combined balance sheets of the 25 biggest U.S. banks, according to data compiled by the Fed. That’s the biggest share in records dating to 1985.

October 9 -

USAA sues PNC over mobile check deposit technology; flood of liquidity that accompanied the pandemic recession unlikely to subside anytime soon; 'enigmatic' CFPB chief could drop more surprises in a second Trump term; and more from this week's most-read stories.

October 9