-

Attorneys for then-President Robert Harra said he is innocent and will file an appeal. The case centers on a scheme said to have been carried out during the crisis years, before the bank was sold to M&T.

May 3 -

Bankers have long complained that anti-money-laundering regulations impose an extra burden without really stopping major crime. D.C. is finally listening.

May 3 -

The provision would make it harder for criminals who use real Social Security numbers to create fake personas and then apply for credit.

May 3 -

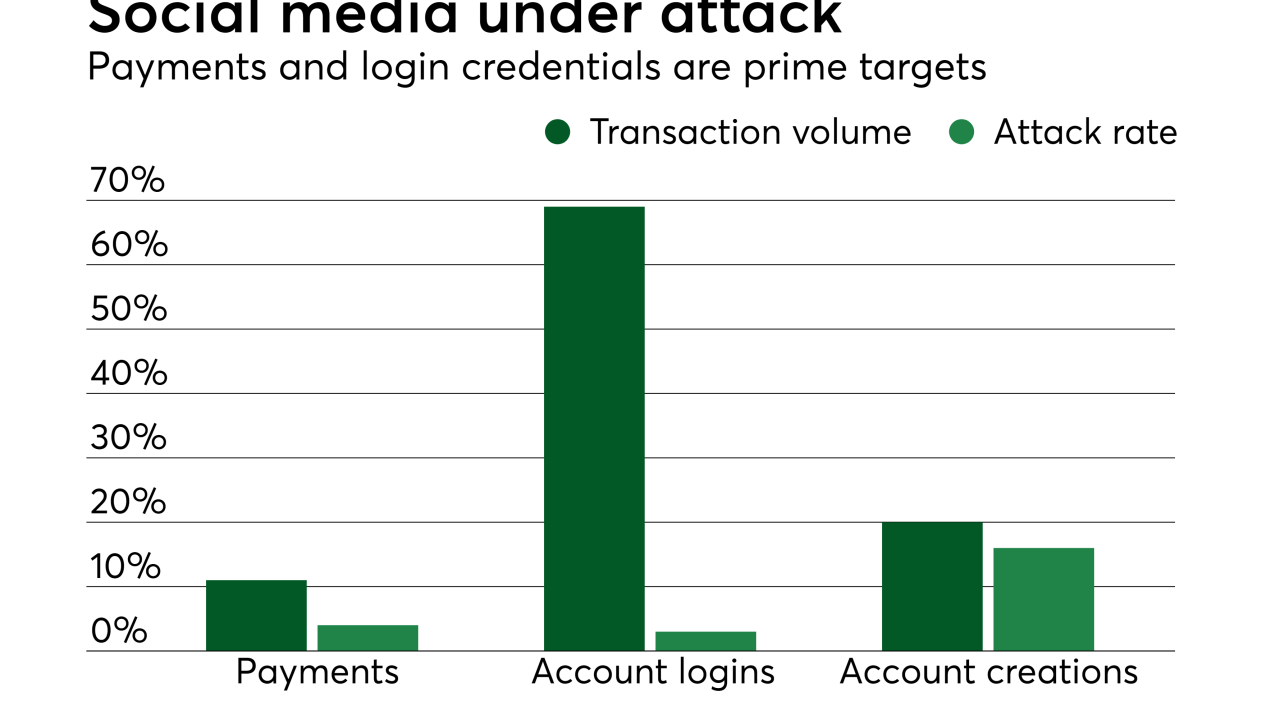

The spread of breached identity information has resulted in an outbreak of new account creation fraud with a new ground zero for the crimes pointing right at Latin America.

May 3 -

The provision would make it harder for criminals who use real Social Security numbers to create fake personas and then apply for credit.

May 2 -

Prometheum wants to win the SEC’s approval of its own token offering, paving the way for others shortly afterward.

May 2 -

The firm will pay $110 million to settle charges it didn’t control traders; hedge fund executive says he was wrongfully accused of sexual misconduct.

May 2 -

The Federal Savings Bank has been under a spotlight since it was revealed that it provided $16 million in mortgages to onetime Trump campaign manager Paul Manafort.

May 1 -

The National Credit Union Administration has banned seven former credit union employees from participating in the affairs of any federally insured financial institution.

April 30 -

Cyberattackers attempted to penetrate Mexico's electronic payment systems Friday, forcing three banks to enact contingency plans, according to people familiar with the matter.

April 30 -

Not a penny of the $1 billion fine against Wells Fargo will end up in the hands of customers harmed by practices flagged by regulators.

April 27 -

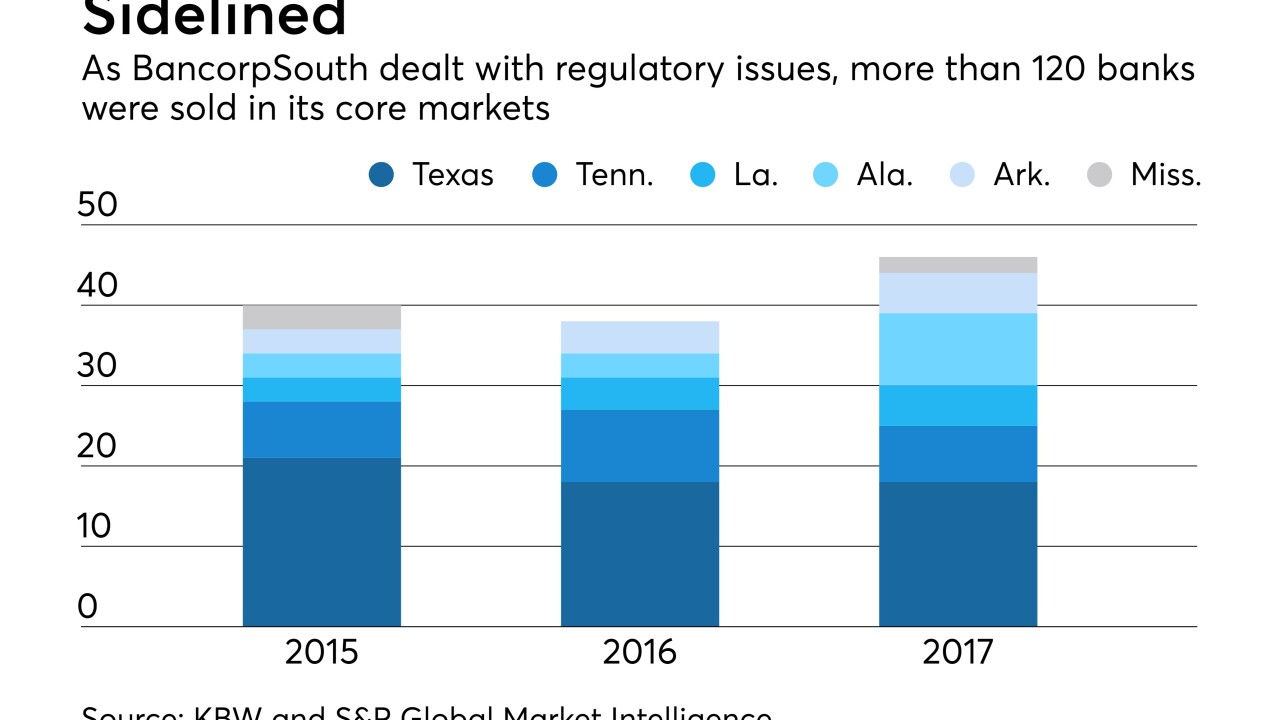

Dan Rollins engineered nearly a dozen deals while at Prosperity Bank. Now CEO at BancorpSouth, he has returned to M&A after spending four frustrating years dealing with compliance issues.

April 26 -

The Federal Trade Commission alleges in a lawsuit that the company's "no-hidden-fee" pledge is deceptive. LendingClub says the claims are unwarranted.

April 25 -

Companies that handle sensitive customer data have even more to worry about when making an acquisition. Not only do they have to be sure the acquired company has good security, but they can't let their guard down even after the acquisition closes.

April 25 -

When regulators recognize ICOs as securities offerings, they will likely require issuers to fully comply with standard Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, increasing compliance pressure, according to Ron Teicher, CEO of EverCompliant.

April 25 EverCompliant

EverCompliant -

CEO Tim Sloan and board chair Elizabeth Duke fielded tough questions Tuesday on everything from the embattled bank’s culture to its ties to the private prison industry.

April 24 -

The bank faces June 15 AML compliance deadline; the features that make Zelle popular with customers entice thieves.

April 23 -

A federal grand jury in Charlotte, N.C., has indicted a former credit union CEO with fraud in connection with the U.S. government's Troubled Asset Relief Program.

April 20 -

The issues at Wells Fargo extend beyond the fines; Ally Financial's auto finance chief departs; ICBA chief Cam Fine signs off; and more from this week's most-read stories.

April 20 -

Recently filed court documents give the clearest sign yet that the National Credit Union Administration is considering appealing a controversial court decision on the regulator's revised field-of-membership rule.

April 20