Digital banking

Digital banking

-

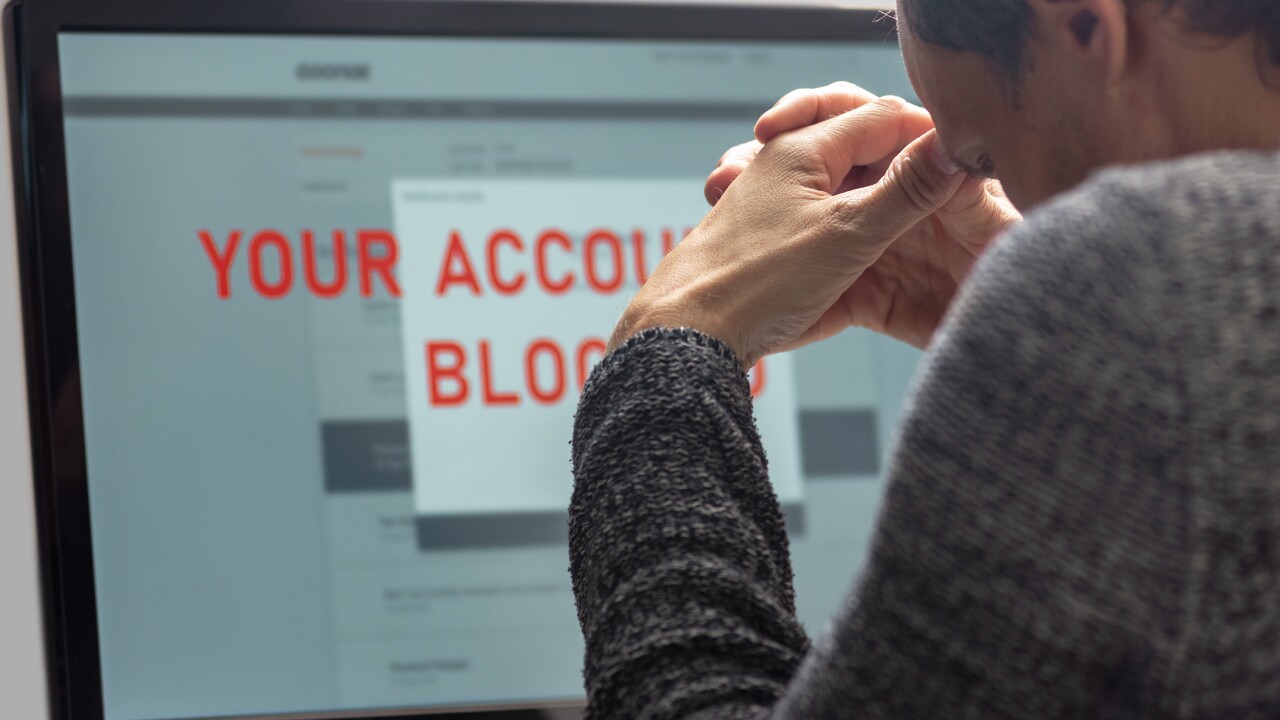

Some established financial technology companies like Robinhood are said to be refusing to accept funds from accounts at young digital-only banks that they say are growing too fast to deter fraud. The companies being blocked respond that it’s an unfair, scattershot approach.

December 20 -

The consumer bureau asked for public feedback about payment platforms as part of a focus on the Silicon Valley giants’ financial services aspirations. But comment letters so far have been dominated by users complaining that they lost money on the big-bank-owned peer-to-peer network.

December 20 -

Worker shortages at call centers and rising concerns about account fees may have contributed to the industrywide decline, according to the authors of a new J.D. Power study. Capital One, which scored highest, benefited from its strength in digital banking.

December 16 -

The Pennsylvania bank run by Sam Sidhu is updating its platform to support real-time payments for cryptocurrency companies and will offer embedded finance and banking-as-a-service to fintechs.

December 16 -

The proceeds will support Silvergate’s network that facilitates cryptocurrency transactions and a leveraged lending product that provides loans collateralized by bitcoin.

December 8 -

The Georgia bank estimates that it will save $12 million annually by shutting down 40 branches.

December 7 -

By acquiring First Sound Bank in Seattle, the fintech would control the strategic direction of the combined company and won't have to share revenue, CEO Luvleen Sidhu says.

December 6 -

Citizens Financial Group, which has offered instant financing for the Xbox All Access program since 2019, will now provide point-of-sale loans for Microsoft PCs, tablets and other products and services.

December 6 -

Coming out of the pandemic, traditional banks will have just two years to update their business models or they risk falling behind more innovative peers and aggressive upstarts, the consulting giant warns in a new report.

December 3 -

Professional Holding CEO Dan Sheehan is dismissive of off-the-shelf bank technology. “Whatever we’re getting in a box, the next hundred competitors are going to be able to get.”

November 23