-

Whether due to costs, growing cyber threats or other factors, a growing number of credit unions are outsourcing an important C-level security role.

April 16 -

The concept of privacy is evolving in the digital age in ways that demand new attention from policymakers. As stewards of considerable personal information, banks should prepare to take part in this debate.

April 2 Dorsey & Whitney

Dorsey & Whitney -

A new kind of ATM fraud has begun to hit U.S. financial institutions. Here's how to protect your credit union.

March 23 -

Employees at the second-largest Indian bank falsified documents in a scheme that ultimately cost the institution at least $2 billion. Some argue a distributed ledger would have helped prevent or minimize the fraud.

March 21 -

Remote deposit capture fraud remains a threat, but analysts say that's just the tip of the iceberg. Here's how credit unions can better protect themselves -- and their members.

March 12 -

To keep up with the fast-moving payments industry and avoid damaging their own bottom line, it’s time for merchants to start paying attention, writes Todd Linden, CEO of payment processing for North America at Paysafe.

March 12 Paysafe

Paysafe -

Financial companies that derive most of their revenue from online and mobile channels have substantially higher fraud costs than do similarly sized companies that rely less on the internet, according to a new report.

March 1 -

Financial institutions and retail companies are trading barbs over which industry poses greater risk to sensitive customer information just as lawmakers are planning to take another stab at a data security bill.

February 28 -

Aspiration Bank relies on software tools to pull data from diverse sources to prevent fraud in account applications.

February 27 -

The MyCUID product is intended to help membes protect against fraud and identity theft by creating a lifetime "portable digital identity" not dependent on any central authority.

February 26 -

From giveaways to budgeting tips and more, here's how credit unions are helping members have a romantic Valentine's Day, no matter how big or small their price point.

February 14 -

A small legal case in California brings a warning to banks: Be careful who you report for fraud.

February 14 -

Despite some declines, payments fraud remains a major concern for credit unions. Here's how experts suggest tackling the problem.

January 26 -

One New Jersey credit union is starting 2018 with an unexpected crash course in fraud prevention, but there may only be so much anyone can do to curtail the problem.

January 26 -

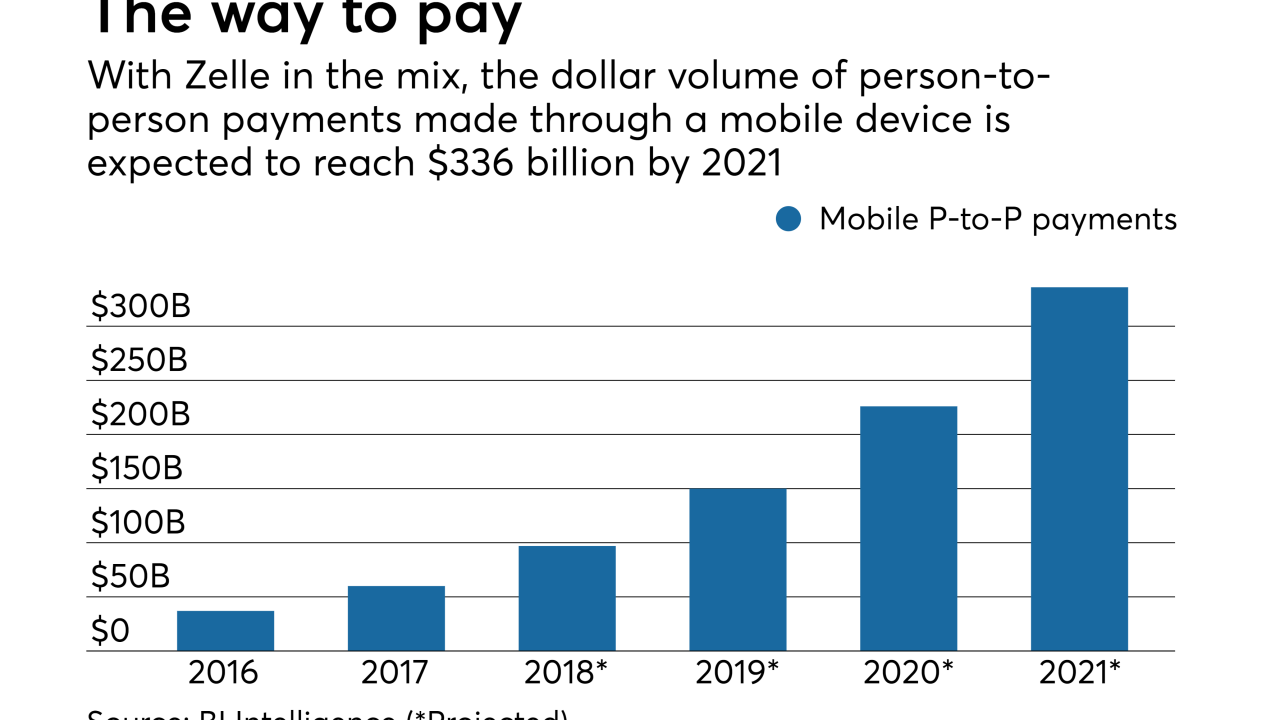

The P-to-P payments service promises to clear transactions in near-real time, but many consumers have complained that they have been unable access their money or even open accounts. Zelle has acknowledged the delays and says they are a result of its rigorous enrollment process.

January 17 -

Seven trade associations — including those representing banks and credit unions — sent a joint letter to Congress outlining data security standards for entities that handle financial data.

December 21 -

The right platform can detect unusual behaviors and block fraudulent transactions as they occur, while still allowing real customers to make legitimate transactions without interruptions, writes Dave Excell, CTO and co-founder of Featurespace.

November 28 Featurespace

Featurespace -

Credit unions are taking steps to ward off fraud as holiday shopping season gets underway.

November 27 -

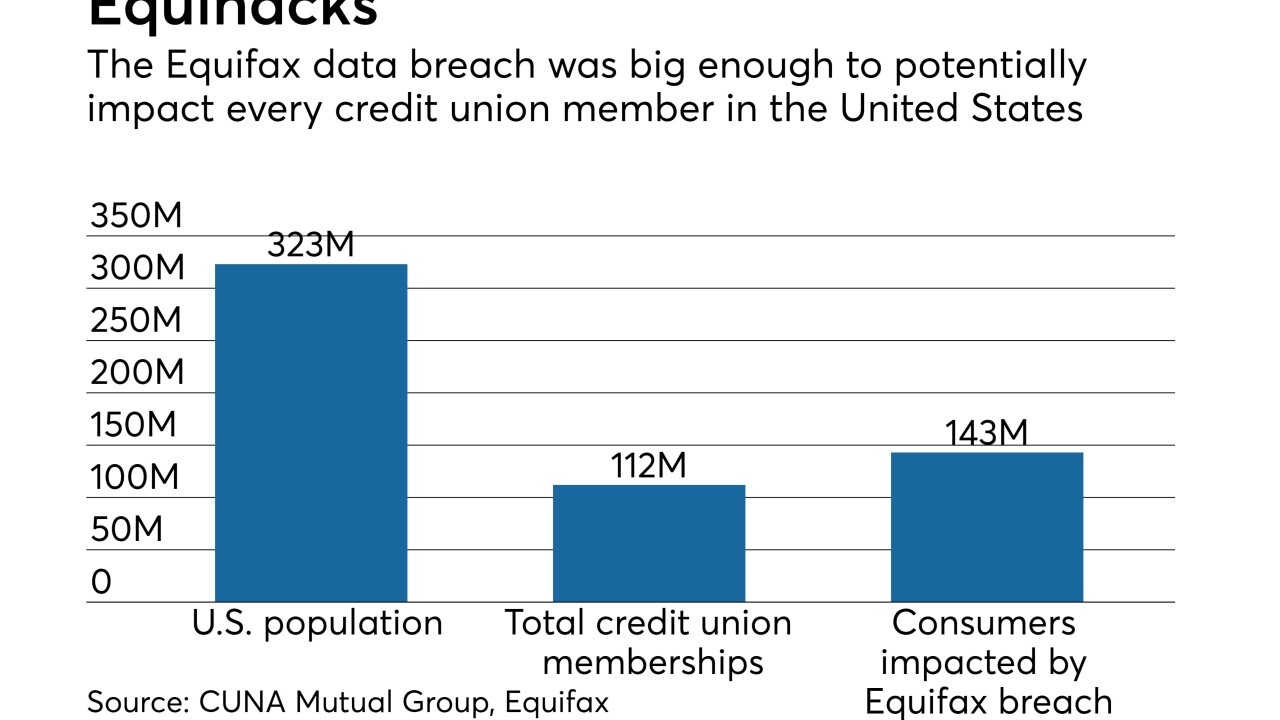

The massive data breach impacted nearly half of all Americans, and credit unions will now need to be on guard for a variety of fraud types that could arise as a result.

October 10 Oak Tree Business Systems, Inc.

Oak Tree Business Systems, Inc. -

Though many of its policies were in place before news of the Equifax breach came out, Mountain America Credit Union is doubling down on its approach to protecting member data.

October 2