Digital payments

Digital payments

-

In addition to monitoring the spike in contactless payments because of the COVID-19 pandemic, Verizon Business has also cited the expected decrease in foot traffic at the largest malls in the U.S. through its mobile data metrics.

November 20 -

Software developers and ISOs must go into payment partnerships with a full understanding of what capabilities their merchants are seeking, including flexibility and choice, says NMI's Nick Starai.

November 19 -

The success of some fintechs in getting bank charters this year only underscores how onerous the process remains for many others. That’s unlikely to change unless policymakers reconsider what it means to be a bank.

November 18 -

Google has redesigned Google Pay to add new financial management and loyalty features; and to offer consumers checking and savings accounts from partner banks and credit unions in 2021.

November 18 -

COVID-19 has accelerated the end of cash and pushed digital payments to a new tipping point.

November 18 -

While most payment firms consider checking a time-consuming expensive relic for business transactions, one San Francisco-based fintech is going the opposite direction by adding checks to its digital platform.

November 18 -

The accelerator has enabled Los Angeles-based fintech Be Money to relaunch itself as Daylight and bring to market a transgender-inclusive preferred name card.

November 18 -

The pilot leverages Keyno’s CVVkey technology that uses a dynamic card verification value 2 (CVV2) code to provide a higher level of security against fraud for online and mobile payments.

November 17 -

Kate Fitzgerald, Senior Editor at PaymentsSource, talks to Barry McCarthy, President and CEO of Deluxe, about the role legacy providers have in the world of modern fintech.

November 17 -

The pilot leverages Keyno’s CVVkey technology that uses a dynamic card verification value 2 (CVV2) code to provide a higher level of security against fraud for online and mobile payments.

November 17 -

Mastercard says it has been notified the Department of Justice has approved its planned acquisition of data aggregator Finicity, putting the card brand on track to close the deal before the end of the year.

November 16 -

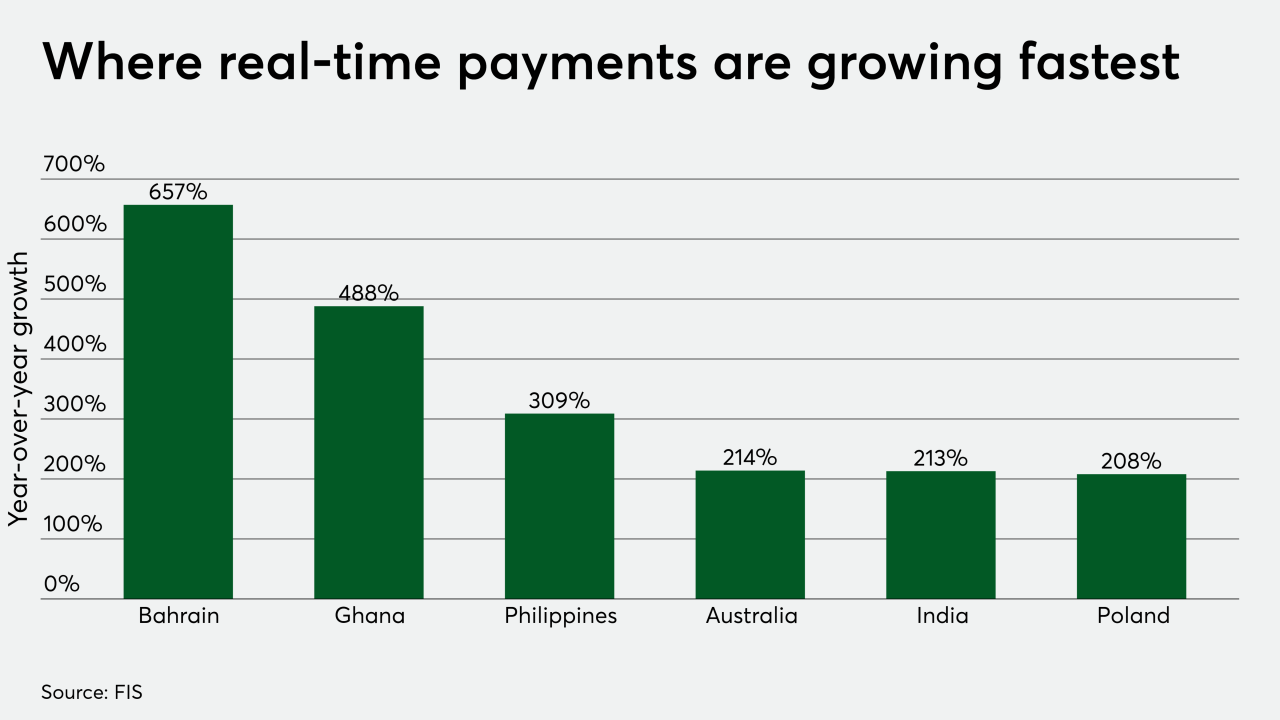

As futuristic as real-time digital payments can be, the concept is almost like a blast from the past for FIS’ Raja Gopalakrishnan.

November 16 -

Replacing the traditional POS model will be a cloud-focused and software-defined model that gives shoppers their choice of checkout and reimagines the store experience, says Zynstra's Brian Buggy.

November 13 -

Our collective work on the real-time payments front is not for naught. That is because the consumer and business needs are evolving, says Bottomline's Jessica Cheney.

November 13 -

Concerns over cash and checks are permanent and will make contactless mainstream, says Global Market Insights' Vinisha Joshi.

November 12 -

Brazil aims to move beyond the era of cash payments on Monday, when the Banco Central do Brasil launches the Brazil Instant Payment System.

November 12 -

Unlike a traditional supply chain, where value and risk travels up and down a set of organizations in a linear fashion, the extended enterprise is a complex network of relationships, says PXP Financial's Koen Vanpraet.

November 11 -

EMVCo, the major card brand-supported venture to establish EMV guidelines and specifications, has begun testing a program to determine if consumer mobile devices can securely accept contactless payments — a move that not only hastens the adoption of contactless payments, but renews criticism over which networks control technology and routing decisions.

November 11 -

For the 2020 holidays, retailers that enable payment flexibility by catering to global shoppers will prepare themselves for lasting success, ensuring they are on the right side of this industry transformation.

November 11 -

In a battle between two giants of ride-hailing and payments, Grab beat out Go-Jek to lead a $100 million fundraising round for the Indonesian government-backed e-wallet provider LinkAja.

November 10