-

Banks, which previously shunned unsecured small-dollar lending, are now embracing the product because of the outbreak. It's just a matter of whether the shift is permanent.

April 13 -

The $2 trillion coronavirus rescue package and other government moves are designed to provide a lifeline for small businesses, but they also create complications as businesses must quickly accumulate payment records and other information to apply for the loans.

April 13 -

Credit unions that take advantage of hedging could see better execution and increased profitability in their mortgage operations.

April 6 Vice Capital Markets

Vice Capital Markets -

The insurance and research company expects the U.S. to fall into a recession as unemployment spikes and the GDP declines.

April 2 -

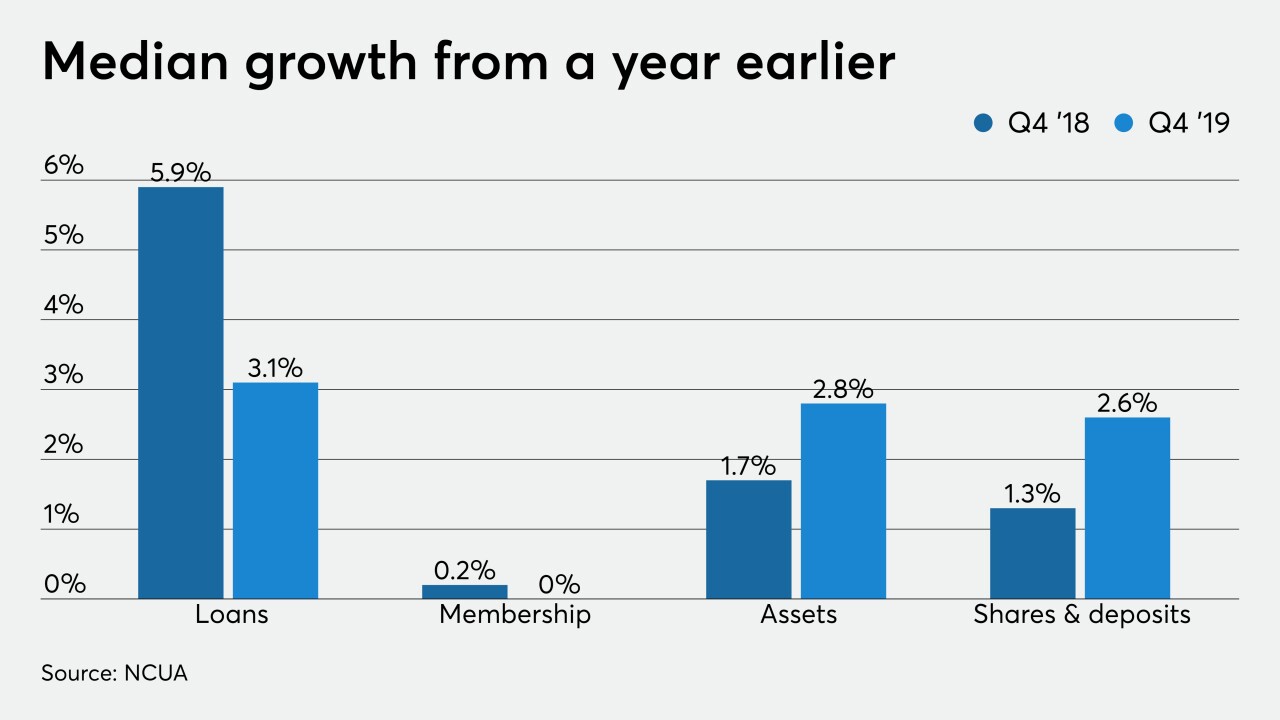

While loans continued to increase, growth was slower than one year previously and membership was flat.

March 25 -

The central bank's sweeping actions suggest a cash shortage gripping sectors directly hit by the pandemic. Banks were supposed to be protected by Dodd-Frank but are still vulnerable to a funding domino effect.

March 23 -

Accommodations for borrowers affected by the coronavirus pandemic, such as payment delays and fee waivers, are "positive and proactive actions that can manage or mitigate adverse impacts," several banking agencies said.

March 23 -

The coronavirus is hitting small businesses hard, slamming one of Square’s core markets just as the payments company got a long-awaited industrial banking license.

March 23 -

Accommodations for borrowers affected by the coronavirus pandemic, such as payment delays and fee waivers, are "positive and proactive actions that can manage or mitigate adverse impacts," the regulators said.

March 22 -

The establishment of the Primary Dealer Credit Facility is among a flurry of recent actions by the central bank to limit the economic impact of the coronavirus.

March 17