-

The digital bank is on a larger mission to attract younger customers. It's inserting itself into the popular video game in the hope that game players will learn about its products and have fun at the same time.

October 30 -

Many credit unions offer youth accounts to help establish early banking relationships, but a new account for kids from the nation’s largest bank has raised the level of competition.

October 21 -

In an exclusive interview announcing the regulator's new financial inclusion program, NCUA Chairman Rodney Hood explains why the time was right to double down on the agency's efforts to expand access for marginalized communities.

October 19 -

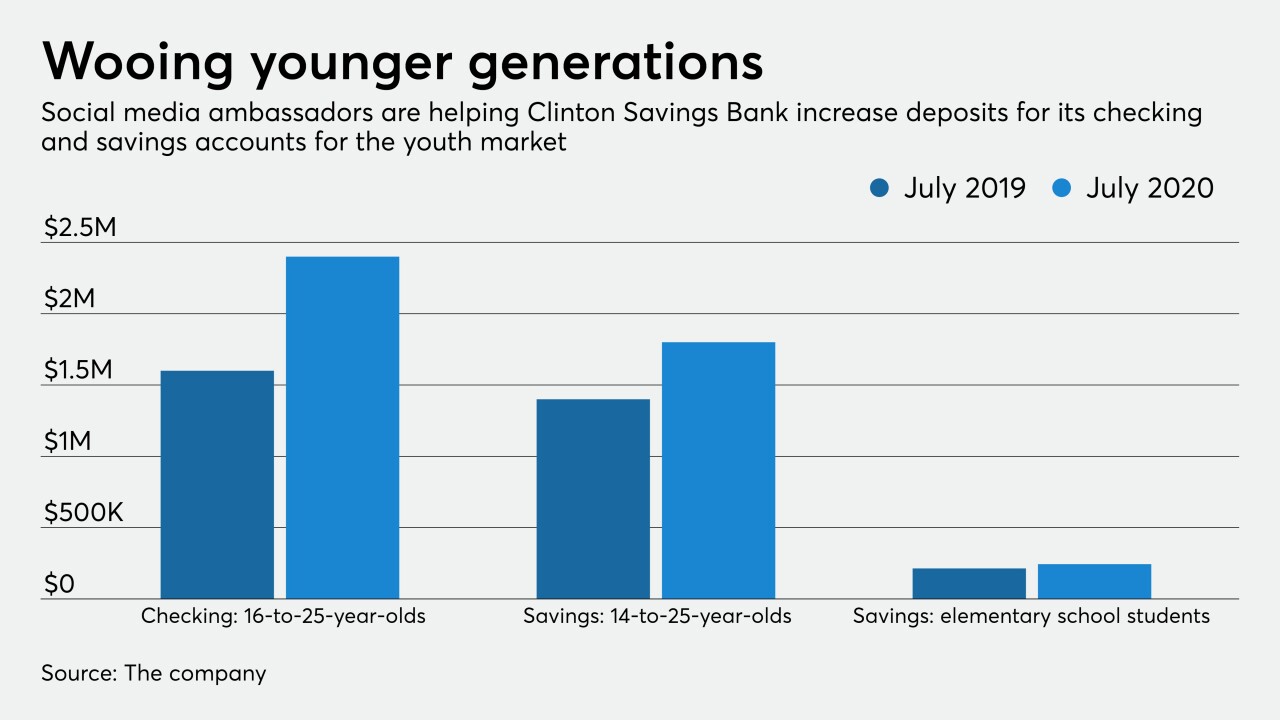

Bank of America and Clinton Savings Bank in Massachusetts are targeting consumers at a young age and hoping to keep them for life.

August 28 -

From student-run branches to courses on credit, budgeting and more, one of the industry's longest-running partnerships is being upended as districts across the country move to virtual learning.

August 12 -

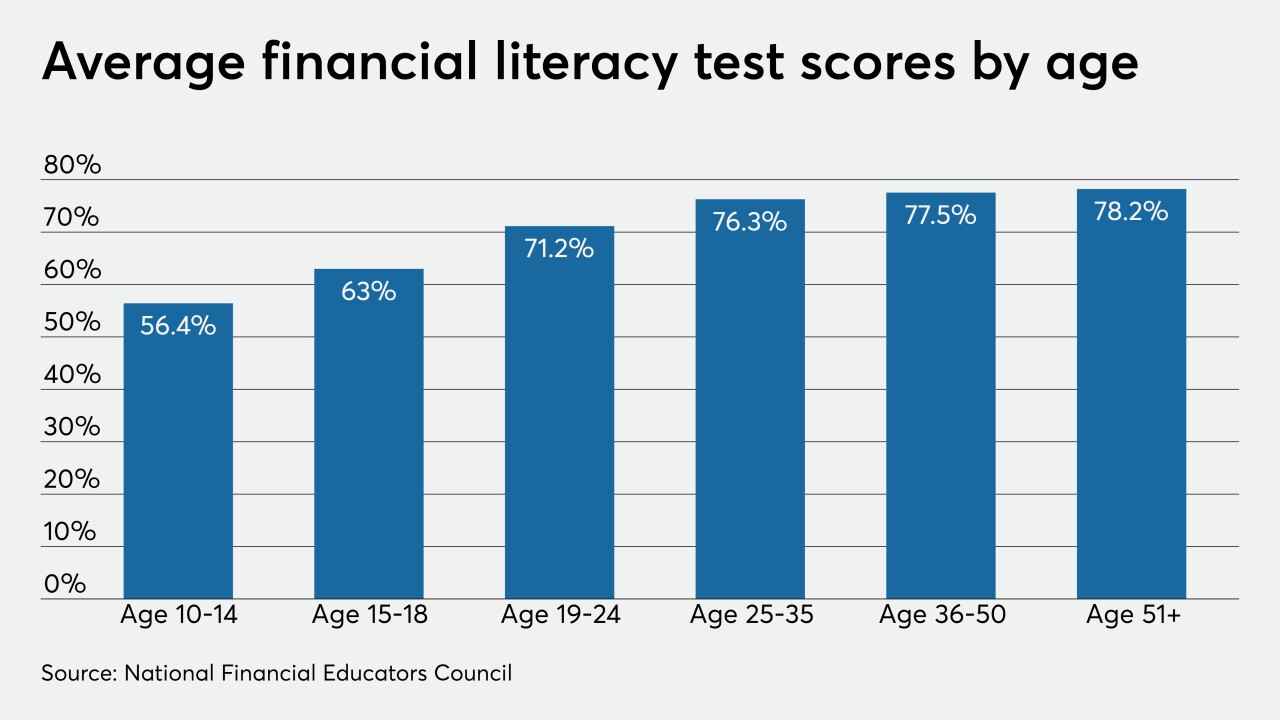

Older Americans also did fairly poorly by getting an average score equal to a C plus.

April 8 -

The Trump administration proposes cutting personnel and other budgetary items at the bureau, while the agency’s director — who controls the purse strings and was hand-picked by the administration — aims to boost spending and hire more employees.

February 20 -

The promotion of Melinda Chausse was one of several leadership changes the Dallas company announced this month.

January 23 -

One credit union's experience helping Puerto Ricans after Hurricane Maria illustrates how powerful financial wellness tools can be.

January 3 PenFed

PenFed -

A new study from the National Endowment for Financial Education indicates there could be wider interest for financial education in the coming year.

January 3 -

The Mechanicsburg, Pa.-based credit union has revamped its financial literacy offerings to align with in-school curricula on the topic developed by the Pennsylvania Department of Education.

December 4 -

One organization's findings reveal that financial counseling, when done right, can also help boost institutions' lending and brand recognition.

November 5 Inclusiv

Inclusiv -

NCUA financial metrics don't illustrate the way these institutions have changed consumers' lives for the better.

November 1 New Jersey Credit Union League

New Jersey Credit Union League -

Another look at the variety of ways credit unions are making a difference.

October 28 -

With more baby boomers aging, credit unions must adopt policies and practices to help identify and stop these crimes.

October 28 Parker Poe

Parker Poe -

The Minnesota Credit Union Network worked with two brewers to create and sell a strawberry milkshake cream ale in an effort to boost the industry's profile and raise money for financial literacy.

October 25 -

TruMark Financial Credit Union raised money for financial literacy with a kiss-a-pig event while other institutions donated to causes such as a food program.

October 21 -

Regulators have long warned the credit bureaus about deceptive marketing that causes consumers to sign up unwittingly for paid monitoring services. But the practice has persisted, according to complaint data.

October 20 -

Ascentra Credit Union Foundation awarded $100,000 to Junior Achievement for financial literacy while other institutions donated money for a variety of causes.

September 30 -

As the U.K. rapidly transitions toward a cashless society — with U.K. Finance predicting that by 2028, just 9% of payments will be in cash — even pocket money is going digital. And the disappearance of tactile interaction with cash changes how kids learn about budgeting.

August 30