Earnings

Earnings

-

Small Business Administration lenders have reported strong quarterly results, but those gains could evaporate later this year. Here’s why.

July 23 -

The goal is to add customers and prop up borrowing until business travel rebounds and consumers burn through their excess cash, CEO Roger Hochschild says.

July 22 -

The retail consolidation in Midwestern markets will also support the bank’s branch expansion in Atlanta, Charlotte and other fast-growing cities across the Southeast.

July 22 -

Comerica, which focuses on the energy sector, reported strong payment trends last quarter, while M&T, which concentrates more on real estate, showed deterioration. The divergence reflects varying exposures to sectors hit hard by the COVID-19 recession.

July 21 -

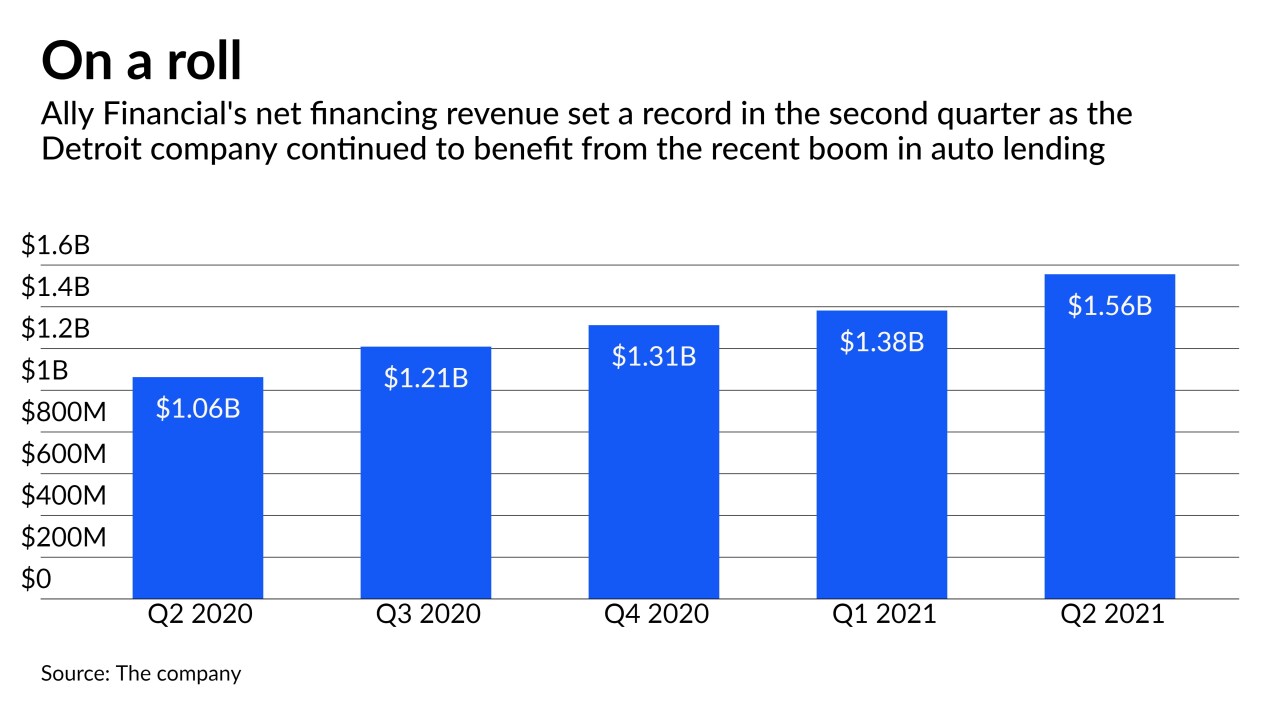

The Detroit company, one of the nation's largest car lenders, enjoyed a surge in profits during the second quarter, largely due to strong consumer demand for vehicles. But how long will the good times last?

July 20 -

The Pittsburgh company offset relatively flat revenue and lending in the second quarter with strong service charges, wealth management fees and a $1.1 million reserve release.

July 20 -

Commercial and industrial loans fell 14.3% in the second quarter. But CEO Chris Gorman says green shoots are emerging, pointing in particular to recent stability in credit line utilization rates.

July 20 -

The Rhode Island bank endured a sharp decline in fee income from home loans, which had spiked earlier in the pandemic. But CEO Bruce Van Saun says the company is well positioned as the refinancing boom fades and the home purchase market becomes more important.

July 20 -

The bank is planning to make product changes and roll out new digital tools that will allow customers to avoid the charges, according to CEO Kevin Blair.

July 20 -

BNY Mellon and State Street have been granting millions of dollars in discounts to ensure investors in money market mutual funds stay in the black. Recent moves by the Fed are expected to relieve the pressure.

July 19 -

The Tennessee company said merger costs tied to its Iberiabank acquisition are up $40 million from previous estimates. However, savings from additional branch closings and unexpected revenue gains should soften the blow.

July 16 -

A strong showing by the North Carolina bank’s insurance arm helped to overcome lower interest rates and sluggish lending in the second quarter.

July 15 -

The Minneapolis company benefited as business for airlines and hotels picked up sooner than expected. The rebound helped fee income in the bank’s payments business approach prepandemic levels.

July 15 -

The bank's noninterest expenses fell by 8% in the second quarter — a sign that CEO Charlie Scharf is making progress in reining in spending that had been soaring in recent years amid heightened regulatory scrutiny. He ultimately hopes to reduce gross expenditures by $8 billion annually.

July 14 -

The global company says that a quicker-than-expected economic recovery is creating some opportunities to invest in businesses that will generate returns over time.

July 14 -

Bank of America expects interest income to rise as stronger borrowing outweighs the impact of low rates. The upbeat forecast is in contrast with remarks from JPMorgan Chase executives.

July 14 -

PNC’s recent acquisition of BBVA's U.S. operations won quick approval from regulators, but a recent presidential directive promises more scrutiny of such deals, according to CEO Bill Demchak.

July 14 -

Wells Fargo’s average loans tumbled in the second quarter as consumers and businesses, buoyed by pandemic stimulus programs, refrained from more borrowing.

July 14 -

Income from stock trading and investment banking trounced analyst estimates in the second quarter and made up for weaknesses in the company's much bigger fixed-income and credit card divisions.

July 14 -

The company fell short of net interest income projections as loans and leases in the consumer banking unit dropped 12% from a year earlier. However, loan balances grew from the first quarter — the first sequential increase in a year.

July 14