-

Hedge fund apparently likes the bank’s corporate services business; Michael Piwowar is credited with “jump-starting” the agency’s deregulatory push.

May 8 -

“Sometimes Washington picks the winners for you,” said Manny Friedman, CEO of the hedge fund EJF Capital.

May 2 -

Acting director wants agency run by a bipartisan body, not a lone director; Fed and OCC push for relaxing the supplementary leverage ratio at the biggest banks.

April 12 -

Short sellers tend to go against the tide, making investments based on a belief that a stock is going to tank. These 10 banks have drawn the greatest amount of short-interest activity recently.

April 1 -

A decade after buying Bear Stearns, JPMorgan has maintained its revenue from fixed-income trading while many rivals saw theirs slip.

March 16 -

From investor angst to regulatory scrutiny, here's a look at three obstacles that must be addressed before Ocwen Financial can acquire PHH Mortgage.

March 1 -

Ocwen Financial Corp.'s acquisition of PHH Corp. will help the nonbank servicer rebuild scale that's been diminished by years of regulatory restrictions and the decline in distressed mortgage volume brought about by improvements in the overall housing market.

February 28 -

As inflation fears put upward pressure on 10-year Treasury bonds and mortgage rates nationally, borrowers could start to take more notice of what lenders are charging them locally.

February 20 -

As the economy strengthens, more banks are facing pressure to pay up for the best lenders and tech specialists.

February 12 -

The private equity firms plan to sell a total of 3 million shares in the Houston company in coming weeks.

February 2 -

The bank said it plans to use proceeds from the placement to expand its operations.

January 30 -

Financial firms have mostly shrugged off the government's budget woes, but Washington's gridlock might pose a bigger risk than they think.

January 22 -

Farmer Mac has terminated President and CEO Timothy Buzby for violating company policies not related to its financial and business performance.

December 7 -

Banks are swapping out long-term holdings for short-term securities to manage interest rate risk. But in the process, they are sacrificing yield — and ammo they might need to pay more for deposits to retain customers.

October 24 -

Bank of America set aside $100 million in its reserves for representation and warranty claims ahead of a pending settlement to resolve legacy mortgage issues.

October 13 -

The Dutch government sold a third stake in ABN Amro Group NV, taking advantage of a rally in the shares of the nationalized lender.

September 15 -

Atlantic Bay Mortgage Group has agreed to buy a majority stake in Virginia Community Bank in a rare instance of a nondepository mortgage company buying a bank, rather than the reverse.

July 26 -

Now that the Federal Reserve has raised short-term rates four times in the past 18 months, all eyes are on deposit costs as banks seek to keep pricing low and fatten margins. But that effort is complicated by the fact that banks must prepare for the unwinding of the Fed's balance sheet and consumers' rapid adoption of mobile deposits.

July 21 -

In an echo of the rescue deals of 2007 and 2008, New Residential's CEO framed the transaction as something undertaken to benefit the entire industry.

May 1 -

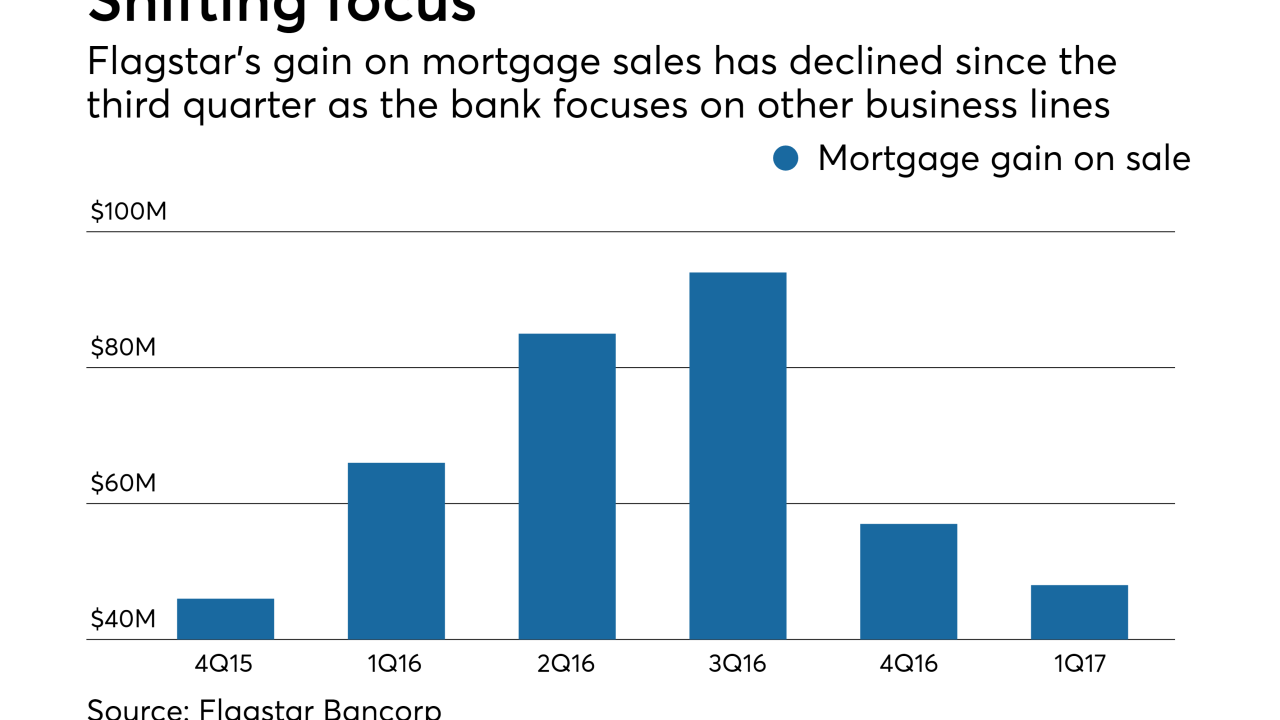

Growth outside of its residential mortgage business contributed to Flagstar Bank beating first-quarter earnings estimates, company executives said.

April 25