-

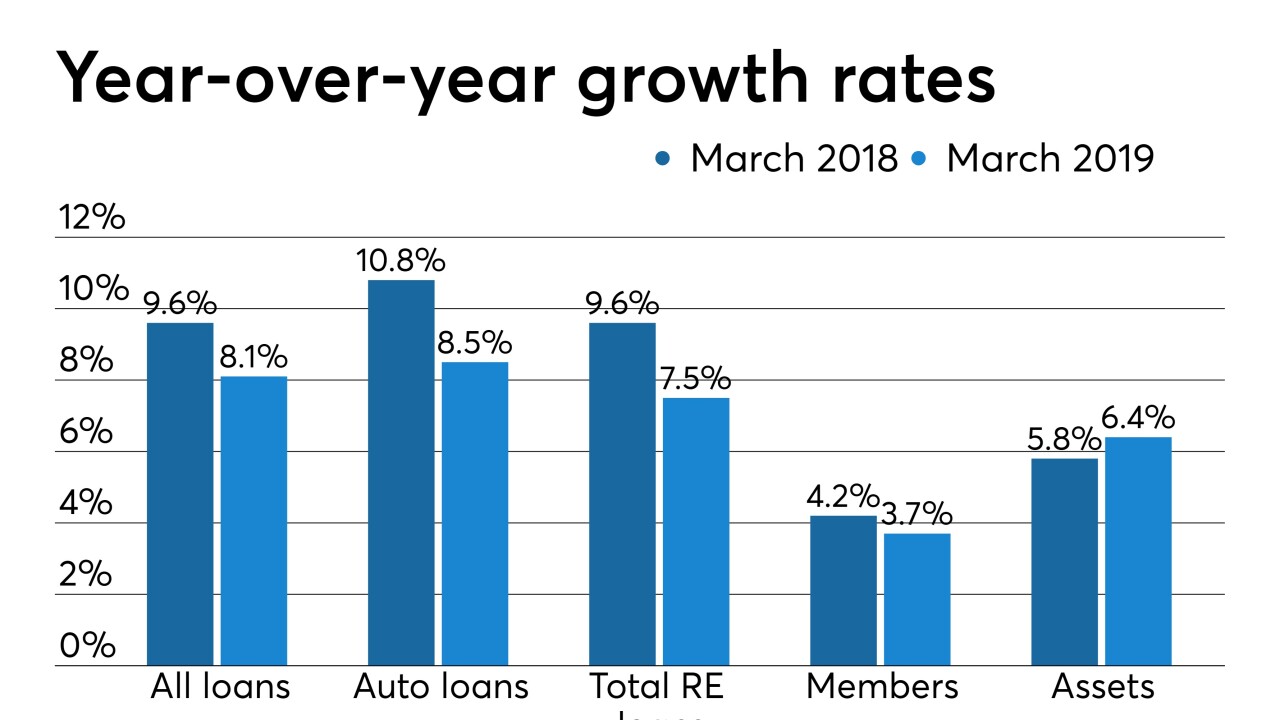

Credit unions reported gains in areas such as loan balances and membership but it was at a slower pace than a year earlier.

June 21 -

The Michigan-based CUSO has acquired a stake in NestReady, giving it exclusive industry rights on the mortgage technology firm's products.

June 20 -

On Dec. 31, 2018. Dollars in thousands.

June 18 -

Median annual membership growth stood at just 2% at the end of the first quarter, though delinquencies dropped and ROA got a boost.

June 14 -

A shrinking bank landscape is creating potential opportunities, but analysts are mixed as to whether credit unions will see any growth as a result.

June 14 -

The key to capturing young consumers is flexibility and choice at the point of sale, says Michael Rouse, chief commercial officer at Klarna.

June 11 Klarna

Klarna -

The Tampa-based institution says it is poised for growth, but the new asset class also opens it up to additional scrutiny from the CFPB.

June 10 -

The small-bank trade group wants Congress to investigate whether the agency did enough to respond to warning signs and curb abusive practices by credit unions.

June 7 -

Loans grew amid a surge in deposits, while membership surpassed 117 million and industry consolidation continued.

June 6 - LIBOR

Although Libor will will not be phased out until at least 2021, Randal Quarles said making the switch early is "consistent with prudent risk management."

June 3 -

New technologies can increase lending and reduce risk but many management teams don't know where to begin with implementing them.

May 31 ZestFinance

ZestFinance -

Wider net interest margins compared to a year earlier helped make up for a slight decline in loan balances, as nearly two-thirds of banks reported higher profits in the first quarter.

May 29 -

ChargeAfter, a startup that matches retail customers with financing options at the point of sale from various lenders, has raised $8 million in its first major funding round.

May 29 -

Purpose Financial has agreed to purchase CreditGenie Inc. as payment companies face pressure to offer point of sale financing.

May 29 -

Steve Hagerman, who was responsible for the first mortgage platform at JPMorgan Chase, will be head of consumer lending technology at Wells. It also named Gary Owen, a veteran of WarneMedia, Promontory Financial and Citi, its chief information security officer.

May 28 -

The California-based institution posted growth in loans but saw net income fall from a year earlier.

May 23 -

Mastercard is making a niche play in the hot point of sale financing market, teaming with Dividio and lastminute.com to offer installment loans at checkout.

May 21 -

From data analytics to focusing on a service culture and more, here's a look at how technology is radically remaking lending.

May 20 -

Year to date Dec. 31, 2018. Dollars in thousands.

May 20 -

A new study from CUNA Mutual Group shows CUs ended March with tepid growth in membership and auto and real estate loans compared with a year earlier.

May 17