-

Banks have long been eager to see regulators knocked down a peg in the courts, but now that it might actually happen under President Trump, some are beginning to wonder if it might ultimately boomerang against the financial services industry.

February 21 -

A federal appeals court upheld a ruling that barred hedge funds from suing to overturn the U.S. government’s 2012 decision to capture billions of dollars in the profits generated by the mortgage guarantors Fannie Mae and Freddie Mac after their bailout.

February 21 -

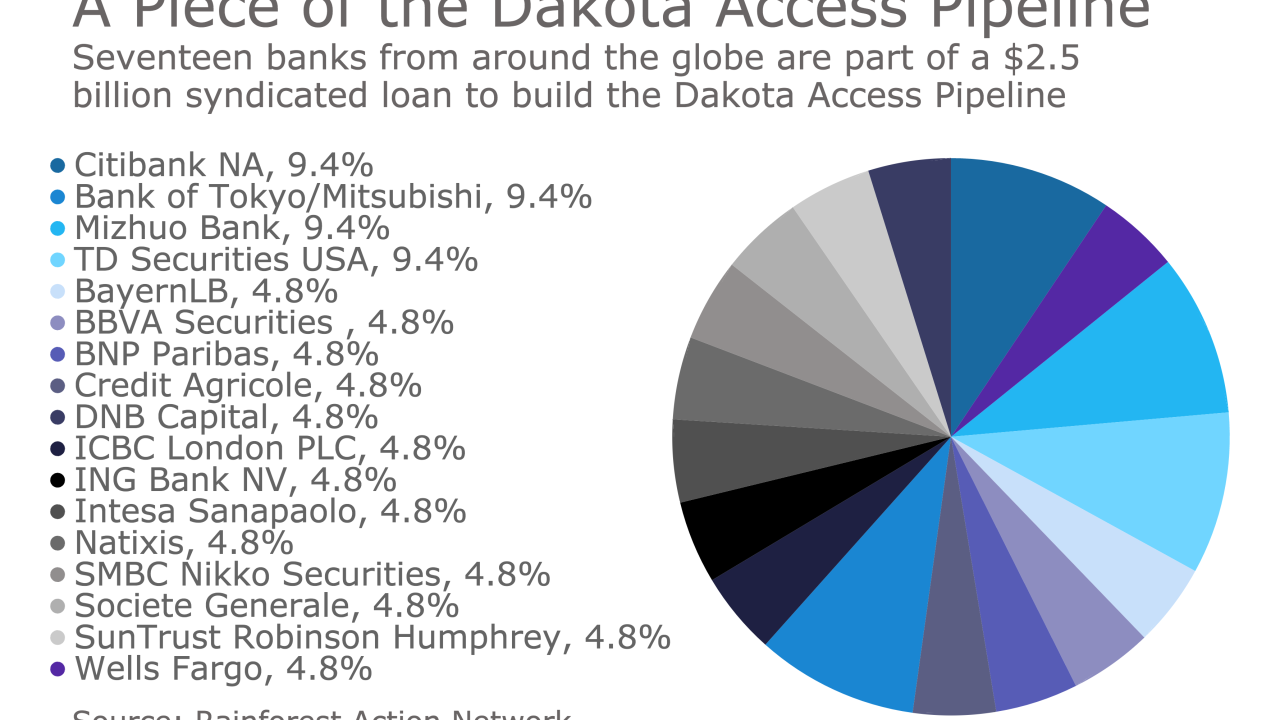

Activists are pressuring banks involved in financing the controversial Dakota Access pipeline to abandon the project. If banks remain committed, they risk alienating customers, but divestment could set a bad precedent.

February 17 -

Banks are woefully unprepared to face potential cybersecurity threats stemming from third-party technology providers, according to a report issued Wednesday by the Federal Deposit Insurance Corp.’s independent watchdog.

February 15 -

Linda McMahon, who married into one of wrestling’s founding families and helped build the WWE into the largest professional wrestling company in the world, was confirmed Tuesday as the head of the Small Business Administration.

February 14 -

Rather than just avoiding costly rules, cost-benefit analyses can also validate worthy ones. That is the case with proposals to toughen the leverage ratio.

February 14 Auburn University

Auburn University -

Regional banks don’t pose risks to the financial system that have caused concern among policymakers, executives of 18 banks told top Republican and Democratic lawmakers in Congress.

February 13 -

Financial firms are going on offense in Washington, pressing a policy agenda that would have been unimaginable just a few months ago. Some proposals, like reforming the Consumer Financial Protection Bureau, have been floated before while others began to gain traction after Republicans swept the November elections. Here's a look at some of the industry's requests.

February 13 -

Republican lawmakers and Trump administration officials oppose the Consumer Financial Protection Bureau, but efforts to beat back CFPB policies might be a longer fight than many in the industry would like.

February 13 MWWPR

MWWPR -

The settlement resolves a bitter, pre-crisis court fight in which Hank Greenberg squared off against three successive New York attorneys general over 11 years.

February 10 -

While lenders support the intent of a proposal to encourage the growth of private flood insurance, they claim a regulatory proposal doesn’t give lenders enough flexibility and remains too complicated.

February 10 -

Some experts say President Trump is being advised to hold off on firing CFPB Director Richard Cordray to get the Supreme Court to rule on the extent of the president's executive powers.

February 8 -

Most recently Thomas Pahl worked on debt collection and credit reporting issues as a partner at Arnall Golden Gregory in Washington.

February 8 -

The past 16 years have seen the pendulum swing far too wide between lax civil rights enforcement on one extreme and overreaching on the other.

February 7

-

Democrats may not be able to score many legislative wins in this Congress, but they appear set on slowing the process down to a snail's pace, particularly when it comes to financial appointments and rollback of the Dodd-Frank Act.

February 6 -

The Federal Reserve’s regular opinion survey of senior bank loan officers suggests that lenders expect to ease lending standards for commercial and industrial loans in 2017, while also expecting to have to tighten lending standards for commercial real estate and auto loans this year.

February 6 -

American Banker readers share their views on the most pressing banking topics of the week. Comments are excerpted from reader response sections of AmericanBanker.com articles and our social media platforms.

February 3 -

The Federal Reserve published the hypothetical stress scenarios it will use as part of the 2017 stress test cycle.

February 3 -

President Trump is scheduled Friday to order a review of Dodd-Frank and a halt to the Obama fiduciary rule. A signing ceremony is set for noon following a meeting of more than a dozen top corporate executives.

February 3 -

President to sign executive order Friday to roll Dodd-Frank as battle lines form over various sections of the act; Deutsche Bank's John Cryan issues an "especially contrite" apology for the German bank's past mistakes.

February 3