-

From frictionless payments to improved underwriting models, connected cars will rewrite the rules for how and where banks interact with their customers.

January 29 -

Connected cars are going to create new revenue streams, not just for automakers, but also for financial services providers.

January 29

-

BMO Harris Bank is providing its customers with a branded P-to-P payment app, continuing a trend of developing mobile payment and banking services.

January 25 -

The Cincinnati bank will be advised by QED Investors on its fintech strategy .

January 20 -

Jim Van Dyke, CEO of futurion, discusses the correlations between mobile deposit features, the ratings of those features, and app adoption.

January 19 -

A consortium of fintech companies have formed a new industry group to advocate for better data sharing via open APIs.

January 19 -

The Office of the Comptroller of the Currency could make the Community Reinvestment Act’s spirit relevant in a digital age so long as it builds the right framework for chartered fintech companies.

January 18 D-N.Y.

D-N.Y. -

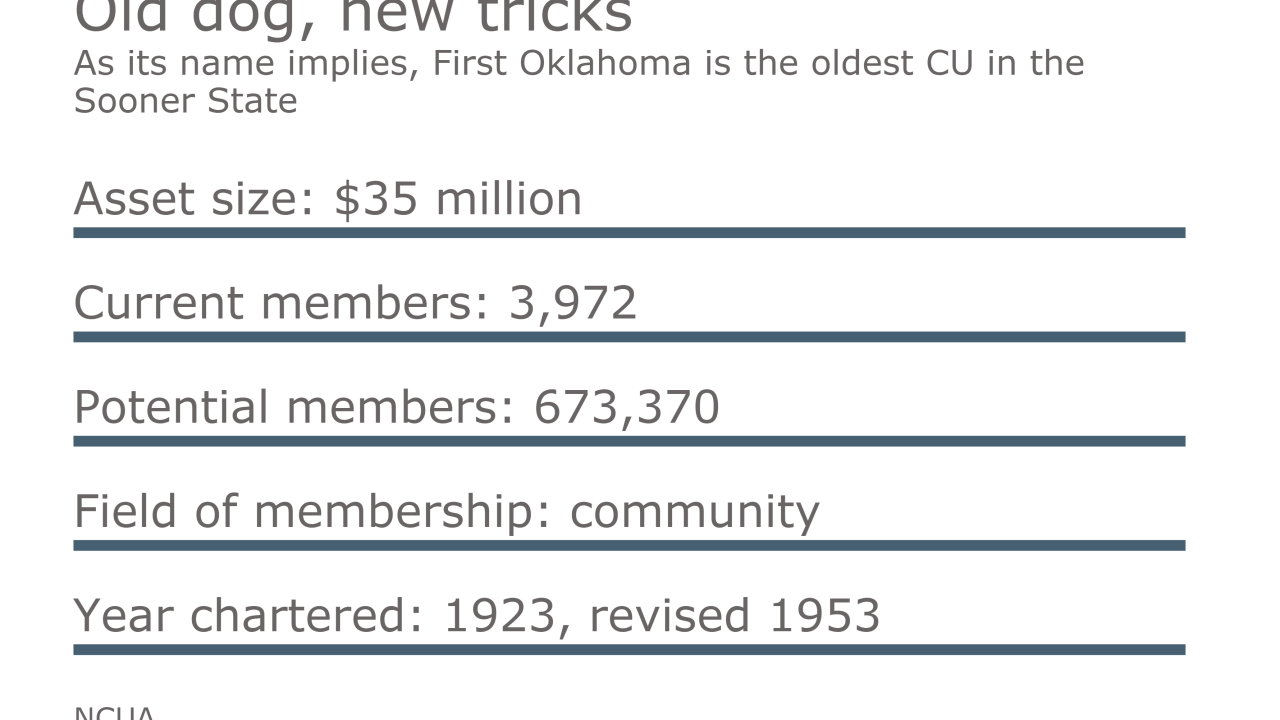

As its name implies, First Oklahoma is the oldest CU in the Sooner State.

January 17 -

The growth of digital channels is changing bank M&A values, forcing buyers to focus less on branches and more on the volume of customer data.

January 10 -

Joint accounts sometimes seem stuck in another era. Here's how to modernize them.

January 10 -

It's tougher for women-led technology companies to raise money from venture capitalists—or any investor—than it is for men. But the challenge is deeper than overt sexism.

January 10 Nvoicepay

Nvoicepay -

DTCC Moving to the Blockchain; Goldman hires Wiesel as tech chief; Donald Trump's team divided

January 10 -

Though banks are bigger in peer-to-peer payments overall, Venmo is better at functionality and branding and millennials love it. Now banks are launching Zelle with high hopes and the advantage of real-time speed. Can they catch up? Should they even bother?

January 9 -

Chatbots, virtual assistants and the like may mean fewer direct interactions between banks and consumers, fintech leaders say. But branches will become self-service destinations.

January 9 -

Activehours, a direct-to-consumer startup that lets hourly wage earners name their paydays, announced it has raised $22 million of funding.

January 9 -

Regulators here made strides to encourage innovation in 2016, while Brexit cast doubt on the London fintech boom. Yet the cross-Atlantic payments battle is just beginning.

January 6 K&L Gates

K&L Gates -

2016 was very good to these financial services executives, who succeeded where others failed, sold their businesses for large sums, felt the love of regulators or could finally breathe a sigh of relief.

January 5 -

Banks are grappling with new challenges in trying to work with voice assistants like Alexa in Amazon's Echo to allow customers to check balances and perform other tasks. But with voice banking on the horizon, banks cannot afford to stall their efforts.

January 4 -

Royal Bank of Canada has introduced a video chat service for its small-business banking customers whose hectic lives may not allow for frequent branch visits.

January 4 -

The bank's new CEO, Onur Genc, fresh from Turkey, will have to find a way to leverage the considerable tech and innovation investments the bank has made and strengthen the brand's U.S. presence.

January 3