-

A collaboration between the two industries to help voters cast absentee ballots has been approved to continue through the general election.

September 18 -

The future of Fannie Mae and Freddie Mac, the Fed’s supervisory regime for the biggest financial institutions, reform of the Community Reinvestment Act and a host of other industry-related issues are on the ballot this November.

September 17 -

The Baltimore institution said it would close on Nov. 3 with the intention that employees use the paid time off to participate in the democratic process.

September 17 -

Legislation favorable to the industry would be unlikely to pass in a divided Congress, but the biggest benefit for banks and credit unions of Republicans' retaining control of the chamber would be defending against the disruption of a Democratic blue wave.

September 14 -

Victories in Massachusetts earlier this week bring the Credit Union Legislative Action Council to a 96% success rate backing races in this election cycle.

September 3 -

The upcoming U.S. election could move the cannabis industry closer to the mainstream, but legal dispensaries will still have to deal with workarounds to accept card or mobile payments.

September 3 -

The move is part of the effort by lenders and other companies to promote racial equity and be more sensitive to the stresses on front-line employees. It also coincides with rising concerns about the postal system’s ability to handle the rush of absentee ballots.

September 2 -

The move is part of the effort by banks and other companies to promote racial equity and be more sensitive to the stresses on front-line employees.

September 2 -

Friends of Traditional Banking is focusing on four GOP senators in tight races as it prepares to endorse two incumbents for the November elections.

August 28 -

Political donations from the sector and interviews with industry experts highlight a wide range of views on affordable housing resources, the appropriate level of regulatory relief and how policymakers should enforce fair housing rules.

August 27 -

If Trump is reelected, his administration would likely move forward with privatizing Fannie Mae and Freddie Mac and relaxing key rules, while a Joe Biden presidency would likely try to expand homeownership access and borrower protections.

August 24 -

The GOP is unlikely to discuss much policy that affects financial services this week during its national convention, though there could be remarks addressing controversial changes to the U.S. Postal Service.

August 24 -

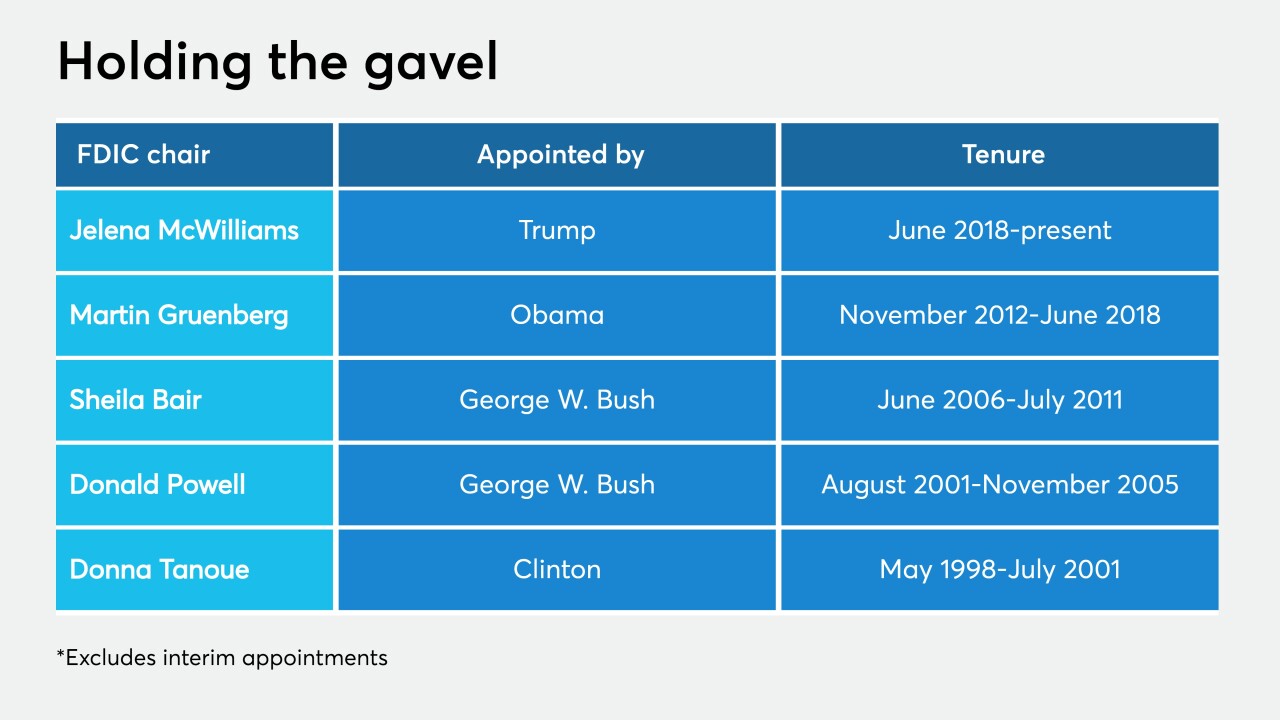

Jelena McWilliams's term as FDIC chair expires in 2023, and she cannot be removed by an incoming president. But if Joe Biden prevails, he may ask her to stay — and if she does, governing a Democratic-majority board would be a very different proposition.

August 18 -

Democrats on Wall Street welcomed Joe Biden's choice of running mate Kamala Harris as a sign that party progressives who favor more aggressive bank regulation had been kept at bay. But her track record in the Senate and in state government might give the financial industry pause.

August 18 -

Two weeks of presidential nominating festivities kick off Monday as the controversy over funding for the U.S. Postal Service worsens.

August 17 -

An obscure government initiative tied to Obamacare’s troubled online rollout could position Sen. Kamala Harris, Joe Biden's running mate, as a key figure in modernizing government stimulus and disbursement payments.

August 13 -

A second-term Trump administration would likely continue its deregulatory efforts, focus on Fannie Mae and Freddie Mac's exit from conservatorship, and seek to facilitate fintech participation in the banking system.

August 12 -

A second-term Trump administration would likely continue its deregulatory efforts, focus on Fannie Mae and Freddie Mac's exit from conservatorship, and seek to facilitate fintech participation in the banking system.

August 11 -

Trade groups are still pushing for the industry's priorities, such as temporarily lifting the member business lending cap, as negotiations over the next round of aid continue.

August 10 -

Whoever wins the White House in November may have immediate agency openings to fill, while a key decision looms about who will run the Federal Reserve after Jerome Powell’s term expires in 2022.

August 7