Earnings

Earnings

-

The Western Michigan city has been a hotbed of credit union activity given its low unemployment rate.

February 19 -

The bank still plans to open branches on the West Coast even as it trims its overall U.S. footprint by 30%.

February 18 -

The bank's announcement that it will slash about 35,000 staff and take $7.3 billion of charges prompted its stock to tumble and renewed questions about the bank's direction and lack of a permanent CEO.

February 18 -

Fort Worth City CU returned money to members who saved and borrowed from the credit union last year, though net income was down amid an increase in charge offs and delinquencies.

February 14 -

The Raleigh, North Carolina, institution's payout for 2019 was 12% higher than the previous year.

February 14 -

Western Union's online strategy is paying off, as web transfers help overcome softness in troubled local markets.

February 11 -

The Rhode Island-based credit union also returned a patronage dividend to members for the 31st consecutive year.

February 11 -

The Indiana-based institution saw net income rise nearly more than 7% last year, along with other gains.

February 10 -

Some of the year-over-year drop in net income can be attributed to higher-than-normal figures in 2018 and costs associated with opening three new branches in 2019.

February 7 -

The credit union can now serve consumers in two additional counties.

February 7 -

The bank’s top shareholders want the chairman to quit if he won’t support the CEO; HSBC expected to go forward with job cuts while searching for permanent boss.

February 6 -

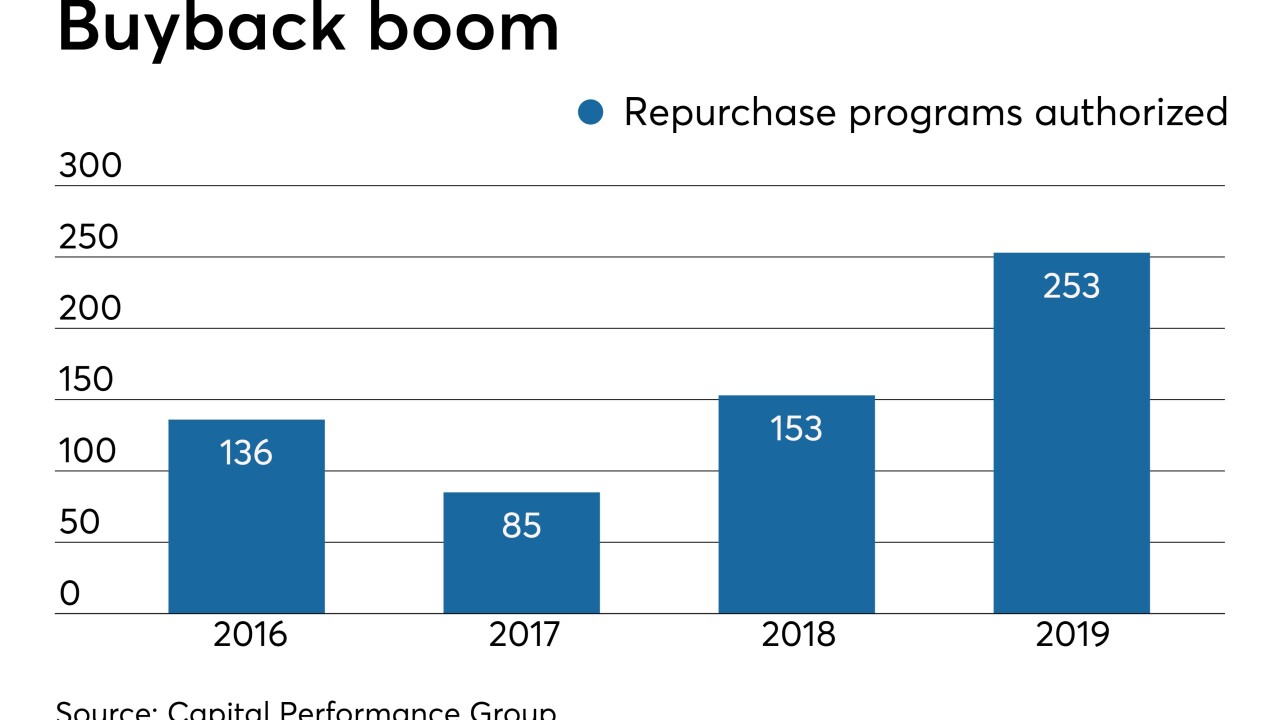

Anticipating a weaker economy and added pressure on stock prices, banks authorized more repurchases of outstanding shares last year.

February 5 -

The Maine-based credit union also grew membership last year to the point where it now serves nearly 40,000 consumers.

February 5 -

The bank’s former Asia investment banking co-chief is its third executive to be so punished; the agency says Telegram’s digital coin is a security.

February 5 -

Certain loan segments are showing signs of deterioration, but consumer lending and digital banking are bright spots. Meanwhile, bankers are eyeing opportunities to improve efficiency, add scale and take advantage of M&A disruption. Here's what to expect from smaller regionals in the year ahead.

February 3 -

The expansion comes after a year in which net income at the Nashville-based credit union dropped by more than half amid a rise in delinquencies and charge offs.

January 31 -

Banks would be allowed to own stakes in venture capital funds; the combined BB&T-SunTrust isn’t realizing cost savings as fast as it projected.

January 31 -

Like its rival Mastercard, payments volume is on the rise at Visa, but the coronavirus complicates the near-term economic outlook and makes China an even tougher market.

January 30 -

PayPal reported strong growth in revenues, earnings, payments volume and users, demonstrating as the company has finally transitioned away from the vestiges of its former eBay ownership.

January 30 -

The bank raised its return-on-equity goals, based mostly on cost cuts and its core trading business; the Fed did raise the rate it pays on bank reserves.

January 30