-

As the holiday shopping season kicks off, retailers are preparing for an influx of payment volume from shoppers and scammers alike. Here are a few of the problems they face.

November 28 -

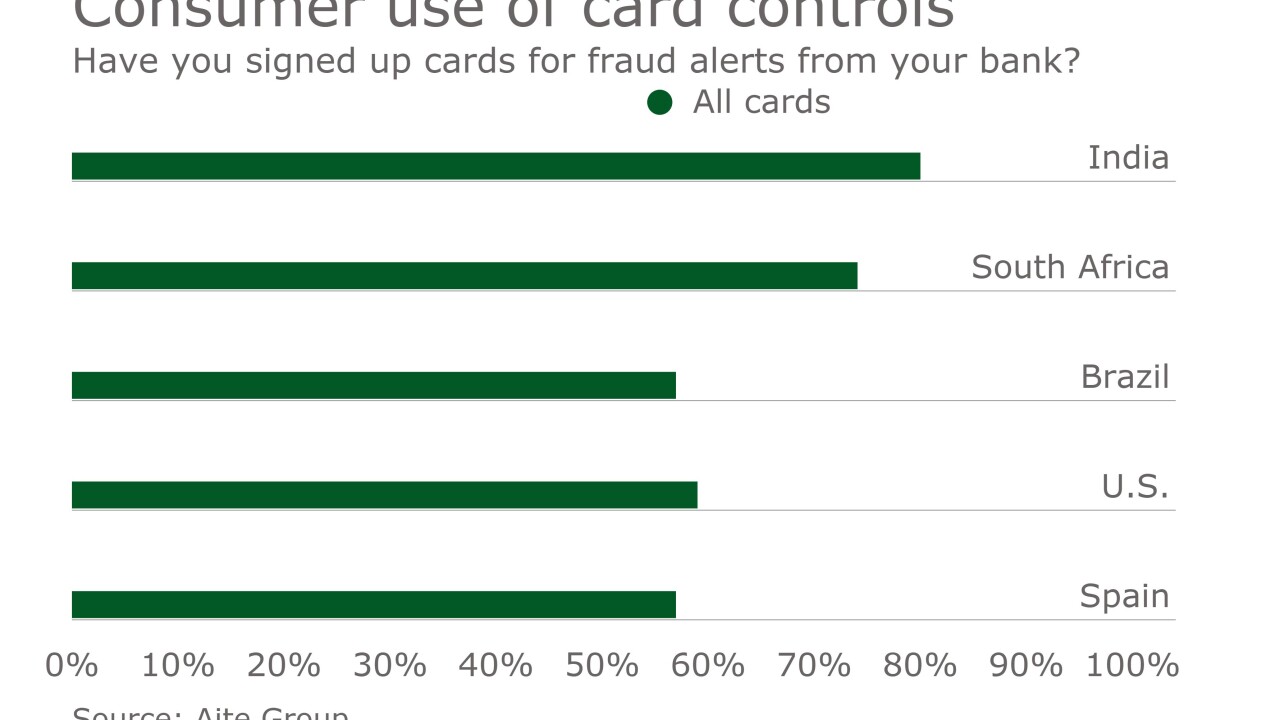

Mobile apps that allow consumers to control their payment cards are becoming more popular as banks use payment security as a way to build customer relationships.

November 22 -

Mastercard will launch its “selfie pay” system in the Asia-Pacific region next year, expanding the global reach of its biometric identity-verification service for online payments to more markets as part of a gradual worldwide rollout.

November 17 -

Digital payments security provider V-Key will protect the cloud-based payments network of Ant Financial Services Group (Alipay) with its virtual secure element software.

November 14 -

Consumers may wholeheartedly trust the biometric security built into their smartphones, but banks could be doing more to protect them.

November 9 -

Samsung Electronics has entered a commercial software license and distribution agreement with fingerprint software company Precise Biometrics.

November 8 -

Citibank has launched Touch ID sensor authentication for its iOS mobile banking users in Hong Kong.

November 7 -

Tesco Bank has confirmed that over the weekend, some of its customers' accounts were subject to online criminal activity, in some cases resulting in money being withdrawn fraudulently.

November 7 -

Payments technology is showing up in places that were unimaginable just a few years ago. That creates new opportunities for merchants and banks, but also new opportunities for fraudsters.

November 4 -

While some banks allow existing customers to

pay by selfie, BBVA is using them to get new customers.November 3 -

By establishing its e-commerce fraud prevention system as a "mobile first" platform, Forter worked to get a step ahead of a growing trend — that many new retailers accept only mobile payments through their apps.

November 1 -

Hitachi Ltd. is introducing a system to protect people from being conned into transferring money from their bank accounts at automated teller machines.

October 31 -

Blockchain and the 'Internet of Things' are enabling a lot of new payments innovation. In Canada, they're part of a huge project that could radically change ID security for more than just payments.

October 24 -

The U.S. migration has passed the one-year mark, but more key dates are on the horizon.

October 24 U.S. Payments Forum

U.S. Payments Forum -

Businesses may need to rethink their approaches to identity verification for millennial consumers.

October 18 -

Australia's banks have submitted a formal statement to the Australian Competition and Consumer Commission

slamming Apple.October 17