-

-

Remote online notarization helped originators close loans amid social distancing measures, but complex local laws remain a barrier to its widespread use.

December 30 -

The Boston community bank and a fintech called Monit have developed an app that helps small-business owners forecast their cash flow and how certain events could affect them.

December 11 -

Infinity FCU sought out a merger partner after realizing that even at $338 million in assets it was too small to provide the technologies members wanted. It could be a harbinger of more deals among larger players.

November 6 -

Waiting for the SBA to sign off on PPP loan forgiveness; banks criticized for requiring balloon payments on loans in forbearance; how backlash over Scharf remarks affects Wells Fargo’s diversity push; and more from this week’s most-read stories.

September 25 -

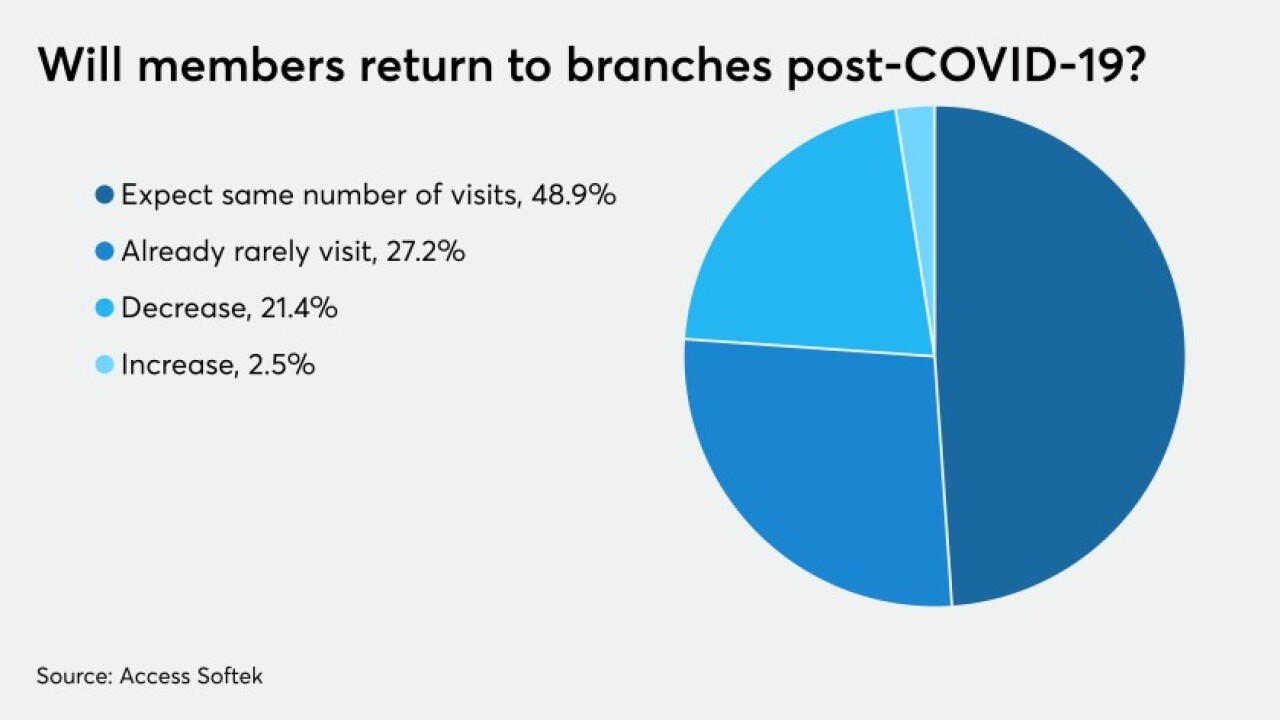

Members are completing more of their banking online than ever before, forcing many institutions to rethink their strategies for physical locations.

September 11 -

Heritage Bank and Dime Community Bank are among those financial services firms taking online and app-store reviews seriously. Here’s why all banks should pay attention.

July 31 -

The pandemic will have an impact on customer adoption of digital technologies. Financial institutions and fintechs can achieve growth by gaining consumers' trust and changing their mindset about new platforms.

July 31 -

-

Now perhaps more than ever, banks and their proxies need to show tact when communicating with past-due borrowers.

June 26 Persado

Persado -

In addition to Apple and Google delivering smartphone apps that would alert users that they are near a person infected by the virus, various other government agencies and businesses are developing that type of technology to address the pandemic's spread.

June 2 -

Many of the cultural changes instituted by Hisham Salama, one of American Banker’s 2020 digital bankers of the year, have led to a more agile tech team and higher customer satisfaction scores.

June 1 -

NorthOne founder and CEO Eytan Bensoussan explains how unlocking bank data will help entrepreneurs in the future.

March 18 -

It was Varo's second try with the Federal Deposit Insurance Corp., but it has now moved within a few steps of obtaining what has eluded fintech firms of late: a green light from banking regulators.

February 10 -

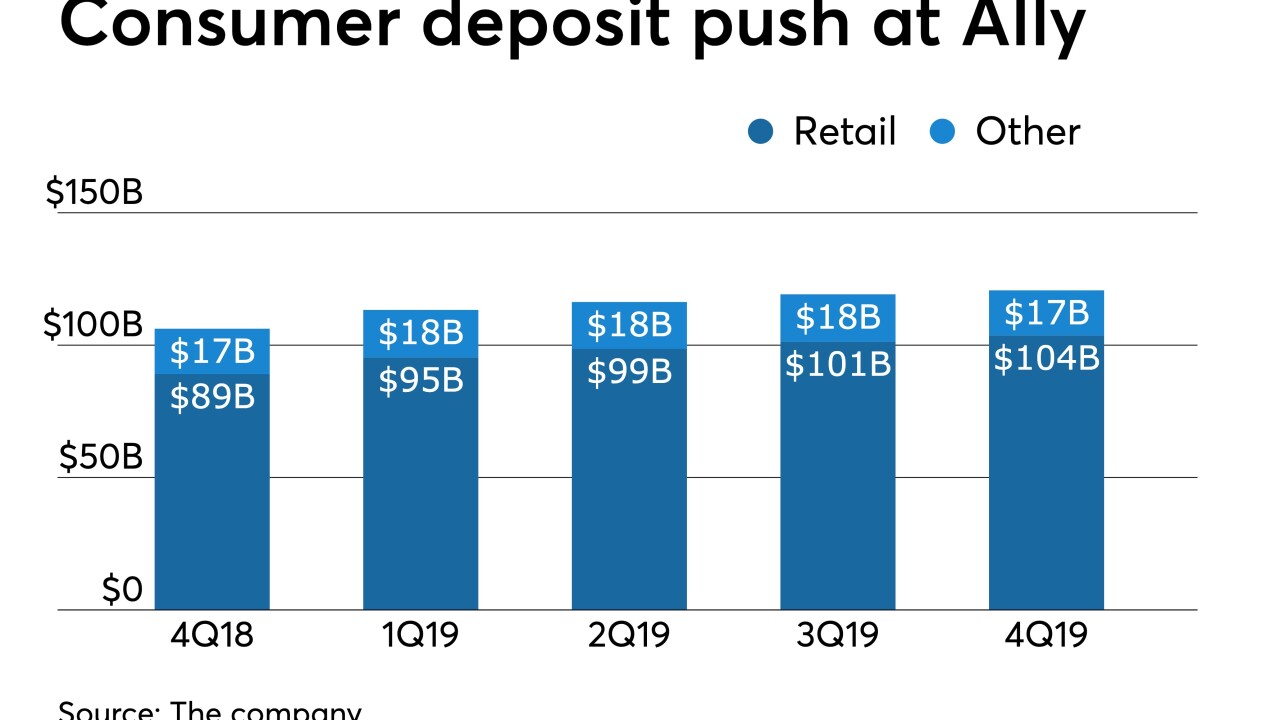

The digital-only bank found customers are anxious about their inability to set aside money, so it decided to offer automated savings tools, consumer chief Diane Morais says. It is one of the larger companies to do so.

February 7 -

Customers of the online lender's payments service can select their own loan terms.

February 4 -

A new app will allow small-business clients to quickly apply for credit while expanded offerings for homeowners associations will help CIT build up its base of low-cost deposits.

January 31 -

Outages or disruptions of GPS signals — sometimes malicious, sometimes not — could quickly knock out computers, ATMs and card networks.

January 29 -

Some fraudsters pose as loan applicants and submit doctored video or photos of property and assets to scam lenders they won't see in person. Firms like Elevate Funding and Credibly are fighting back.

January 28 -

Rellevate, founded by Stewart Stockdale, will offer pay advances, fast bill pay payment and international remittances for consumers who live paycheck to paycheck.

January 27