-

While national banks have remained strong during the pandemic, they are still navigating risks from a murky credit environment and other potential warnings signs, according to a report by the Office of the Comptroller of the Currency.

November 9 -

Weak loan demand, persistently low yields and the continued struggles of sectors such as hospitality and retail are among the myriad lending challenges facing small regional banks.

October 20 -

The family-owned bank from the South and the New York commercial lender each would fill a clear need for the other. First Citizens would gain business lending expertise and an online deposit-gathering platform, and CIT would get the cheap deposits it coveted.

October 16 -

The flood of liquidity that accompanied the pandemic recession isn’t likely to subside anytime soon. Banks will have to employ a mix of securities buying, hedging and other balance-sheet-management tricks to prop up margins longer than initially imagined.

October 5 -

Originations in the third quarter are on pace to double what the Detroit lender reported a quarter earlier, adding more high-yielding loans to the balance sheet.

September 15 -

The $18.8 billion in net income was 70% less than a year earlier as the uncertain economic picture and new accounting rules drove a sharp rise in provisions for future losses.

August 25 -

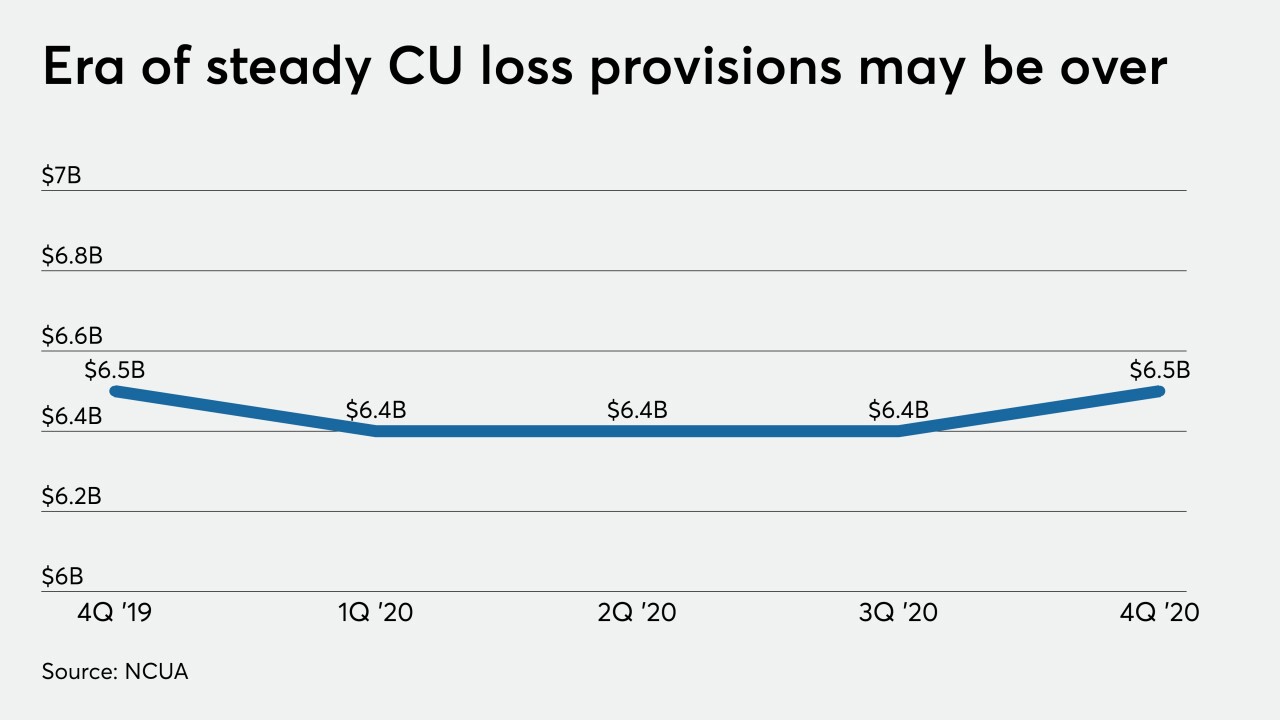

The industry will have to grapple with pressure on net interest margins, interchange income and credit quality, said CUNA Mutual's Steve Rick during a virtual conference.

August 13 -

In what was a challenging quarter for the industry, the company reported strong loan growth and a wider margin. Continued momentum will depend on government stimulus, the reopening of New York City and borrowers' ability to make payments after their deferral periods end.

July 29 -

The company reported growth of more than 103% since the end of last year.

July 22 -

With multiple business sectors reeling from the pandemic, banks are facing tighter net interest margins, provisioning more for losses and seeing their balance sheets expand, the agency said in a report.

June 29 -

A record amount of funds have flowed into banks since the coronavirus hit, but a low-rate environment and tepid loan demand are complicating efforts to put that money to work.

June 17 -

Past is not prologue, and a successful strategy for becoming a top-performing bank in 2020 is very different from what it might have been just six months ago.

June 5

-

Fallout from the coronavirus pandemic is pressuring banks that have relied on expansion efforts and fee income to produce outsize investor returns.

June 4 -

With rates so low — after steep emergency Federal Reserve cuts in response to the pandemic’s fallout — banks will struggle to generate bread-and-butter interest income and asset-sensitive lenders will face substantial net interest margin contraction this year and next, analysts say.

May 18 -

Even CUs that don’t directly serve the oil and gas industry are likely to be impacted, experts say.

May 6 -

Smaller institutions should prepare themselves for some of what the competition has experienced, including increased provisions for losses and declining net interest margins.

April 20 -

Bankers will be pressed on upcoming earnings calls to forecast how the coronavirus pandemic — and the government's response — will shape credit quality, margins and fee income.

March 25 -

Margins will be squeezed after the Federal Reserve lowered interest rates earlier this month to counteract the economic fallout from the coronavirus.

March 25 -

Credit unions intensified their focus on gathering deposits in 2019 but many institutions are still looking for cheaper core funding.

March 12 -

The Fed’s decision to cut its benchmark interest rate amid growing coronavirus concerns is bound to have an impact on banks, but just how broad and how deep remains to be seen.

March 3