-

Credit bureau says records of 143 million consumers were compromised; state agency penalizes Habib Bank for enabling terror financing.

September 8 -

New York’s banking regulator ordered Habib Bank Ltd. to pay $225 million and surrender its license to operate in the state, effectively removing Pakistan’s largest lender from the U.S. financial system.

September 7 -

Husband and wife claim they were fired for raising concerns about the bank’s sales practices; commercial mortgage-backed securities on pace to top last year’s volume.

September 6 -

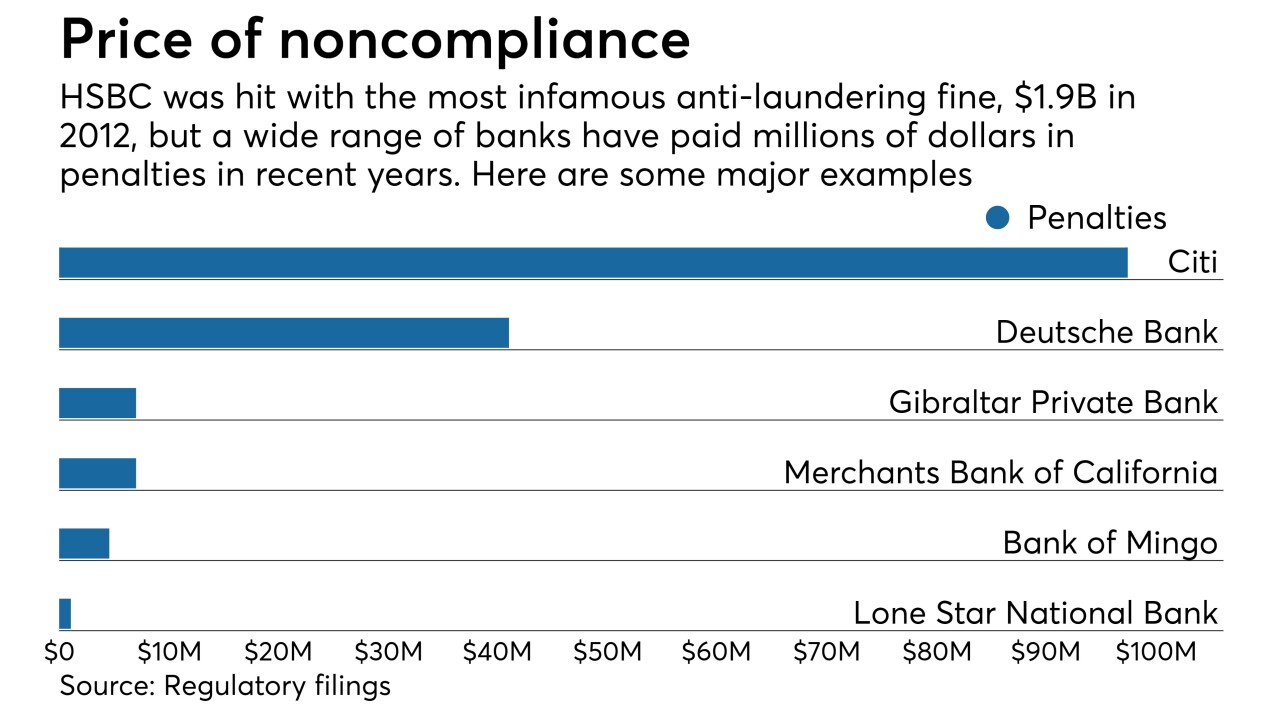

Nothing like revelations of a client’s Ponzi scheme that lead to your bank paying $4 million in anti-money-laundering fines. That’s what happened at Gibraltar Private Bank & Trust, but its CEO argues its compliance overhaul has given the bank a competitive advantage in cosmopolitan New York and South Florida.

September 5 -

The 3-year-old order was related to Discover Bank’s programs for combating money laundering. A related agreement with the Federal Reserve Bank of Chicago remains in effect.

August 30 -

A data-driven approach to money laundering prevention can help increase profits and improve regulatory compliance, writes Edmund Tribue, risk and regulatory practice leader at NTT Data Services.

August 30 NTT Data Consulting

NTT Data Consulting -

CFPB and OCC are looking at auto lenders’ policies regarding so-called GAP insurance; banks want greater collateral from retailers.

August 29 -

Wells Fargo CEO Tim Sloan has told employees that a third-party review of unauthorized accounts will be published “within a few weeks.”

August 23 -

Hackers are stealing enthusiasts’ phone numbers, then changing the passwords to clean out their financial accounts; bank makes pledge to human rights groups.

August 22 -

Payment processors and banks are being called on to cut off funds to white supremacist groups, but there are practical and legal limits to what firms can do.

August 17