Digital banking

Digital banking

-

The journey Diane Morais is taking Ally on is all about being more relevant to customers. Doritos offers a lesson on how to do the opposite. CIT's Ellen Alemany says banks are 'terrific' about addressing sexual harassment. But what about the gender pay gap and boardroom balance?

February 8 -

Capital One has been rolling out coffee shops where it can offer banking services — but are not considered branches. The cafes have been especially effective at gathering deposits, putting more pressure on community banks that have already been losing deposits to their larger rivals.

February 8 -

Marquette Bank is proof that community banks don't have to be the fastest or flashiest to compete with online lenders. Instead, the Chicago bank closely mirrored fintech offerings while promoting personal service to set itself apart.

February 8 -

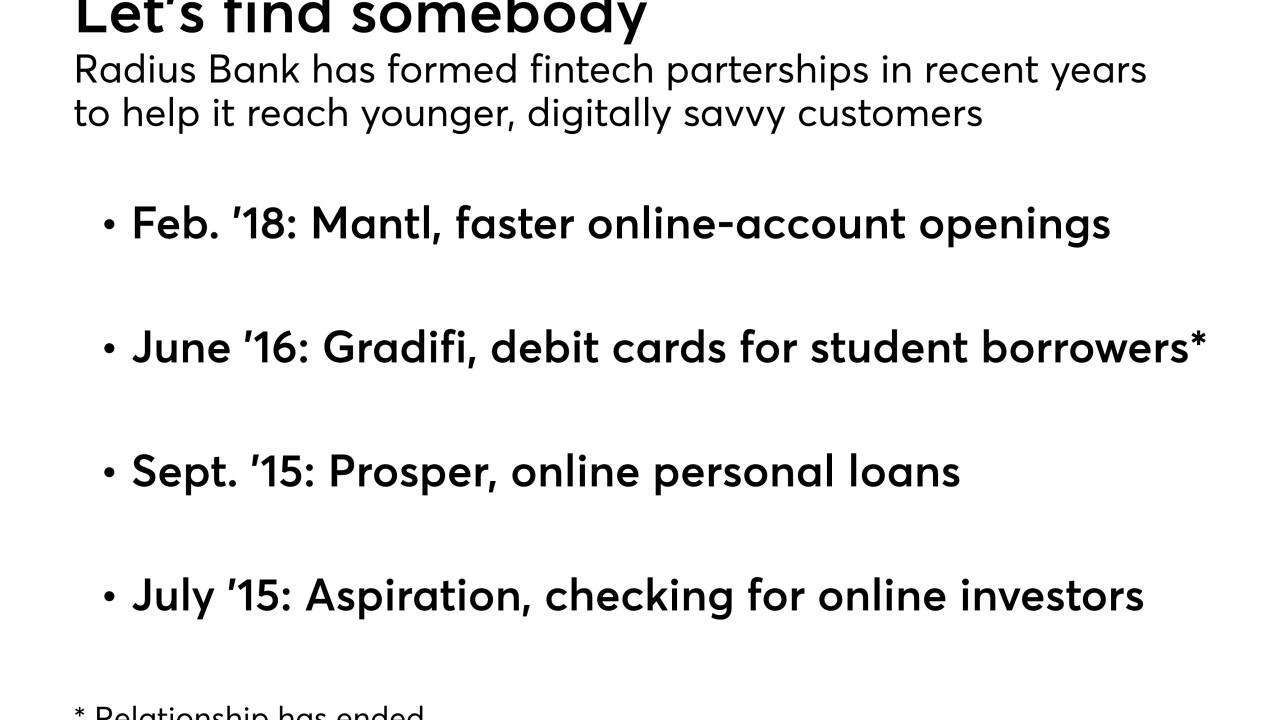

Its latest partner, Mantl, has built software that lets consumers open accounts in four minutes. In such alliances Radius seeks expertise it lacks, gets heavily involved in product development, and tries to balance the spirit of innovation with the demands of compliance.

February 7 -

It's not enough to hire someone with strong IT skills—they also need "soft skills" such as a passion to keep learning and understanding members needs.

February 5 -

The data-sharing directive has gotten off to a rocky start overseas, underscoring the need for domestic banks to start educating customers about the model well before it’s adopted stateside.

February 2 -

Readers react to a clash between Mick Mulvaney and Richard Cordray, opine on how quickly Congress can move financial services legislation, slam calls for increased bank consolidation and more.

February 1 -

How do you eliminate "pain points" in the banking experience, increase wallet share and improve loyalty? Companies like Ally, USAA and Bank of the West are believers in tracking the customer journey to find the answers.

February 1 -

The cloud-based vendor was formerly a division of Live Oak Bank.

January 31 -

The pioneering brand re-enters a market where fintechs now account for over 30% of personal loan originations.

January 30 -

The Mobile Act would allow financial institutions to scan or copy a customer’s photo ID when opening an account remotely, while another bill contained provisions that would protect bankers from lawsuits if they report suspected elder financial abuse.

January 30 -

The Mobile Act would allow financial institutions to scan or copy a customer’s photo ID when opening an account remotely, while another bill contained provisions that would protect bankers from lawsuits if they report suspected elder financial abuse.

January 30 -

Elizabeth Warren takes acting CFPB director Mick Mulvaney to task over his decision on data collecting; B of A gets heat from harrassment reveal and free checking halt; and more.

January 26 -

Reps. Elijah Cummings and Jimmy Gomez, both Democrats, questioned why B of A would stop offering accounts that are popular with low-income consumers when it stands to reap huge financial benefits from recently passed tax cuts.

January 26 -

Readers weigh in on how Mick Mulvaney is remaking the Consumer Financial Protection Bureau, chime in on JPMorgan’s plans to roll out more branches, react to fee income trends and more.

January 25 -

Ideal CU puts emphasis on digital strategy, Veridian taps new branch manager and more CU professionals in the news.

January 25 -

The bank tweeted that website and mobile app service were restored after an outage that lasted much of the day.

January 25 -

Digital alerts for clients aren't new, but they can still provide small banks a platform to reach new markets and appeal to younger clients.

January 25 -

StreetShares seeks to tap into the loyalties of military veterans, bringing together borrowers and savers through an online platform.

January 24 -

Executives point out while they are fixing the online lender's very public problems, loan originations are still in the billions and it has expanded into wealth management.

January 24