-

Credit unions that take advantage of hedging could see better execution and increased profitability in their mortgage operations.

April 6 Vice Capital Markets

Vice Capital Markets -

The insurance and research company expects the U.S. to fall into a recession as unemployment spikes and the GDP declines.

April 2 -

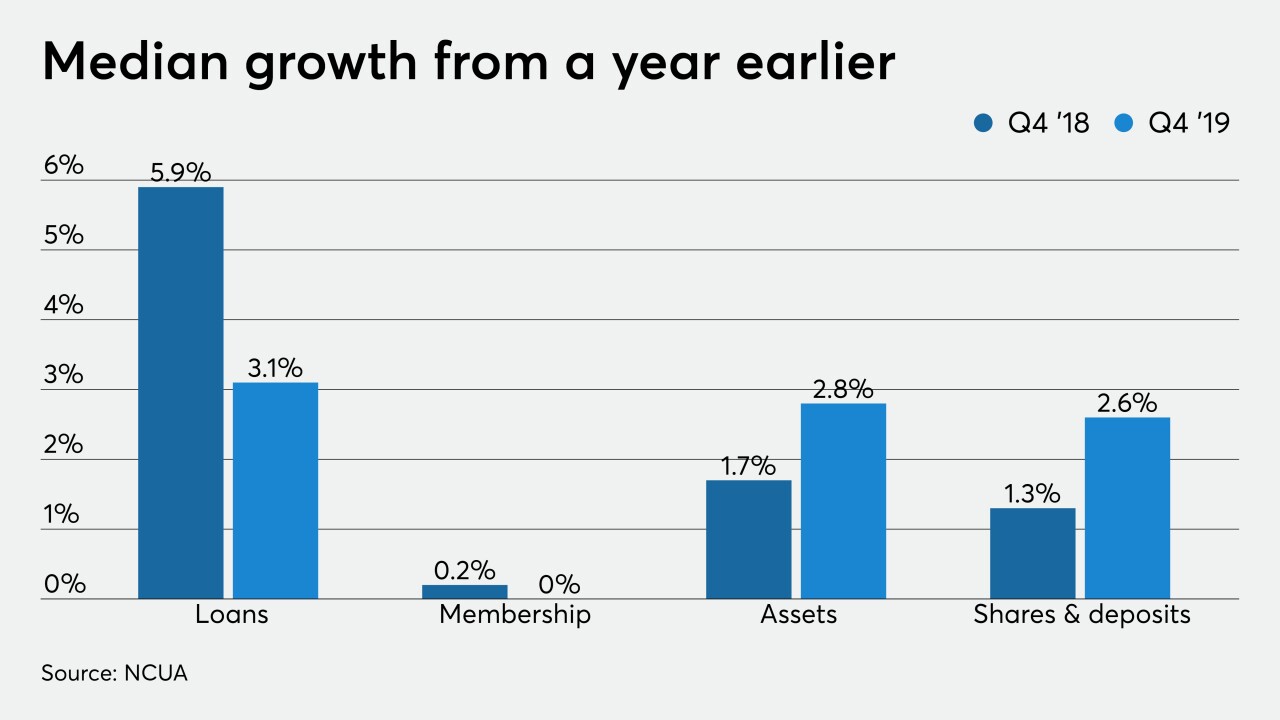

While loans continued to increase, growth was slower than one year previously and membership was flat.

March 25 -

The central bank's sweeping actions suggest a cash shortage gripping sectors directly hit by the pandemic. Banks were supposed to be protected by Dodd-Frank but are still vulnerable to a funding domino effect.

March 23 -

Accommodations for borrowers affected by the coronavirus pandemic, such as payment delays and fee waivers, are "positive and proactive actions that can manage or mitigate adverse impacts," several banking agencies said.

March 23 -

The coronavirus is hitting small businesses hard, slamming one of Square’s core markets just as the payments company got a long-awaited industrial banking license.

March 23 -

Accommodations for borrowers affected by the coronavirus pandemic, such as payment delays and fee waivers, are "positive and proactive actions that can manage or mitigate adverse impacts," the regulators said.

March 22 -

The establishment of the Primary Dealer Credit Facility is among a flurry of recent actions by the central bank to limit the economic impact of the coronavirus.

March 17 -

The Federal Reserve's support for the commercial paper market made clear that it was willing to go beyond cutting interest rates, but the central bank may feel pressure to do even more as the crisis worsens.

March 17 -

The central bank said it was establishing the Commercial Paper Funding Facility to "support the flow of credit to households and businesses."

March 17 -

The chairwoman of the House Financial Services Committee should call on regulators to take more aggressive steps with bad banking practices, starting with Wells.

March 11

-

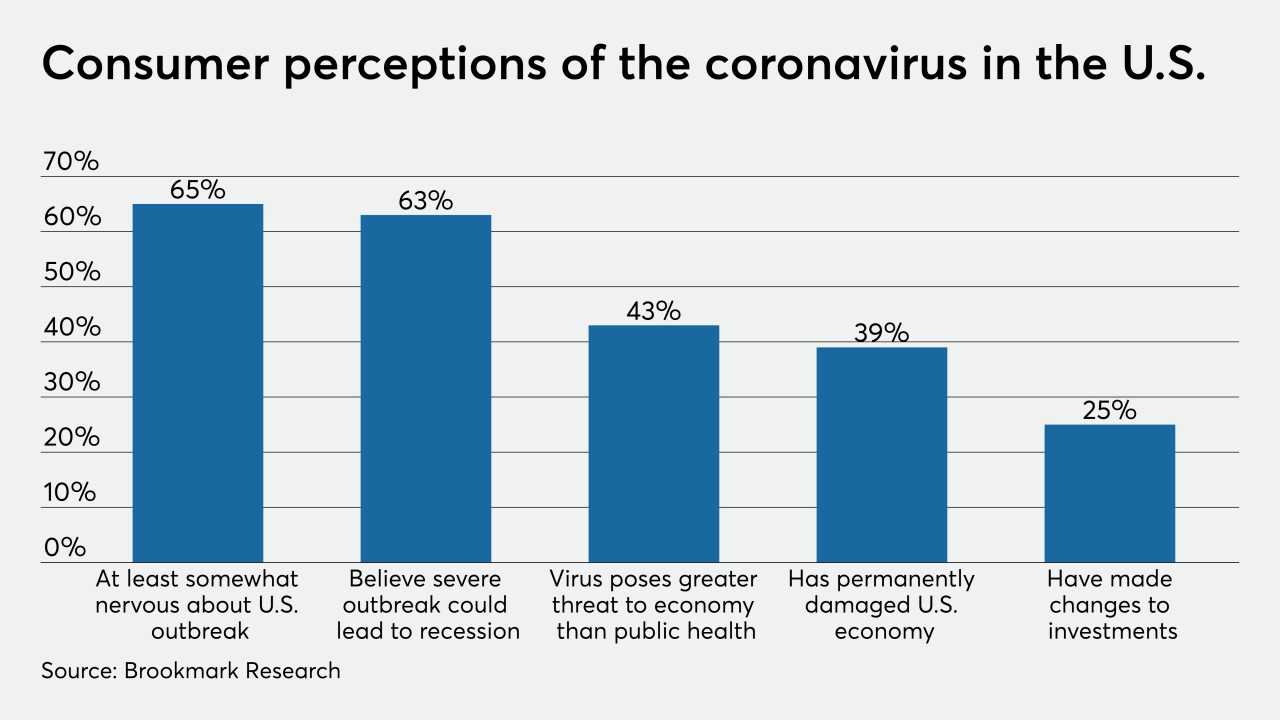

There may only be so much institutions can do if the outbreak affects borrowers' ability to repay credit.

March 10 -

Attempts to rewrite the method for determining unintended discrimination in housing should not bleed into fair-lending laws.

March 4 Upstart

Upstart -

The Exton, Pa.-based credit union grew its commercial real estate and credit card lending in 2019 from a year earlier.

March 2 -

San Diego County Credit Union saw membership rise 4.5% last year, but net income was down due to decreased loan volumes, increased charge offs and higher operating expenses.

February 28 -

Afterpay has found an opening in the U.S. by targeting the millennials who don't have a credit card to use at the point of sale.

February 28 -

The proposal is the fourth piece of legislation unveiled this week to tweak the Federal Credit Union Act.

February 26 -

Data from regulators in the Badger State show state-chartered CUs making gains in several key areas in 2019 even amid a dip in ROA and an increase in allowance for loan losses.

February 21 -

Some institutions say the combination of chatbots and social media could entice new borrowers, but burdensome legacy systems may limit their effectiveness.

February 20 -

Phenix Pride FCU in Alabama is one of several institutions Inclusiv and the African-American Credit Union Coalition are celebrating during Black History Month.

February 19 Inclusiv

Inclusiv