-

From SoFi to Venmo, fintech competitors are creating a customer experience that is so fast and easy community bankers like Julieann Thurlow cannot help but worry.

March 27

-

As banks work to integrate their mobile apps with their physical channels, the march toward universal cardless ATM technology continues.

March 27 -

Technology is moving at light speed beyond smartphones. To compete in this environment, banks need to zero in on solving for basic human needs.

March 24 TD Bank

TD Bank -

B of A's Cathy Bessant and Michelle Moore have a few suggestions for women who want to advance and RBC's Janice Fukakusa sets a new pay benchmark for female executives. Plus, Bank of the West's Nandita Bakhshi and Citi's Yolande Piazza.

March 23

-

Instead of waiting to be disrupted by fintech startups, a pair of credit unions are rethinking what they are, who they serve and how they do it — and it's paying off by bringing younger members into the fold.

March 22 -

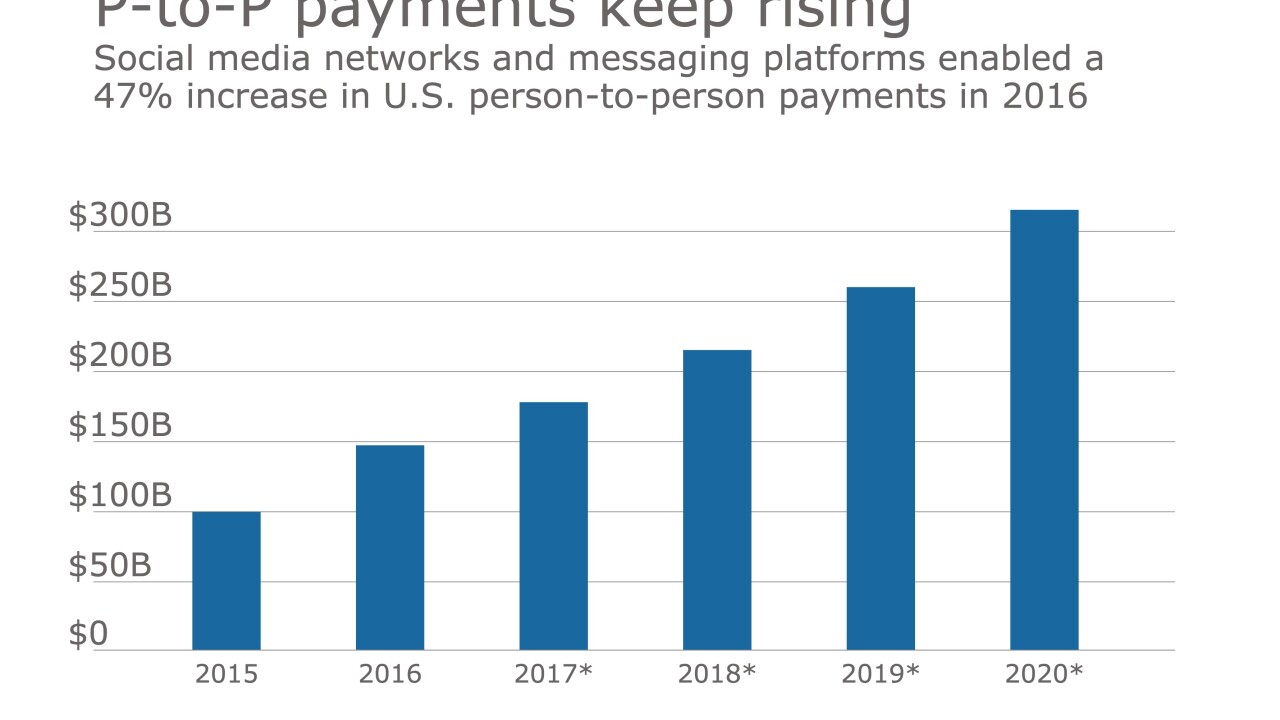

The rapid advancement of social media platforms into the payments and finance markets, as well as millennials' devotion to apps like Venmo, were major factors driving a 47% increase in the U.S. digital person-to-person payments market last year.

March 21 -

Retail-focused Provident Bank has added an on/off switch that allows customers to suspend their debit cards. A few big banks rolled out similar features last year.

March 21 -

The underbanked rely on mobile access more than online or in-person contact. Therefore, the U.S. must follow developing countries’ leads and let consumers sign up for mobile-only accounts.

March 21 Oracle Financial Services Software

Oracle Financial Services Software -

Customers of National Capital Bank in Washington wanted mobile banking with remote deposit capture, but the community bank first had to find a new CEO.

March 20 -

The rapid advancement of social media platforms into the payments and finance markets, as well as millennials' devotion to apps like Venmo, were major factors driving a 47% increase in the U.S. digital person-to-person payments market last year.

March 20