-

Brian Knight at George Mason University says fintechs will be held accountable for legal violations in sandboxes — and banks can use sandboxes, too.

January 22 -

The industrial loan company charter is getting more attention as doubts grow about a new federal license for fintechs.

January 21 -

Some in the industry worry the Fed may balk at allowing OCC charter recipients into the payments system, but Otting downplayed those concerns.

January 16 -

Although most consumer-facing financial institutions now offer mobile applications, that doesn’t mean that they are ready for a world where smartphones are the primary point of contact with their customers, writes Rune Sorensen, a product manager at Nets.

January 15 Nets

Nets -

One bank's push to use Ripple's XRP in cross-border payments; LendUp spins off credit card business, names new CEO; a worrisome resurgence of rivalry among the banking agencies; and more from this week's most-read stories.

January 11 -

Nicolas Kopp, head of N26 in this country, explains how the company plans to spend a chunk of the proceeds on its expansion here and add to the intensifying competition among fintechs.

January 10 -

Whether it's the OCC's special-purpose charter, ILCs or some other option, observers see fintechs being able to obtain banking powers.

January 9 -

In venturing into what's normally a province of large banks, nbkc in Kansas City, Mo., discovered innovative tax-management and other products that it could offer to its own customers or sell to other banks.

January 8 -

The agency refuted claims by the Conference of State Bank Supervisors that the OCC was overstepping its authority.

January 8 -

The coming year will bring a wave of data-sharing deals between banks and fintechs, increased bank use of automated advice, marked changes to financial jobs as a result of automation, and much more.

January 6 -

As banks begin to use artificial intelligence in their businesses, they’ll need to consider the potential for bias as well as the impact new technologies will have on workers.

December 31 CCG Catalyst

CCG Catalyst -

Readers this year responded to Mick Mulvaney's leadership at the Consumer Financial Protection Bureau, the banking industry's role in the national gun debate, Rep. Maxine Waters' upcoming leadership of the Financial Services Committee, the influence of tech companies like Facebook and Amazon on financial services and much more.

December 27 -

More traditional players interested in creating a safer market for digital assets have issued a checklist that cryptocurrency firms can follow to build confidence among banks, consumers and regulators.

December 26 -

Prometheum may succeed whether others have failed because it has attempted to work closely with regulators.

December 21 -

The promotion of “insured” accounts by nonbanks and fintechs is a worrying trend, because it could leave customers falsely believing their accounts are just as safe as FDIC-insured ones.

December 21 Consumer Bankers Association

Consumer Bankers Association -

The Office of the Comptroller of the Currency has gotten the ball rolling for financial technology firms trying to operate a national platform, but the FDIC and Federal Reserve should act to remove other policy roadblocks.

December 20

-

Good Money just raised $30 million and is a year away from launching, but already is raising concerns for its trash-talking of established players.

December 19 -

The payments processor was among numerous firms earlier this year to withdraw an ILC charter application over questions about its plan.

December 19 -

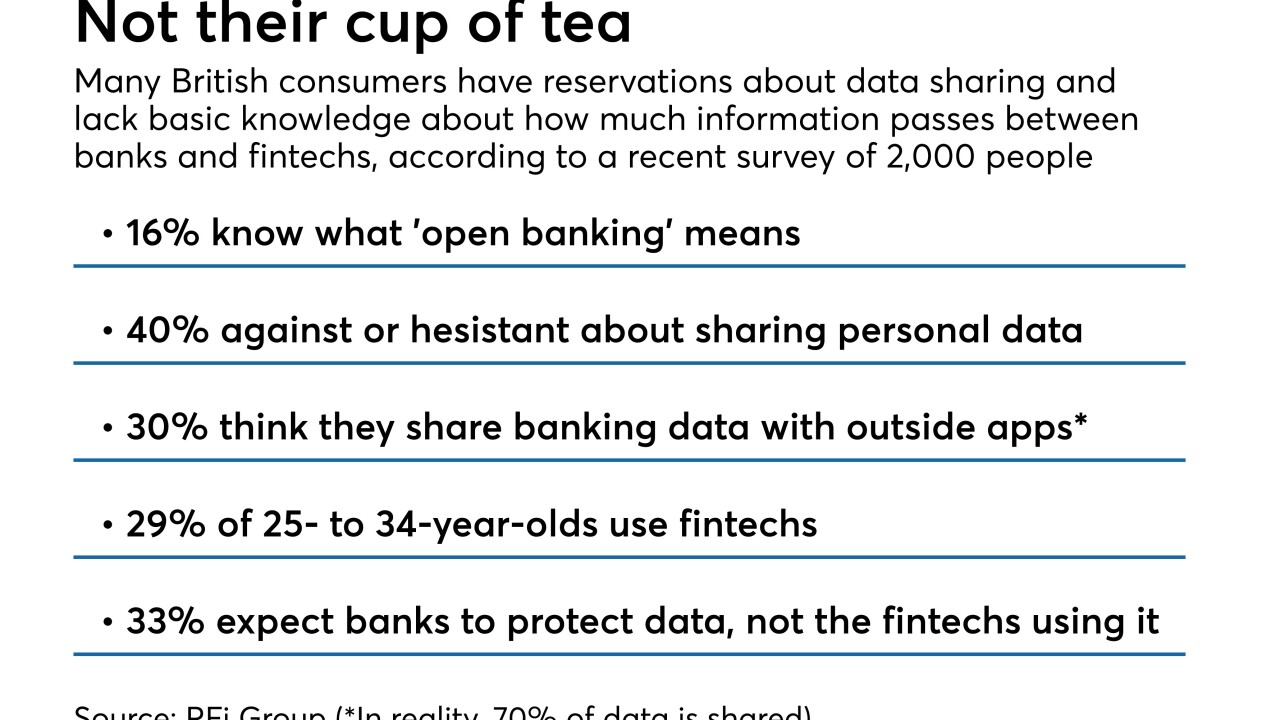

Though it became official in January in the U.K., most people there don't know what it is, according to a new survey that offers many insights for U.S. banks.

December 19 -

Fabrice Coles, who was the CBC's executive director, will work on consumer and fintech policy issues at the Bank Policy Institute.

December 18