-

Its savings, budgeting, spending and goal-setting tools, combined with artificial intelligence to add smart insights and advice, are a good example of how regional banks are trying to distinguish their mobile products from those of bigger banks with larger tech budgets.

January 14 -

Nicolas Kopp, head of N26 in this country, explains how the company plans to spend a chunk of the proceeds on its expansion here and add to the intensifying competition among fintechs.

January 10 -

The credit union service organization based in Florida has returned more than $500 million in patronage dividends since 1994.

January 8 -

As consumers continue to migrate to banking apps, it may be tempting for banks to focus solely on improving that channel experience. But doing so would be making the same mistake as focusing only on cards or cash at the point of sale.

January 7 -

As consumers continue to migrate to banking apps, lenders may be tempted to focus solely on improving that channel. But new data suggests consumers aren't abandoning other platforms just yet.

January 4 -

A partnership between the mobile carrier and BankMobile could help stripped-down banking and deposit transfer services find a footing among U.S. customers.

January 2 -

From the end of overdraft fees to the rise of banks that watch their customers' every move, there are several new banking trends on the horizon in 2019.

January 1 -

There are steps financial firms can take to protect their customers in the event a major wireless network is compromised, including reconsidering the use of SMS messaging for account authentication.

December 24 -

Among the most innovative CEOs of his generation, the former Umpqua chief and Pivotus founder is taking some of his best ideas to a new fintech as an adviser.

December 20 -

Good Money just raised $30 million and is a year away from launching, but already is raising concerns for its trash-talking of established players.

December 19 -

Digit, Chime and Pluto are among those said to be stepping into a void left by the banking industry. But designing helpful enough, yet flexible enough, financial safeguards for consumers is easier said than done.

December 18 -

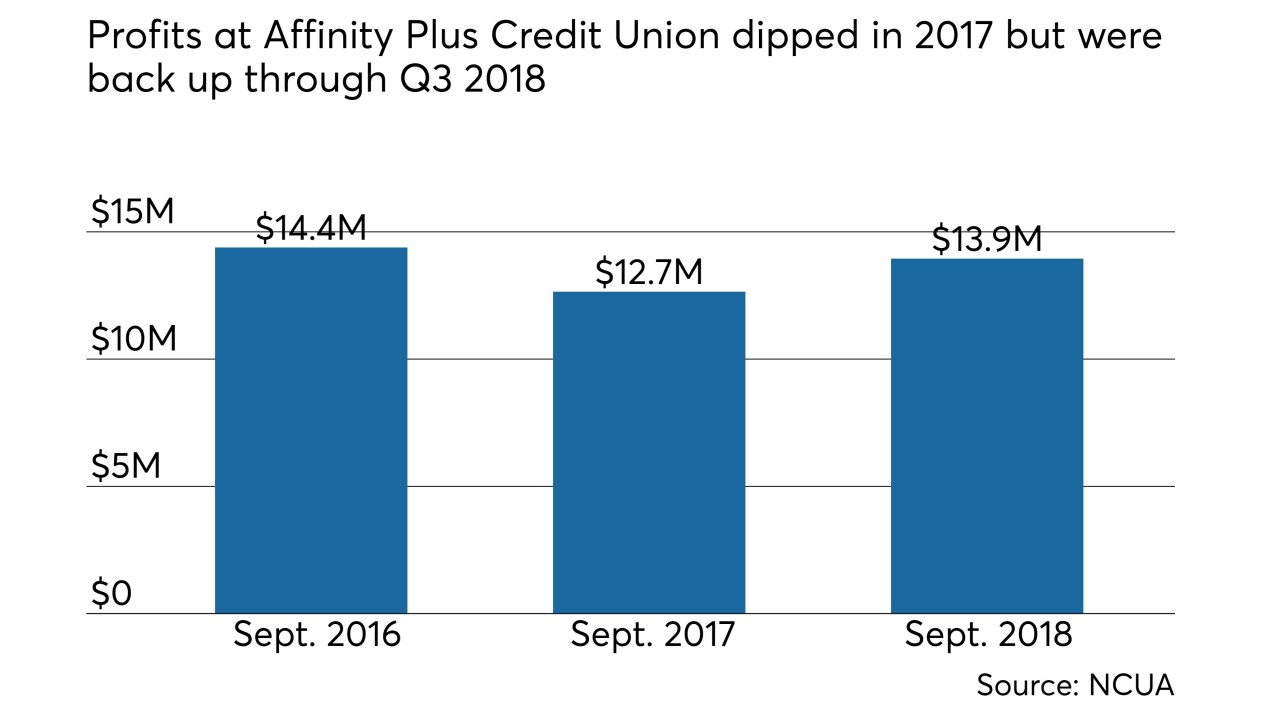

Along with a core conversion, the Twin Cities-area credit union deployed new loan origination systems and online and mobile banking platforms.

December 18 -

Synchrony Bank’s tie-in with the latest Spider-Man movie is an example of ways companies are looking to add augmented reality to their mobile-marketing arsenals.

December 17 -

Branch acquisitions, once a popular way to scale up in new markets, have started to go by the wayside in the digital age.

December 16 -

Augmented devices and automation will push banking services beyond the current mobile phone delivery model into a virtual world — but how, exactly? Bank of America, Wells Fargo and others are trying to find out.

December 13 -

Jason Brown explains why his company, Tally, helps consumers by paying their monthly balances, providing advice and offering a lower-rate credit line.

December 11 -

Several challenger banks are trying to relieve consumers’ financial stress by offering tools that guide better habits.

December 10 -

Few firms have been able to blend predictive virtual assistants, geolocation, data analytics and other cutting-edge technology into apps like TD Bank, which has more mobile users in Canada than anyone in finance.

December 3 -

The central bank may be looking at other benchmarks besides the fed funds rate to conduct monetary policy; dropping human appraisers from most home sales raises concerns.

November 30 -

In a bid to show it can best the competition, the Massachusetts-based institution will donate to a local food pantry every time new members join the CU and download its app.

November 29