-

The Federal Deposit Insurance Corp. handed community bankers a critical win on Thursday by rescinding a plan to treat reciprocal deposits as brokered deposits in the calculation of small-institution assessments.

January 21 -

Sen. Richard Shelby's bill changing how regulators gauge if a bank is "systemic" would refocus post-crisis policy on institutions that pose the greatest threat.

January 7

-

Officials who assess how well banks lend and invest in their communities seem out of sync with the experiences of Main Street.

December 29

-

For steering the Winston-Salem, N.C., company through an extended period of industry adversity, while providing a blueprint for large-scale M&A, King has been named American Banker's Banker of the Year for 2015.

December 20 -

The Consumer Financial Protection Bureau's Calvin Hagins warned mortgage lenders about the regulatory agency's four exam priorities for next year: loan-officer compensation, steps taken to ensure borrowers' ability to repay, compliance with "Know Before You Owe" consumer disclosures, and marketing services agreements.

December 8 -

Unlike the high-profile hacking incidents at big banks, smaller institutions have their own breed of threats such as cyberextortion that they must focus on in strengthening their security.

December 2

-

The New York Department of Financial Services' letter indicating potential cyber rules are prompting concerns that the state's plans could lead to more stringent measures throughout the industry.

November 18 -

While cybersecurity has already been part of bank exams for years, the Federal Deposit Insurance Corp. is highlighting it as a separate comment in order to ensure the issue is getting appropriate attention from bank executives and boards.

November 12 -

Banks undergoing annual Federal Reserve assessments should feel emboldened to challenge "matters requiring attention," and the Fed should hear them out.

November 2

-

The government's spotlight on servicing problems means companies should be taking steps now in the face of regulators' current enforcement authority and the potential of coming rules.

October 20 -

The clash between the Department of Housing and Urban Development and its inspector general over down payment assistance programs run by state or local housing finance agencies continues to heat up.

October 6 -

In comments to the Treasury Department, traditional financial institutions are calling for more oversight of an industry that is fast becoming a big competitive threat.

September 30 -

Bank executives and outside experts finger technology as the area most in need of improvement when it comes to vetting financial institutions' ability to withstand the next bit economic shock.

September 21 -

Nearly 20 trade groups representing lenders, banks, credit unions, title companies and others are urging federal regulators to provide guidance on how they plan to enforce a new mortgage disclosure regime that goes into effect Oct. 3.

September 9 -

A data breach-related court case involving Wyndham hotels and new Defense Department rules governing contractors provide banks some dos and don'ts in bringing vendors' security practices into line.

August 31 -

As marketing services agreements disappear under pressure from regulators, loan officers will have to compete based on skill and customer service to win referral business.

August 31 -

WASHINGTON A Federal Deposit Insurance Corp. publication on Monday advised banks to include cyber risk in standard disaster-planning and business-continuity exercises as part of general strategic-planning discussions.

August 24 -

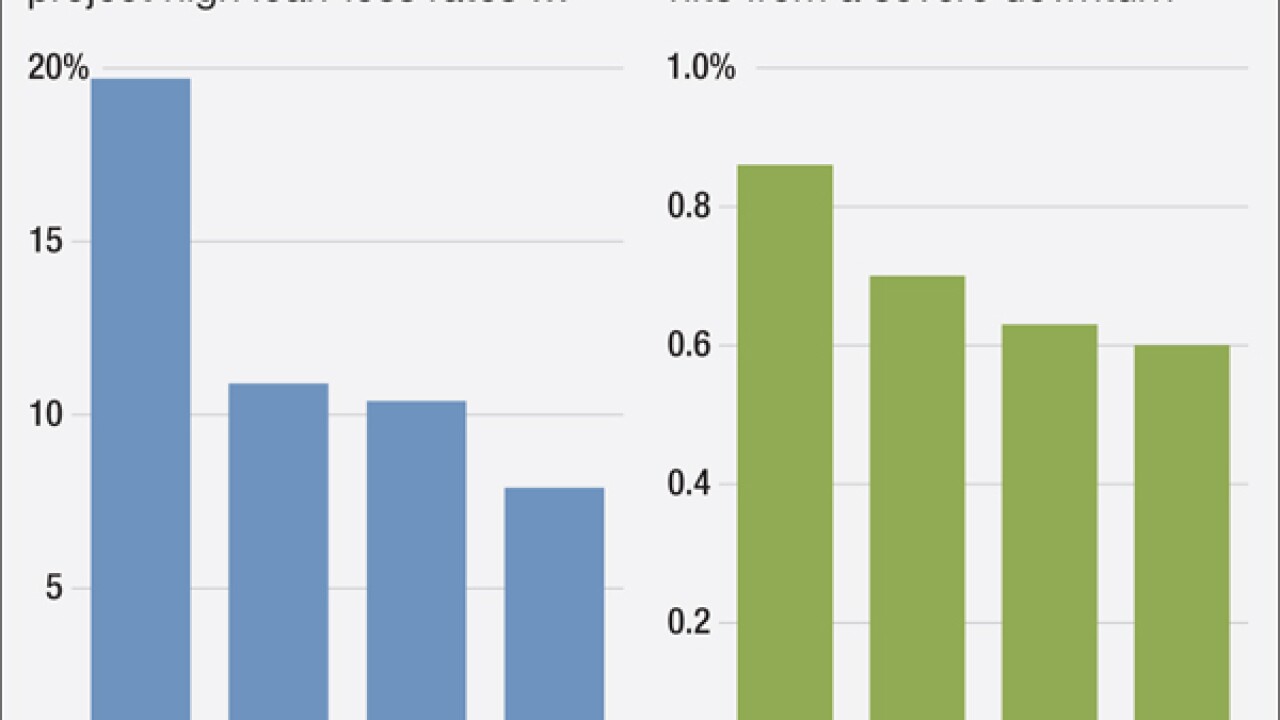

The first stress tests for regional banks show loan losses closely in line with the postcrisis period. However, an independent analysis suggests losses likely would be even higher.

August 4 -

A high percentage of loans to oil and gas firms are large and syndicated. As a result, more shared loans are becoming problematic for participating lenders.

August 3 -

The Federal Housing Finance Agency is still not producing enough adequately-trained examiners necessary to monitor Fannie Mae and Freddie Mac, according to an inspector general report.

July 29