-

In recent weeks three surveys have been released that assess the U.S. fraud landscape across all of these audiences. These reports provide a holistic snapshot of where payments fraud in the U.S. is today.

February 7 -

Despite some declines, payments fraud remains a major concern for credit unions. Here's how experts suggest tackling the problem.

January 26 -

One New Jersey credit union is starting 2018 with an unexpected crash course in fraud prevention, but there may only be so much anyone can do to curtail the problem.

January 26 -

There are a number of tactics and solutions organizations can employ to shut down the favored methods of fraudsters, including the use of bots and device compromise, writes Michael Lynch, chief strategy officer at InAuth.

January 25 InAuth

InAuth -

Most U.S. merchants faced a 2015 deadline for EMV compliance, but gas stations have until 2020. Those extra years bring with them an assortment of new technology that can fundamentally change the ways motorists fuel up.

January 17 -

Seeking a way to facilitate higher-value contactless transactions, the Bank of Cyprus plans to issue an EMV card deploying biometric authentication to replace a PIN code.

January 4 -

Some of the most important work in payments happens before the transaction, when retailers have to make sure their devices can handle the new technologies and card types that are about to get thrust upon them.

January 2 -

Gemalto’s business boomed a couple of years ago at the peak of the U.S. EMV migration, but when new card orders tapered off and payments technology turned in new directions, the company’s profits got hammered.

December 12 -

Atos SE made a 4.3-billion-euro ($5.06 billion) unsolicited bid for Gemalto NV with the backing of the French state’s investment bank, seeking to create a European leader in cybersecurity, digital technologies and payment services.

December 12 -

Discover's shift starts in April 2018. Mastercard has also eliminated signatures for credit and debit card transactions.

December 7 -

U.S. payments consultancy FIME has added Discover's payment application specification (D-PAS) accreditation to the Pulse ATM network, allowing it to provide guidance and support services on EMV chip technology for acquirers and issuers unfamiliar with D-PAS.

November 29 -

Nearly half of the cardholders in the U.S. have had at least one card reissued in the past year, with those experiencing fraud multiple times saying they have had nearly five cards reissued.

November 28 -

With a solution that addresses the unique security, transaction speed and integration requirements of the transit environment, EMV contactless open payments for transit can become a reality and change our public transportation experiences for the better, writes Randy Vanderhoof, director of the U.S. Payments Forum.

November 17 U.S. Payments Forum

U.S. Payments Forum -

Most larger credit unions have reissued chip-enabled cards, but some small CUs have lagged — and it’s nearly impossible to get an industry-wide picture of where adoption stands.

November 10 -

Call centers are becoming a prime target for fraud due to some shockingly lax controls and the ease of social engineering attacks in an environment where employees are trained to put the customer first.

November 8 -

For most retailers heading into this year’s holiday-season sales crunch, the epic Equifax data breach was only the latest in a series of escalating threats that are having a profound effect on the way they handle payments.

November 6 -

Certain prepaid debit card issuers that didn’t initially adopt EMV technology — because of a lower perceived security threat for these limited-use cards — are now going the EMV route.

October 30 -

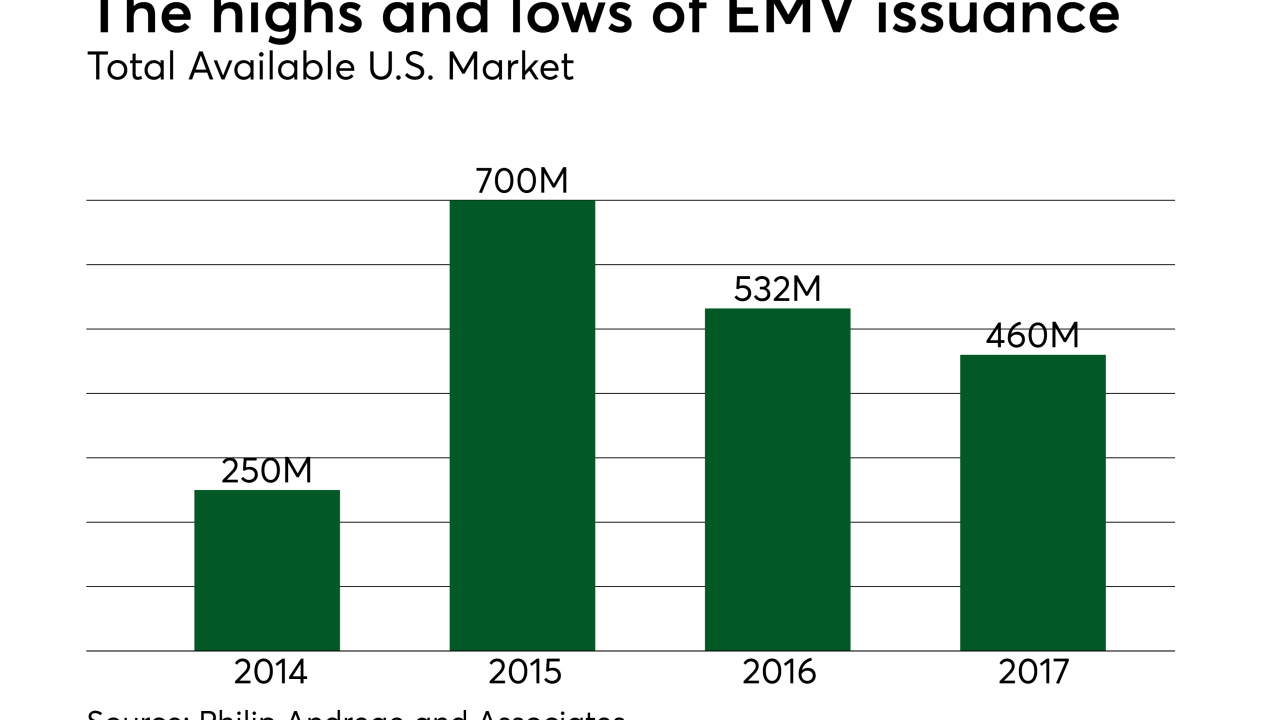

Now two years on from the U.S. EMV liability shift, chip cards are commonplace in American wallets. But the benefits of EMV cards — a longer five-year lifespan and a reduced need to reissue in the event of fraud — have muted the demand for new cards.

October 26 -

It's been nearly six years in the making, but TableSafe has the EMV certification it has long needed to make its pay-at-the-table Rail platform a future-proof option for restaurants.

October 25 -

The heat will now be on card networks to reassure consumers of card security through other methods, during the ongoing barrage of data breaches that could undermine consumers’ confidence in cards.

October 19