-

Loan demand disappointed as optimism for economic growth under President Trump gave way to uncertainty over the prospects for regulatory relief and tax reform. Credit quality held up, but the retail and health care sectors have become potential trouble spots. Here’s a recap drawn from banks’ quarterly earnings calls.

April 28 -

The weakening car-loan market poses a big challenge for the Detroit-based lender, but it also could also present an opportunity, since other big banks are sharply reducing their exposure.

April 27 -

The Tulsa, Okla., company also benefited from higher interest and fee revenue while keeping expenses under control.

April 26 -

The Georgia company invested in HCSB Financial's recapitalization a year before agreeing to buy the coastal South Carolina bank. Doing so allowed United to stay to close to HCSB and its board, which helped when the time came to discuss a deal.

April 25 -

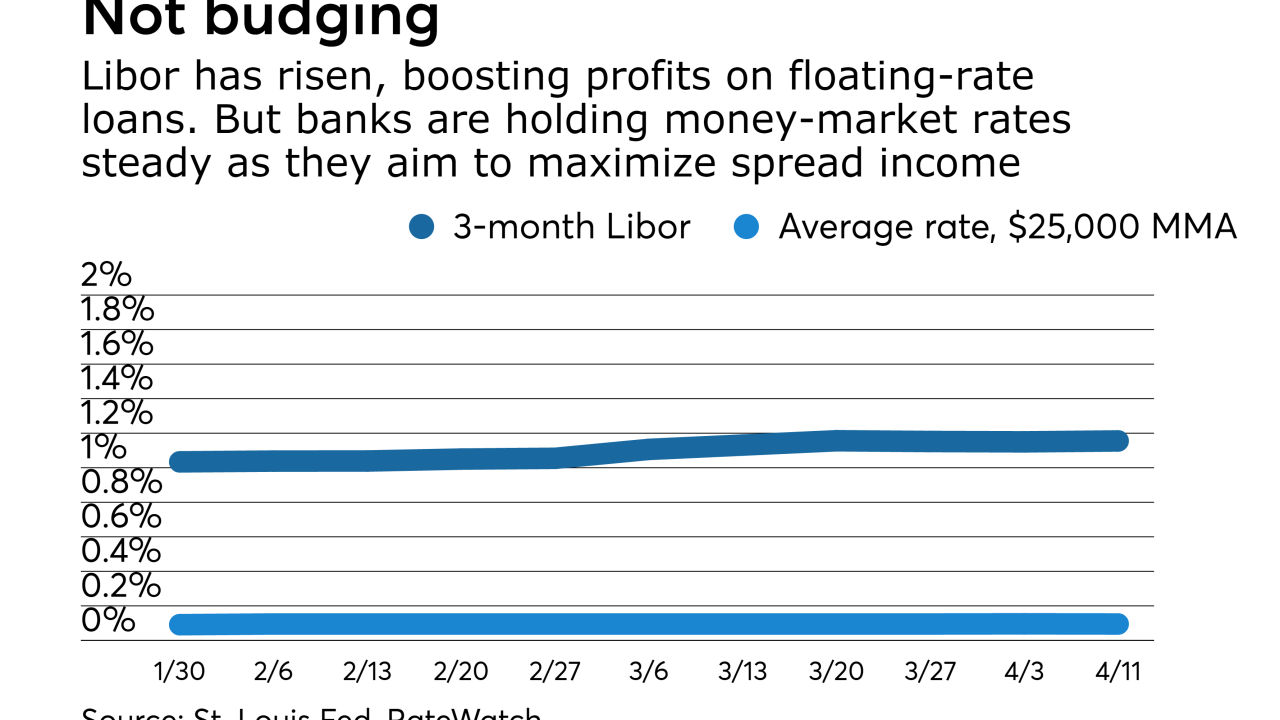

Even with net interest margins improving, banks are reluctant to raise rates on deposits until more floating-rate loans reprice. But how long can they wait before depositors start demanding higher yields?

April 24 -

The Mississippi company's first-quarter earnings rose 60% from a year earlier. Its results from last year were weighed down by a settlement with regulators.

April 19 -

The Ohio company said it is retaining more FirstMerit deposit accounts than it had projected. At the same time, Huntington is moving forward with cost-cutting tied to the acquisition.

April 19 -

A review of activity that long ago would not shed additional light on the scope of misconduct in Wells Fargo's retail banking unit, CFO John Shrewsberry said in an interview.

April 13 -

Business confidence remains high, but Fed data shows commercial borrowing actually decelerated during the first quarter. Fortunately for banks, rate hikes have fattened margins.

April 7 -

Customers of National Capital Bank in Washington wanted mobile banking with remote deposit capture, but the community bank first had to find a new CEO.

March 20