-

The quest for fast payments is advancing on the consumer side, but most banks are said to be undecided about a host of issues tied to speeding up transactions between businesses.

June 21 -

U.K. payments technology provider Paysafe has entered a partnership with Company.com and Ingo Money to offer same-day settlement to small business merchants in the U.S.

June 20 -

The move from standard to real-time transactions adds another layer of complexity and creates further opportunities for fraudsters. Quicker transaction times increase the chances of fraudulent transactions going undetected, writes David Worthington, vice president of payments at Rambus.

June 20 Rambus

Rambus -

Beem It, a startup owned by three of Australia’s largest banks, has launched a free real-time social payments app designed to run on older debit networks instead of the country's new faster payments platform.

June 11 -

Mastercard is working with Starling Bank as its strategic partner to settle funds sent within the U.K. through its Mastercard Send service.

June 6 -

Intuit has added new features to QuickBooks Payroll so employers can make payroll at the last minute, delivering same-day paychecks to workers with the option to make direct deposits to contract employees.

May 31 -

The companies have built a product that attempts to beat the current standard of next or same day settlement.

May 30 -

The expansion of Visa Direct is designed to speed disbursements for health care patients who can receive an instant payment versus waiting several days to a week for payout.

May 8 -

Payment system change in the United States has always benefited from a consensus-driven approach that incorporates the views and behaviors of many, financial institutions, payment processors, technology providers, merchants, regulators, consumer advocates and others, writes Michael Bilski, CEO of North American Banking Company.

May 2 North American Banking Company

North American Banking Company -

Australia is the latest country to enable Faster Payments with the February 2018 launch of the New Payments Platform. It's 10 years behind the U.K.'s version, but benefits from a decade of experience and observation.

May 1 -

Financial institutions providing funds via the Fed's same-day ACH transfers need to their systems protect their customers, are commercially reasonable and, most important, follow strictly the protocols the financial institution has agreed to with its customer, writes Alexander Buchanan, counsel at Waller Lansden Dortch & Davis LLP.

April 19 Waller Lansden Dortch & Davis LLP

Waller Lansden Dortch & Davis LLP -

Contractor invoices are sent up a long string of approvals and payment is sent back down that long string before they are ultimately paid, writes Will Mitchell, co-founder and CEO of Contract Simply.

April 16 Contract Simply

Contract Simply -

Financial institutions in the U.S. are not only under tremendous pressure to determine how they’ll become a part of the new Federal Reserve-driven faster payments ecosystem, but also what the shift to immediacy will mean to their current operating model, long-term strategy, and future relevance to consumers and corporates, writes Bruce Lowthers, COO at FIS.

April 16 FIS

FIS -

Driving an Uber car isn't like many other jobs, and drivers' payments and expenses are also very different. Much of those differences are built on Green Dot technology, and the bank is ready to see if its platform can work for more than just Uber.

April 13 -

Europe's banks stand to benefit a lot from the SEPA Instant Credit Transfer scheme — but "instant" is a high bar that many banks may not be able to reach.

April 4 -

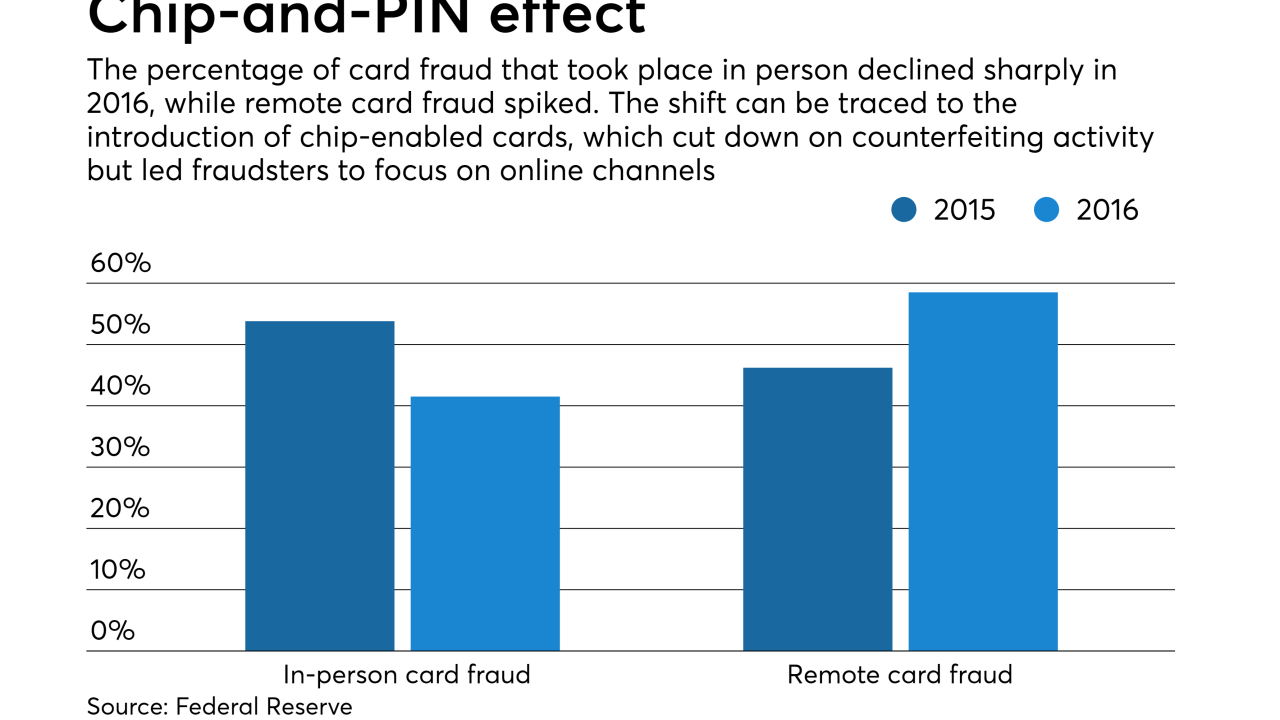

The central bank is taking a lead role in trying to combat the longstanding problem. A broad study by the Fed aims to measure the extent of payments fraud and to foster more collaboration in thwarting it.

April 3 -

The announcement comes after a Federal Reserve Board task force issued a report in September that said it would further examine options for modernizing the U.S. payments system.

March 29 -

These apps may not seem like much of a threat as long as they stay in their lane — but increasingly, ride-sharing companies are pushing the limits of how their apps can be used for payments.

March 29 -

Denizen is designed for expats and migrants to receive money and make payments without international transfer fees or currency exchanges.

March 26 -

The tracking engine automatically provides status updates to all GPI banks involved in any GPI payment chain and allows them to confirm when a payment has been completed.

March 23