Digital payments

Digital payments

-

Fuel card operator WEX is expanding its mobile payments app for fleet drivers to U.S. Shell stations, more than doubling the app’s reach following last year's launch at ExxonMobil stations.

July 9 -

The U.S. card brands are already pushing Indian regulators to relax their data storage rules, and a new quirk in the country’s tax code creates a battle on an entirely different front.

July 9 -

Amazon is moving into new markets armed with local storage lockers and partnerships, while many traditional retailers still lack the proper online capabilities, claims Arik Shtilman, CEO and co-founder of Rapyd.

July 9 -

Just four months after receiving an e-money license from Central Bank of Ireland, fintech startup Soldo has raised €54 million ($60.5 million U.S.) to help fund its relocation from the U.K. into Ireland ahead of the possible Brexit split.

July 8 -

The latest skepticism to Facebook Inc.’s plans for its new cryptocurrency called Libra comes from India as Asia’s third-largest economy is not keen on allowing the digital currency in the country.

July 8 -

Once a dataset’s data and lifecycle events are in a known state with lineage, new and exciting opportunities are possible, writes David Levine, head of data product strategy for PeerNova.

July 8 -

The incident underscored the vulnerability of digital payment platforms to technical troubles. Visa and Mastercard have each experienced serious outages within the last couple of years.

July 5 -

E-commerce payments and fintech services provider PayU has acquired a majority stake in Southeast Asia online payment software company Red Dot Payment in order to expand into the Asian market.

July 5 -

The technology behind bitcoin has spread far and wide, boosting bank and payment innovation. The competitive impact on the traditional payment industry will be felt for years to come, according to Demetrios Zamboglou, COO of BABB.

July 5 -

Swish is expanding to physical stores to extend usage among the millions of Swedes who use the app for account-to-account transfers.

July 3 -

It’s too early to measure the market effect of New York City's contactless transit payment acceptance pilot launched barely a month ago, but many merchants in the immediate area may not be ready if demand spikes.

July 3 -

Seamless transactions are the key to engaging and holding onto consumers, says Tim Tynan, CEO of Bank of America Merchant Services.

July 3 -

Payoneer, which developed a platform to facilitate cross-border payments, hired FT Partners to explore options for expansion, including a private funding round, according to a person familiar with the matter.

July 2 -

Cloud computing has boosted P2P and makes it easier for developers to build new businesses and payment technology, says Demetrios Zamboglou, BABB's chief operating officer.

July 2 -

FamilyMart and 7-Eleven Japan are using mobile payment technology to compete with each other and attempt to manage the country's labor shortage.

July 2 -

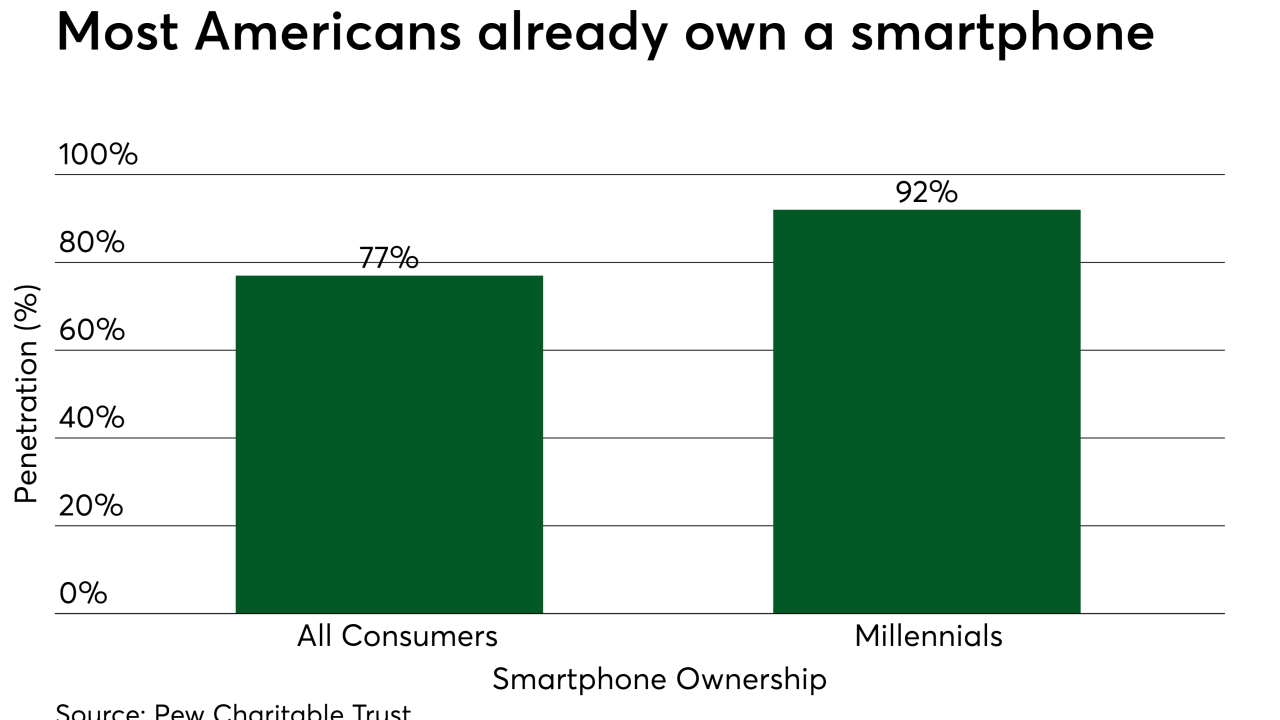

Fiserv is supporting mobile bill presentment in to meet a growing demand for receiving and paying bills through smartphones, which are now nearly ubiquitous in the U.S.

July 1 -

The bank is considering eliminating as many as 20,000 jobs; BIS doesn’t want central banks to fall behind private cybercurrency efforts.

July 1 -

By turning compatibility into a nonissue, APIs help enable open banking, which has the potential to offer core banking services such as payment initiation or account balances through APIs, writes JPMorgan Chase's Stephen Markwell.

July 1 -

Most large banks have declared their strategies for adopting contactless cards, but the rank and file of FIS’ midsize and smaller issuers are still weighing their options about when to flip the switch.

July 1 -

From regulatory reform to natural disasters and more, here's a look at Credit Union Journal's special report on what to expect for the second half of the year.

June 28