-

With today’s generation of home buyers so rooted in a digital world, how will the financial services industry need to change to meet their needs? What new consumer technology will they need to adopt to meet consumers where they are? How will those approaches differ from how things have been done historically in the industry? Join us in a discussion with Blend’s Founder, Nima Ghamsari as we chat through how banks and financial institutions need to think through these questions.

-

How technology is enabling new types of payment transmission and what this means for banking.

-

The Nashville-based institution is still awaiting regulatory approval on a proposal to operate as a subsidiary of Fortera Credit Union.

August 24 -

The company reported growth of more than 103% since the end of last year.

July 22 -

An article in The Atlantic warning that collateralized loan obligations will be banks’ next downfall overestimates the risk of these securities.

June 22 Janney Montgomery Scott LLC

Janney Montgomery Scott LLC -

Consumers are parking their funds at financial institutions as lending slows and interest rates remain near zero, making it difficult for credit unions to deploy these deposits.

June 22 -

The coronavirus is changing how consumers interact in branches and banking online. Bank leaders should be prepared.

March 23

-

There's much bank executives can learn from the 737 Max and Deepwater Horizon catastrophes, which could have been averted if regulators had been notified sooner.

February 18 Ludwig Advisors

Ludwig Advisors -

More digital competition, tougher tech choices and a completely new generation of customers are just some of the challenges facing bankers in the near future.

December 12 -

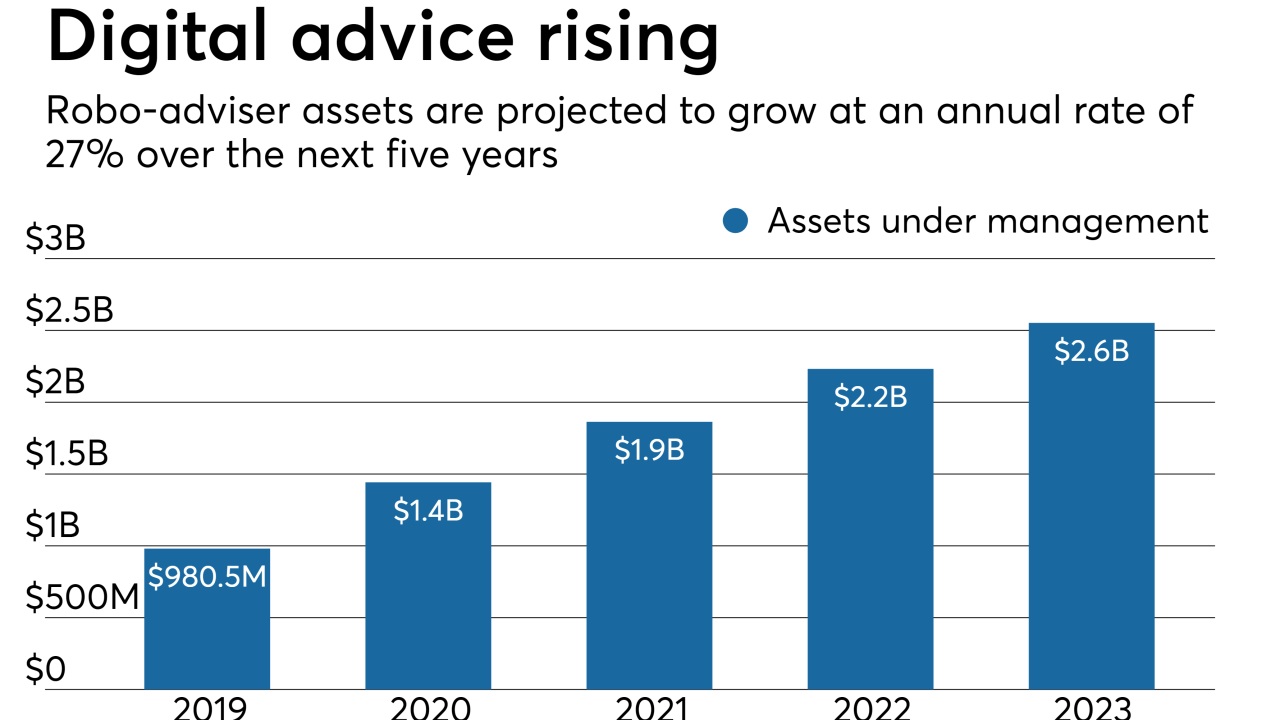

Wealthfront will add third-party mortgages to its investing platform, while Varo Money says robo advice and mortgages are in its long-term plans.

December 3 -

It’s been a bumpy decade for crypto and blockchain, but both are here to stay.

November 8 Polyient Labs

Polyient Labs -

Banks should stop competing on volume with large techs and start competing on added-value services to win over customers.

November 8 IBM

IBM -

A new partnership will let some community banks and credit unions roll out robo-advice platforms without a significant investment of their own.

November 7 -

It’s been a bumpy decade for crypto and blockchain, but both are here to stay.

November 5 Polyient Labs

Polyient Labs -

Software creates a portfolio for bank customers that could be designed to support, say, efficient energy sources or refugees and avoid investments clients consider objectionable.

October 8 -

Here’s why we joined other banks globally in disclosing the environmental impact from loans and investments.

September 25 Amalgamated Bank

Amalgamated Bank -

After investing in a payments CUSO earlier this year, the Florida-based credit union is looking for additional opportunities to work with fintechs.

September 24 -

The chief investment officer at Bessemer Trust is driving results by building cohesive teams and listening carefully to clients.

September 22 -

Under Kuijpers, DWS Group is embedding environmental, social and governance principles in the work of asset managers across all classes.

September 22 -

When HSBC announced 16 appointments amid changes to top management in April, Bouazza, who previously co-led the bank's Latin American business, was the lone woman selected.

September 22