-

Both standards are confusing and not universally adopted. But both are a necessary baseline to protect merchants and payment companies.

April 10 Clearent

Clearent -

One in four acquirers say that how they approached Payment Card Industry security standard compliance caused them to lose merchant accounts.

March 22 -

A key aspect of the job for security leaders at retailers is to present cyber risk threats to boards and top executives in terms they understand. Bay Dynamics says the best way to do that is through the common language of dollars and cents.

February 14 -

The time banks have to investigate red-flagged credit payments has shrunk from several days to a few hours and fraudsters have already taken notice.

December 29 -

As retailers, banks and technology companies continue to suffer data breaches, issuers and merchants need to take extra care when selecting payment vendors.

December 19 Forte Payment Systems

Forte Payment Systems -

The payments messaging network Swift has told its client banks that the threat of cyberattacks "is very persistent, adaptive and sophisticated and it is here to stay."

December 12 -

Large banks will soon launch Zelle, their person-to-person payments app. Will it succeed or will it be another name on a growing list of such platforms that never panned out?

December 9 -

Bank of New York Mellon has created a dedicated innovation group for launching new technologies in its treasury services unit.

November 29 -

To jawbone Mexico into paying for the wall, President-elect Trump has threatened to suspend remittances. Such a move would disrupt one of the busiest corridors of money in the world.

November 9 -

Citigroup customers can now dispute credit card charges through its app, one of several mobile enhancements rolled out by the company Wednesday.

November 2 -

Zelle, the big banks' answer to Venmo, is set to launch next year. But will its reach be enough to curb Venmo's momentum?

November 2 -

Samsung sees banking as a long game, and Samsung Pay is its first move. As mobile banking grows, the Korean electronics company believes financial services is ripe with opportunity.

October 28 -

Australian banks wants Apple to open up its payments system to third parties. U.S. banks are likely following the situation closely as many are looking to renegotiate their contracts.

August 31 -

Loyalty programs are likely the underpinning of the adoption of mobile payments, so banks need to make sure reward points are part of their digital offerings.

August 29 -

Banks are playing a more active role in the next phase of fintech, both as investors and partners, says David Sica, partner at venture capital firm Nyca. That change is shaping how the firm looks at new investments.

August 26 -

B of A says customers are becoming inundated with wallet options, so they are holding out on building their own.

July 25 -

Keefe Bruyette & Woods and Nasdaq have launched an index that tracks fintech companies.

July 19 -

If the financial services industry wants to avoid spending years aimlessly testing blockchain prototypes, it needs to focus on coming up with standards and working together.

July 15 -

Visa's Digital Commerce App is allowing banks to develop their own mobile wallets. Many of its clients are larger community banks that may not otherwise have the resources to develop such a product internally.

June 13 -

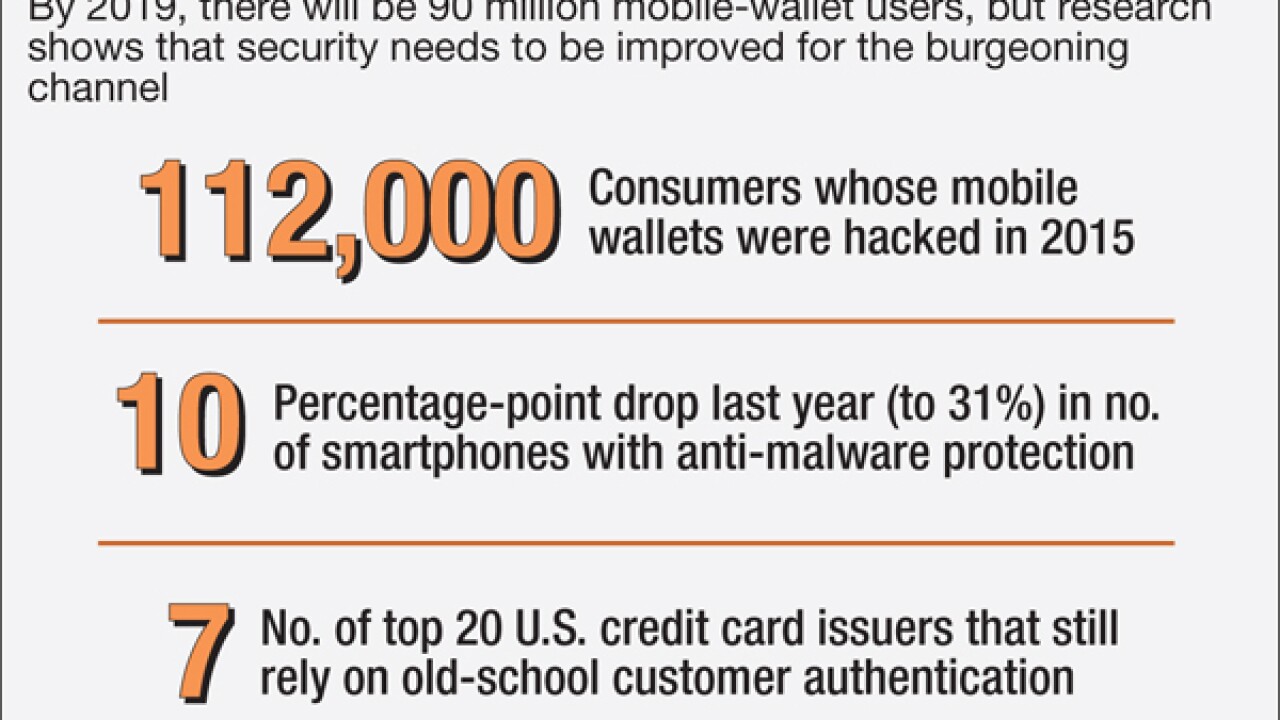

As mobile wallets become more popular they'll also become more popular targets for fraud. Banks ought to improve enrollment guidelines and other security tools in plotting their mobile-wallet strategy.

April 18