Digital banking

Digital banking

-

One CU is opening up its digital transformation process for the entire credit union movement to see.

February 23 -

The North Carolina bank is the latest regional to experience a widespread outage.

February 23 -

The bank will allow its customers to apply for car financing online and receive a decision within minutes.

February 22 -

The internet giant, SunTrust, Ally and other backers have invested $16 million in a new funding round for Greenlight Financial Technology, further blurring the lines between banks and tech companies.

February 21 -

Scores of customers have been unable to use digital channels to access accounts for more than a week, and many have taken to social media to voice their displeasure with TD’s response to the outage. The lesson for other banks: Test new platforms, and test them again, before making them live.

February 20 -

Banco Santander joined existing investors JPMorgan and USAA as well as others in raising $25 million in secondary-round financing for Roostify, which seeks to build a paperless mortgage process.

February 15 -

POPin Video Banking Collaboration offers video chat and simultaneous collaboration between financial institutions and the consumers they serve.

February 15 -

As regulators look to update the Community Reinvestment Act, they should better integrate online and mobile banking activity as part of exam performance.

February 15 -

Webster Bank’s partnership with the national broker-dealer LPL is a reversal of its initial opposition to robo-advisers. It is the latest regional bank to enter a market first claimed by the biggest banks.

February 13 -

The bank joins a small group of companies that believe short-term forecasts will ultimately help customers build healthier financial lives.

February 13 -

The online small-business lender is enjoying a payoff from its year-old push to cut costs and tighten underwriting standards. It is also set to announce another lending agreement with a major bank this year, its CEO said Tuesday.

February 13 -

After launching a video-banking platform in 2016, Vibrant Credit Union has now rolled the program out across its entire branch network, citing high member satisfaction rates, a boost in lending and decreased wait times.

February 9 -

The journey Diane Morais is taking Ally on is all about being more relevant to customers. Doritos offers a lesson on how to do the opposite. CIT's Ellen Alemany says banks are 'terrific' about addressing sexual harassment. But what about the gender pay gap and boardroom balance?

February 8 -

Capital One has been rolling out coffee shops where it can offer banking services — but are not considered branches. The cafes have been especially effective at gathering deposits, putting more pressure on community banks that have already been losing deposits to their larger rivals.

February 8 -

Marquette Bank is proof that community banks don't have to be the fastest or flashiest to compete with online lenders. Instead, the Chicago bank closely mirrored fintech offerings while promoting personal service to set itself apart.

February 8 -

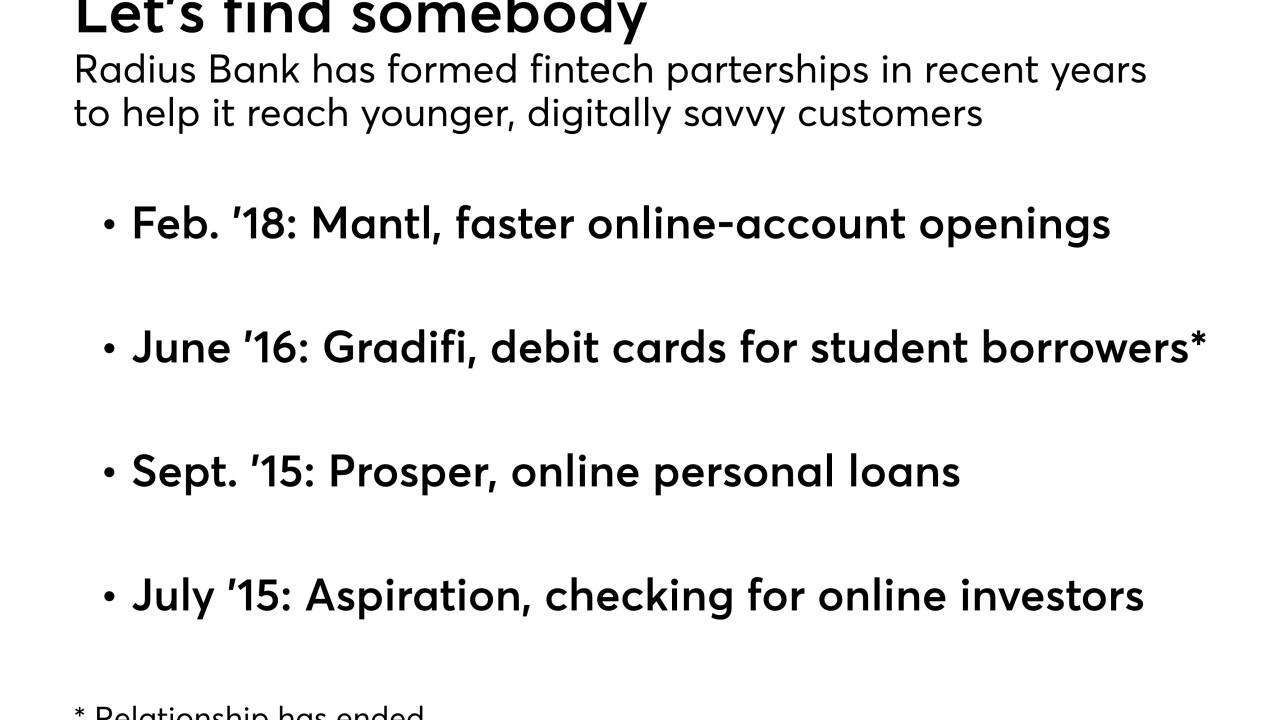

Its latest partner, Mantl, has built software that lets consumers open accounts in four minutes. In such alliances Radius seeks expertise it lacks, gets heavily involved in product development, and tries to balance the spirit of innovation with the demands of compliance.

February 7 -

It's not enough to hire someone with strong IT skills—they also need "soft skills" such as a passion to keep learning and understanding members needs.

February 5 -

The data-sharing directive has gotten off to a rocky start overseas, underscoring the need for domestic banks to start educating customers about the model well before it’s adopted stateside.

February 2 -

Readers react to a clash between Mick Mulvaney and Richard Cordray, opine on how quickly Congress can move financial services legislation, slam calls for increased bank consolidation and more.

February 1 -

How do you eliminate "pain points" in the banking experience, increase wallet share and improve loyalty? Companies like Ally, USAA and Bank of the West are believers in tracking the customer journey to find the answers.

February 1