-

The bank is planning to make product changes and roll out new digital tools that will allow customers to avoid the charges, according to CEO Kevin Blair.

July 20 -

BNY Mellon and State Street have been granting millions of dollars in discounts to ensure investors in money market mutual funds stay in the black. Recent moves by the Fed are expected to relieve the pressure.

July 19 -

Mortgages and wealth management generated fees that gave top midtiers an edge, as the pandemic halted most lending outside of the Paycheck Protection Program.

July 19 -

A strong showing by the North Carolina bank’s insurance arm helped to overcome lower interest rates and sluggish lending in the second quarter.

July 15 -

PNC, Regions and TD are among the banks that have taken steps to reduce their reliance on charges that disproportionately hit consumers living paycheck to paycheck. The changes come at a time when the Biden administration is expected to take a tougher stance on overdrafts.

July 13 -

Executives at Citizens Financial and Regions Financial said they plan to make policy changes that will reduce their reliance on the controversial but already dwindling charges.

June 15 -

Ally and Huntington are the latest banks to take steps that will reduce revenue from customers who spend money they don’t have. The moves come at a time when technological, regulatory and social forces are converging to encourage change.

June 3 -

The online bank's decision to stop charging the fees is part of a broader reassessment across the industry. Ally had waived overdraft fees early in the pandemic and has historically been less reliant on them than many other institutions.

June 2 -

With rock-bottom rates suppressing interest income, some buyers are looking beyond traditional M&A and striking deals for asset managers, insurance firms and other businesses that generate the bulk of their revenue from fees.

May 25 -

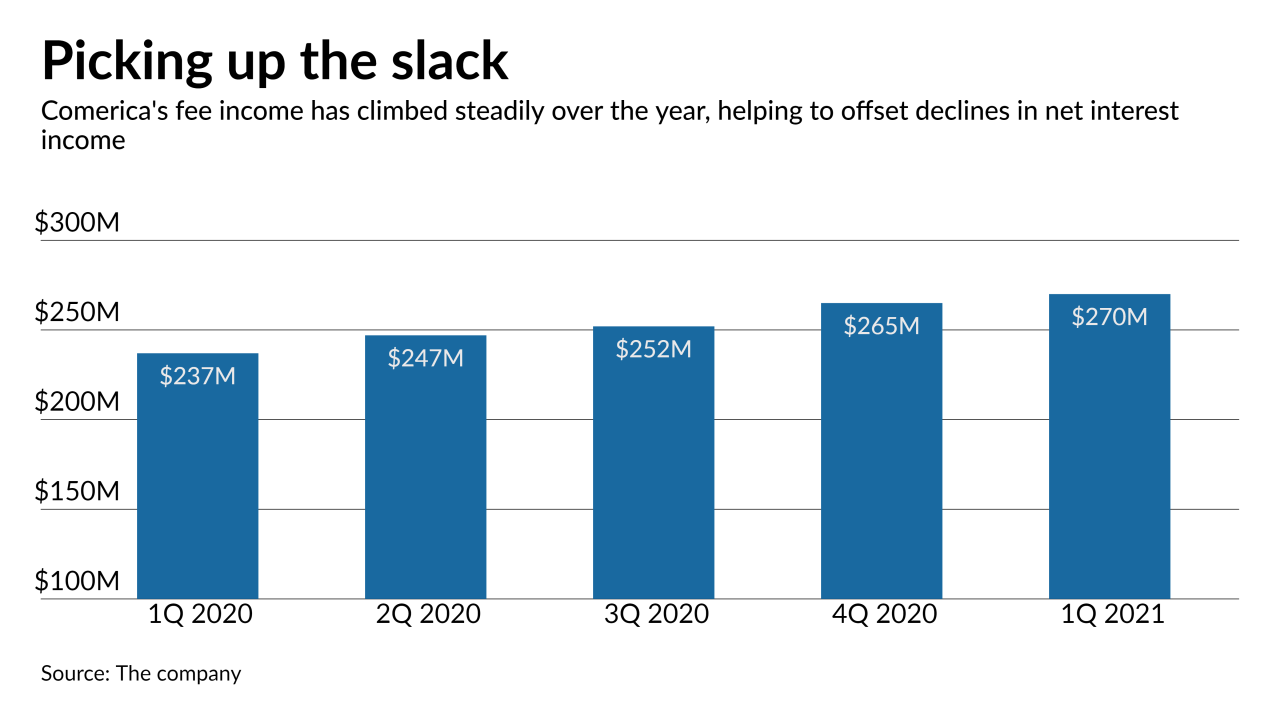

At Comerica and Synovus, higher fees from cards, mortgage banking and other sources helped to offset declines in net interest income.

April 20 -

Some institutions for more than a year have reduced or eliminated overdraft and funds transfer fees to help members hard hit by the economic downturn, but it's unclear how much longer they can keep coasting on other sources of noninterest income.

April 15 -

The San Antonio company will no longer charge fees on transactions of $100 or less that take checking account balances into negative territory, as long as the customer has a $500 monthly direct deposit set up.

April 15 -

Business First Bancshares is counting on its acquisition of Smith Shellnut Wilson to help it offer more advisory services to commercial clients.

March 30 -

UMB Financial’s success in aviation financing has boosted fee income, and the Missouri company has opened an office in Dublin — a hub for airplane sales and leases that could get busier as the airline industry restructures.

March 19 -

Acquiring AmeriHome would provide the fee revenue the Phoenix company seeks to compensate for low interest rates and tepid commercial loan demand. The deal also would allow it to reinvest billions of dollars of excess liquidity.

February 17 -

Noninterest income from Paycheck Protection loans and mortgage refinancings isn't enough to make up for shortfalls elsewhere, and growth prospects are hard to identify.

February 16 -

Acquisitions of wealth management, insurance, fintech and other firms are expected to pick up as banks seek new sources of fee income and look to improve digital capabilities.

January 27 -

Amerant Mortgage includes several former bankers from City National Bank of Florida in Miami.

January 26 -

Flush with capital from issuing subordinated debt, Peapack-Gladstone is exploring acquisitions in Florida and New York in an effort to generate more fee revenue.

January 25 -

Noninterest income has bolstered profits this year. But its growth is expected to slow over the next two years, making for a gloomy earnings outlook unless vaccine distributions and the economic recovery are relatively swift.

December 17