-

Sir Tim Berners-Lee, creator of the World Wide Web, exhorted developers to think about unintended consequences, saying he felt guilty over the digital divide and the proliferation of fake news.

October 17 -

Credit Suisse, State Street and several other banks are experimenting with a blockchain technology that could allow them to make corporate deposits more affordable to hold on their books.

October 13 -

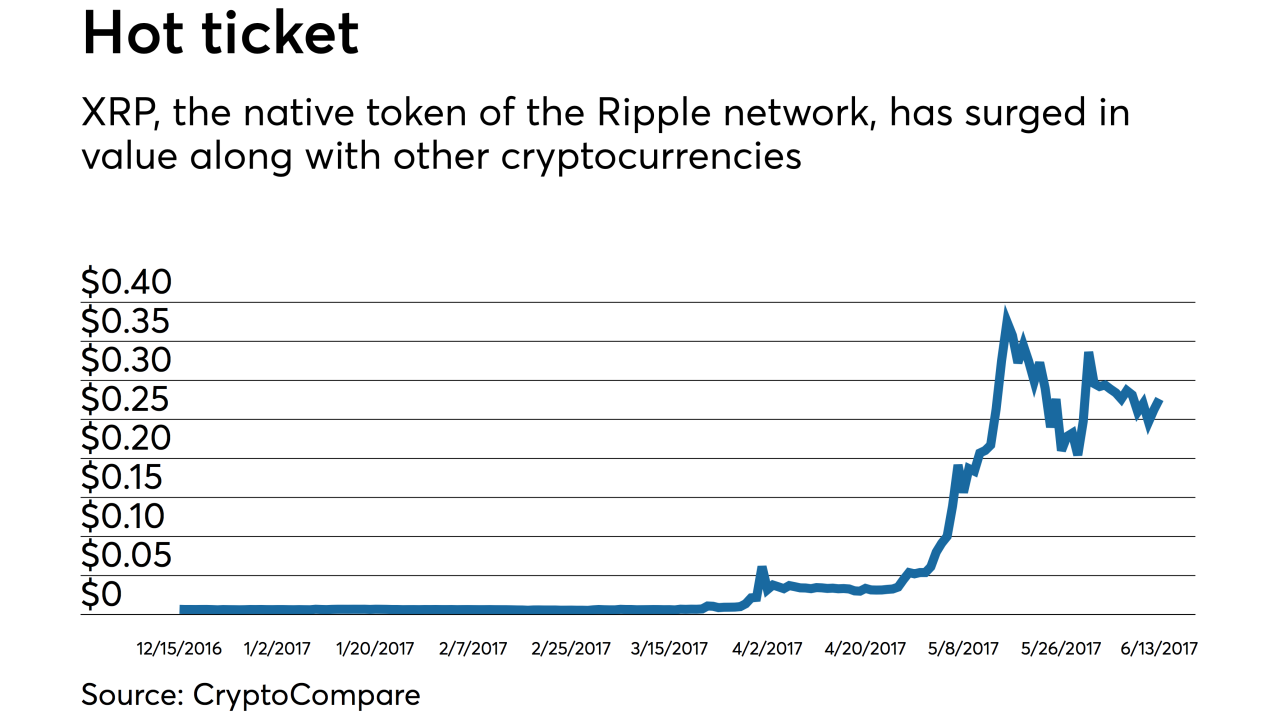

Ripple announced several new customers Tuesday. The startup says its software, designed to compete with Swift, allows banks and others to send cross-border payments more quickly, transparently and cheaply.

October 10 -

The explosion of interest in digital assets this year, and the multiplying of their market value, are making cryptocurrency debit cards newly attractive. Banks could partner with intermediaries or issue the cards directly, but obstacles remain before that day can arrive.

October 2 -

For high-value, low-volume transactions, that is. Big Blue formally launched the platform Tuesday, but the custody bank has been using it for months, as has a group of Canadian institutions.

August 22 -

The Japanese exchange bitFlyer has processed $30 billion in bitcoin trades so far in 2017. Now it has its sights set on American crypto enthusiasts.

August 18 -

Sanger is out at Wells Fargo and so it is a crisis that gives us our first female board chair at a major U.S. bank. Women lead two major tech initiatives at JPMorgan Chase, which is also adding a fourth woman to its executive committee.

August 17

-

CULedger, LLC is backed by CUNA, Mountain West CU Association, Best Innovation Group.

August 17 -

The business world has been seeking the benefits of distributed ledgers but worries about security, control, privacy, performance and other issues. Microsoft says its new Coco framework will solve all these and more.

August 10 -

Readers react to USAA teaming up with Amazon’s Alexa, how a new Wells Fargo’s scandal could affect arbitration rules, a digital identity startup’s ambitions, and more.

August 4 -

Christine Duhaime, an anti-money-laundering attorney in Toronto, lays out the reasons banks should become early experts (and assist) in initial coin offerings. She also lays out the risks, especially in the wake of the SEC’s report suggesting some ICO tokens are really securities.

August 1 -

Startups and open-source software projects have raised $1.3 billion this year through initial coin offerings. The real boom may still lie ahead, fears of a bubble notwithstanding.

July 28 -

The federal agency's investigative report concludes that crowdsales of blockchain tokens known as initial coin offerings may need to comply with securities laws.

July 25 -

A new blockchain network that promises to compete with Ethereum is taking the token sale trend to the next level.

July 13 -

It’s not speed, which will steadily if not exponentially increase in the near term. It’s the centralists that are holding onto their roles as reconcilers of data.

July 11 Financial InterGroup Advisors

Financial InterGroup Advisors -

Using technology from the blockchain startup Ripple, the U.K.'s central bank completed a successful proof of concept—and reaffirmed its goal of integrating with distributed ledgers.

July 10 -

Just as we call letters "snail mail," in the future people may consider bank transfers snail money.

June 21 -

Readers chime in on the GSE conservatorships, bitcoin’s future, regulatory relief for regional banks, a recent Supreme Court ruling on debt collection, and more.

June 16 -

Most fintech startups fall into one of two camps: those that want to compete with banks and those that want to save banks from themselves. Ripple is the rare exception that wants to do both.

June 14 -

Private companies incorporated in Delaware could start issuing and tracking shares of stock on a distributed ledger this summer.

June 13